Oil ekes out gains in prudent turnaround

- Oil price attempts to end the losing streak after negative Friday and Monday performance.

- Israel Prime Minister Benjamin Netanyahu backs US Secretary of State Antony Blinken’s ceasefire proposal.

- The US Dollar Index eases further as markets embrace a soft landing for the US economy.

Oil tries to end its retreat with markets embracing a possible soft landing in the US, which means no recession and a rather steady demand for Oil at hand. Meanwhile on the geopolitical front, Israel’s Prime Minister Benjamin Netanyahu has confirmed he supports the ceasefire proposal US Secretary of State Antony Blinken has put forward, according to a report from Bloomberg. Even though Hamas still has to have its say about the agreement, the news means a substantial easing in tensions in the MIddle East, avoiding for now any supply disruptions from the region. Meanwhile, traders are adding the US to the list of countries that see sluggish demand for Oil after China was top of the list already earlier with economic activity easing further.

The US Dollar Index (DXY), which tracks the performance of the US Dollar against six major currencies, is easing as well on the back of that assumption that the US economic growth is softening. Markets first feared a recession, though they now seem to embrace the narrative again of a soft landing for the US economy. This narrative, however, hinges on Federal Reserve Chairman Jerome Powell, with markets hoping he will confirm on Friday at the Jackson Hole Symposium that they have got it right this time.

At the time of writing, Crude Oil (WTI) trades at $74.14 and Brent Crude at $77.70

Oil news and market movers: Options markets skewed

- With Israel supporting the ceasefire proposal, US Secretary of State Antony Blinken said the next step was for Hamas to agree to the proposal aimed at de-escalating the 10-month old conflict in the Middle East, according to Bloomberg.

- Recent China data shows another slowdown in factory activity, which means even less demand ahead from the biggest Oil importer.

- The options markets are feeling the pressure, with Brent Crude options seeing the skew flip in favour of puts for the first time since August, Reuters reports. The potential risk here is that hedge funds still have to cut large portions of their stake in Oil, which could see more bearish sentiment in the option markets.

- MT Newswires reports that US local demand for fuel is still very much supported, with Labor Day travel up 9% year over year according to motor club AAA.

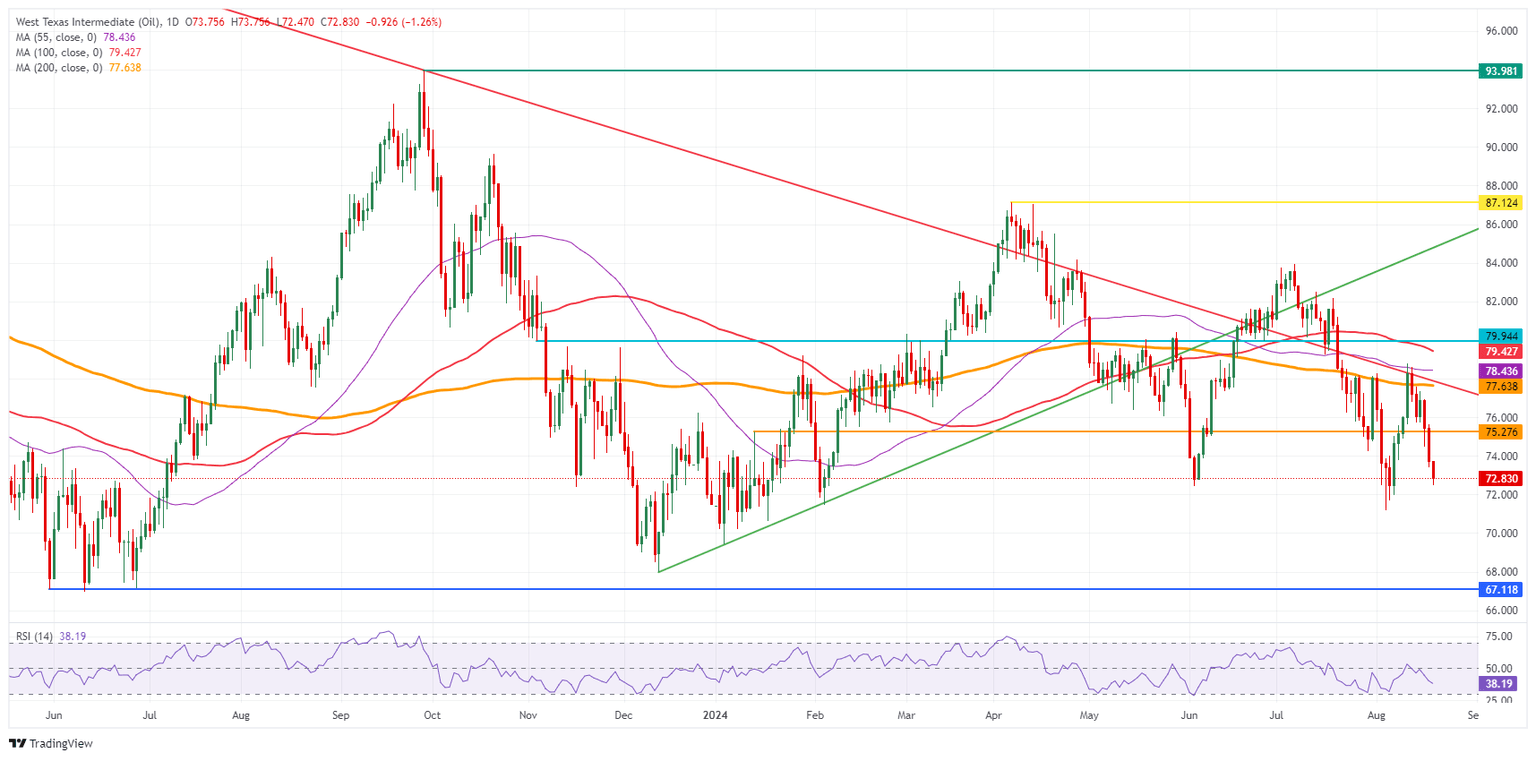

Oil Technical Analysis: For now

Oil is setting forth its correction as it has entered the $72-region. The move still has more room to go with the Relative Strength Index (RSI) telling sellers that it is not the end of the line just yet. More downside means at least a test towards $70.00, which could be the line in the sand for hedge funds that are still holding on to long positions bought on the speculation of Middle Eastern turmoil.

On the upside, it becomes very difficult to be bullish with a lot of resistance levels nearby. The first element to look out for is the pivotal $75.27. Next up is the double level at $77.65, which aligns with both a descending trendline and the 200-day Simple Moving Average (SMA). In case bulls are able to break above it, the 100-day SMA at $78.45 could trigger another rejection as it did last week.

On the downside, the low from August 5 at $71.17 is the best level for a bounce. It might not be bad to start considering levels below $70.00 in case ceasefire talks reach a breakthrough and hedge funds start selling their speculative stake in Oil contracts. The $68.00 big figure level is the first level to watch followed by $67.11, which is the lowest point from the triple bottom seen back in June 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.