Oil rallies over 2% with Middle East tensions nearing war status

- WTI trades back above $86 after whipsawing around it this week.

- Oil price rises near 1% despite EIA calls for a negative outlook on Oil demand.

- The US Dollar Index surges close to 106.00 and sets forth a fresh five-month high.

Oil prices are jumping higher again on Friday after the small 0.75% decline from Thursday. The move comes as commodities are soaring again fueled by geopolitical tensions and despite the fact that the US Dollar is stretching higher for a fourth straight day in a row this week. Meanwhile, the International Energy Agency (IEA) has cut its Oil demand forecast for this year and the next one, anticipating slower growth in 2025, due to a lacklustre economic outlook and the increasing market share of electric vehicles in the global car market

The US Dollar meanwhile is printing a staggering 1.8% rally in the US Dollar Index (DXY) after markets are increasingly expecting a bigger interest-rate differential between the Federal Reserve (Fed) and other central banks. This rate differential is separating the countries (and ergo the local currency) where central banks are in dire need to cut against countries from those countries where cuts are currently not needed. Robust US economic data points to the US as the leader of the countries where rate cuts under current conditions are not needed at all.

Crude Oil (WTI) trades at $86.82 and Brent Crude at $91.34 at the time of writing.

Oil news and market movers: Iran to strike any moment

- The Israeli government has asked residents to brace for potential direct attacks from Iran in coming days.

- The outlook for Oil demand from OPEC and IEA diverge substantially. While the IEA is calling for less demand in 2024 and 2025, OPEC on Thursday said it is watching summer demand very closely as it would not be able to handle any unforeseen uptick in demand.

- Furthermore in the IEA report from this Friday: more than 3 million barrels per day will be added coming from non-OPEC projects, with Brazil as the biggest contributor

- OPEC output increased by 110,000 barrels per day against February’s data. Saudi Arabia and Kuwait accounted for the small uptick, according to Bloomberg.

- More and more local governments in Europe, US and Israel are warning for possible retaliations from Iran.

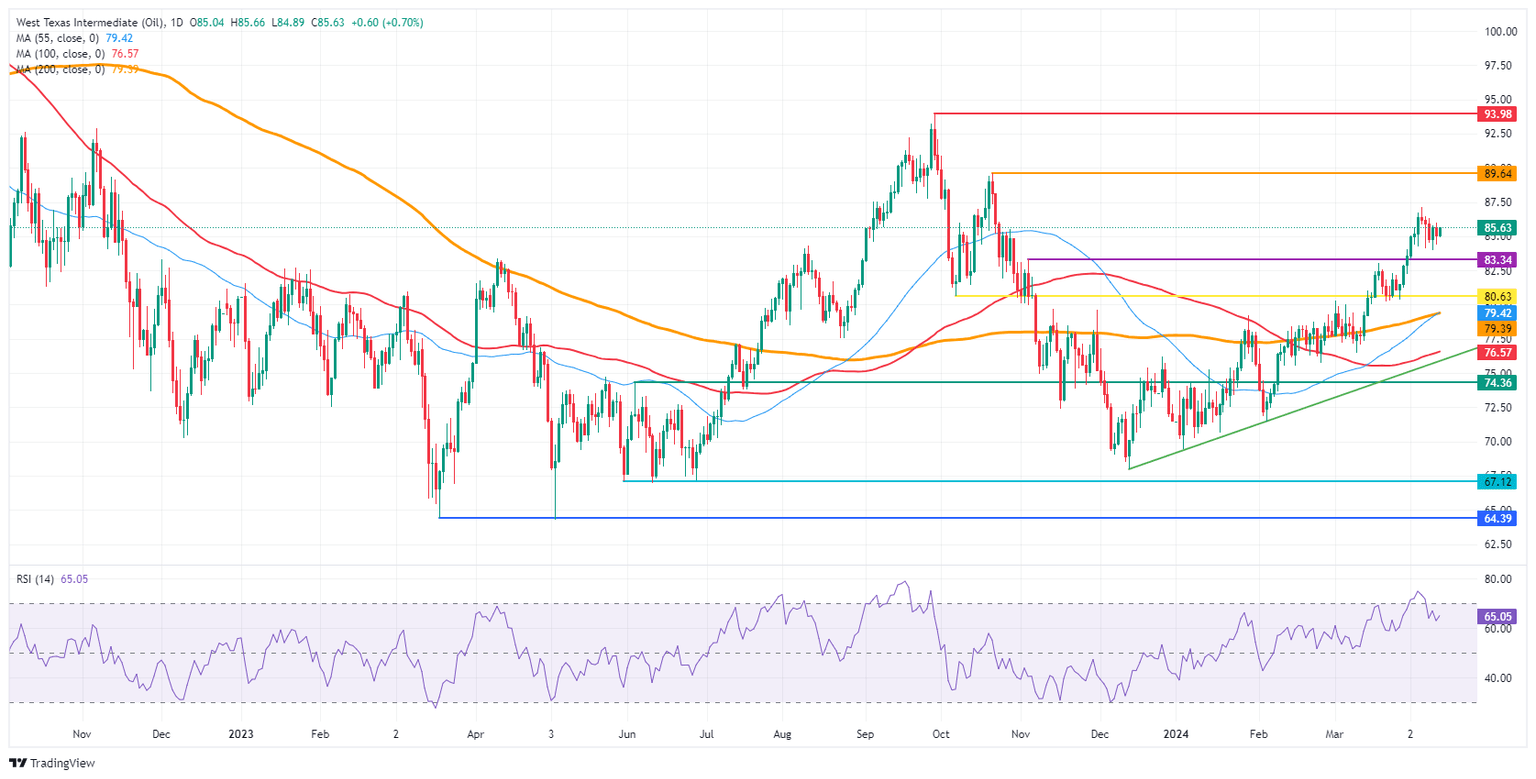

Oil Technical Analysis: Rally to $100

Oil prices remain elevated with tensions in the Middle East nearing a new dynamic. After Iran vowed to retaliate against Israel or any US asset in the region, tensions are getting high as such an attack could drag the whole region back into a long drawn-out dispute with the risk of Oil delivery disruptions. Meanwhile, the bearish IEA report said that Brazil soon will add substantially more non-OPEC Oil to the markets. Although Brazil was set to join OPEC from the beginning of this year, that inauguration still needs to happen.

If the high of last week at $87.12 gets broken, the $90 handle should come into grasp. One small barrier in the way is $89.64, the peak from October 20. In case of further escalating tensions in the Middle East, expect even $94 to become a possibility, and a fresh 18-month high could be on the cards.

On the downside, $83.34 is the first level to have a look for after a very clean break and test for support on April 1 and 2. Should it not hold, $80.63 is the next best candidate as a pivotal supportive level. A touch softer, the convergence with the 55-day and the 200-day Simple Moving Averages (SMAs) at $79.32 should halt any further downturn.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.