Oil jumps on Monday with bearish positioning unwinding

- Oil pops above key pivotal level of $75.27 and advances to fresh five-day high.

- Most investors are in a wait-and-see mode ahead of Wednesday’s US CPI and Fed decision.

- The US Dollar Index trades above 105.00 after the European elections showed an advance of far right parties.

Oil prices have a change of heart with the US session underway on May, with the West Texas Intermediate (WTI) benchmark trading in the green, while dust settles over elections in the European Union that saw an advance from far-right parties. Even though the center parties held their ground, the far right gained presence in the Parliament, making it more likely that coalition talks head into gridlock, delaying reforms and decision-taking on economic development that would spark up demand for Oil. Apart from the EU elections, investors are keeping their powder dry ahead of Wednesday, when the US CPI report will be published and the US Federal Reserve will likely give further clues on the timing for a first interest-rate cut.

Meanwhile, the US Dollar Index (DXY) is trading above 105.00 after rallying higher on Friday driven by the stellar performance in the Nonfarm Payrolls numbers. The uncertainty stemming from the European election results added fuel to the fire in favor of a higher US Dollar, but until Wednesday the Greenback is expected to trade sideways.

At the time of writing, Crude Oil (WTI) trades at $75.74 and Brent Crude at $79.93

Oil news and market movers: Option markets turn bullish

- Bloomberg reports that the bear run in Oil looks to be coming to an end with several positions being unwinded, which opens room for more upside.

- Saudi Aramco is cutting Oil prices for July for the Asian markets. A softer demand outlook in the region is the main driver for the cut, according to Bloomberg.

- Oil prices might decline further for this week, according to Polymerupdate.com, with the demand-supply outlook from OPEC, EIA and IEA as main drivers together with the US Federal Reserve rate decision.

- The outlook for Oil remains bullish, according to Goldman Sachs’ head Commodity Strategist Daan Struyven. Struyven sees Brent hitting $86 per barrel by the third quarter over solid summer demand, Bloomberg reports.

- Iraq is set to reach a final deal with Kurdistan to restart Oil exports.

Oil Technical Analysis: Repositioning

Oil prices are heading towards the Fed rate decision in a depressed state following their near 10% slide lower last week (from last week’s high to last week’s low). With uncertainties on the horizon in Europe and sluggish demand in the US – where the Fed might keep rates steady for longer – all eyes look to Asia. This triggers an overload in offer from the Middle East to the region with price cuts, as seen by Saudi Aramco.

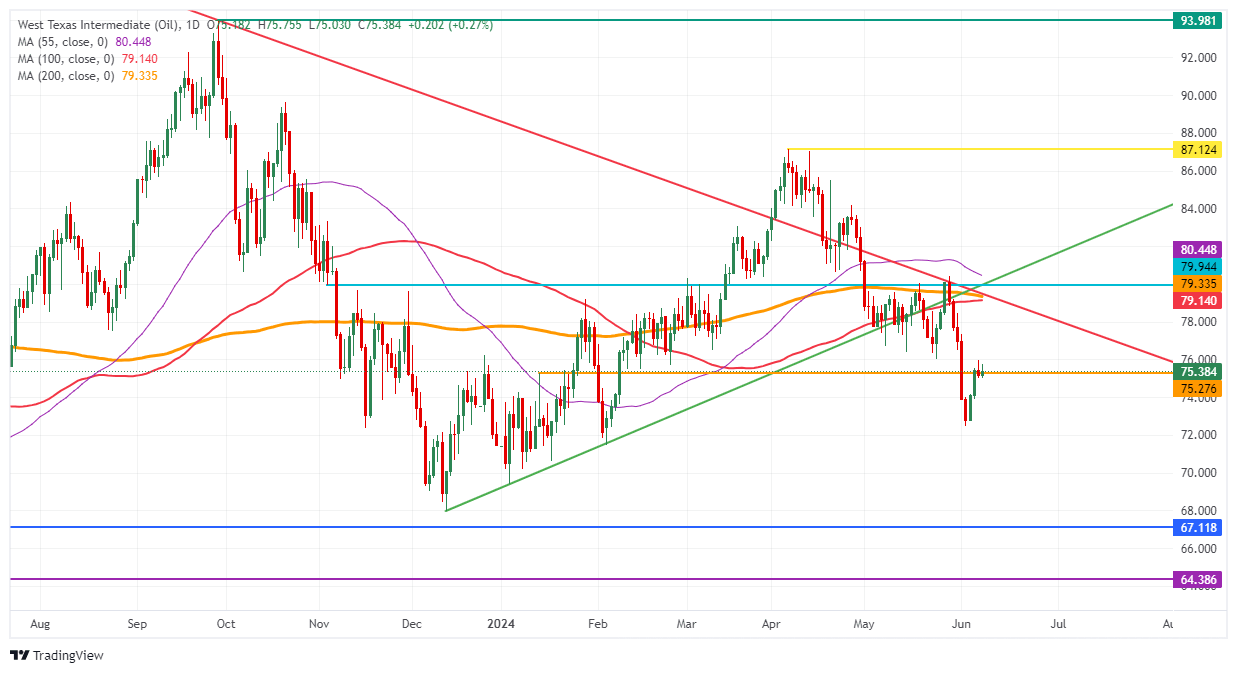

Looking up, the pivotal level near $75.27 needs to be recovered firmly first before aiming for the key Simple 100-day and 200-day Simple Moving Averages (SMA) at $79.14 and $79.33, respectively. Next, the 55-day Simple Moving Average (SMA) at $80.44 is level with a lot of resistance where any recovery rally could pause. Once broken through there, the road looks quite open to head to $87.12.

The $76.00 marker is still acting as a resistance with the $75.27 level playing a crucial role if traders still want to have an option to head back to $80.00. However, risks are skewed towards another leg lower should sluggish demand during the summer prevail and send Oil further down, all the way to $68.00, below $70.00.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.