NZD/USD Price Analysis: The Bird is in full flight

- NZD/USD bulls are in control while the front side of the daily and hourly trendlines.

- Bulls aim for the daily highs with the 0.65400 area in sight.

New Zealand's central bank governor said on Thursday that benchmark interest rates needed to go higher following its hawkish tone and forecast that rates would now peak at 5.5%, compared with a previous forecast of 4.1%.

NZD/USD rallied to a high of 0.6259 on Thursday, heading towards the strongest levels in nearly three months with eyes on 0.6485 after the Reserve Bank of New Zealand delivered a supersized 75 basis point rate hike to get ahead of inflation.

That hike was the largest since the RBNZ introduced the OCR in 1999 and brought the policy rate to a 14-year high of 4.25%. This leaves the upside firmly in play while the price remains on the front side of the daily trendline.

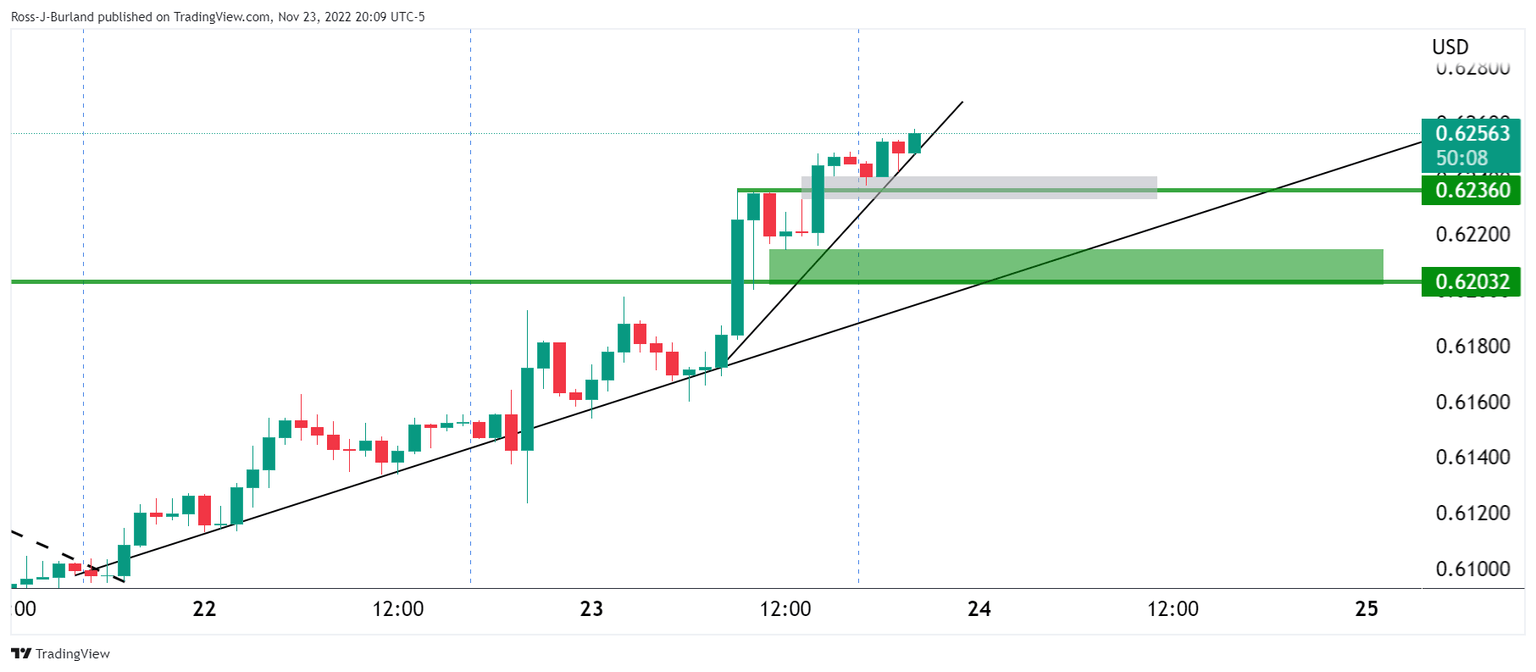

NZD/USD H1 chart

The bulls are creeping higher in Asian trade despite the ground it has already made since the RBNZ.

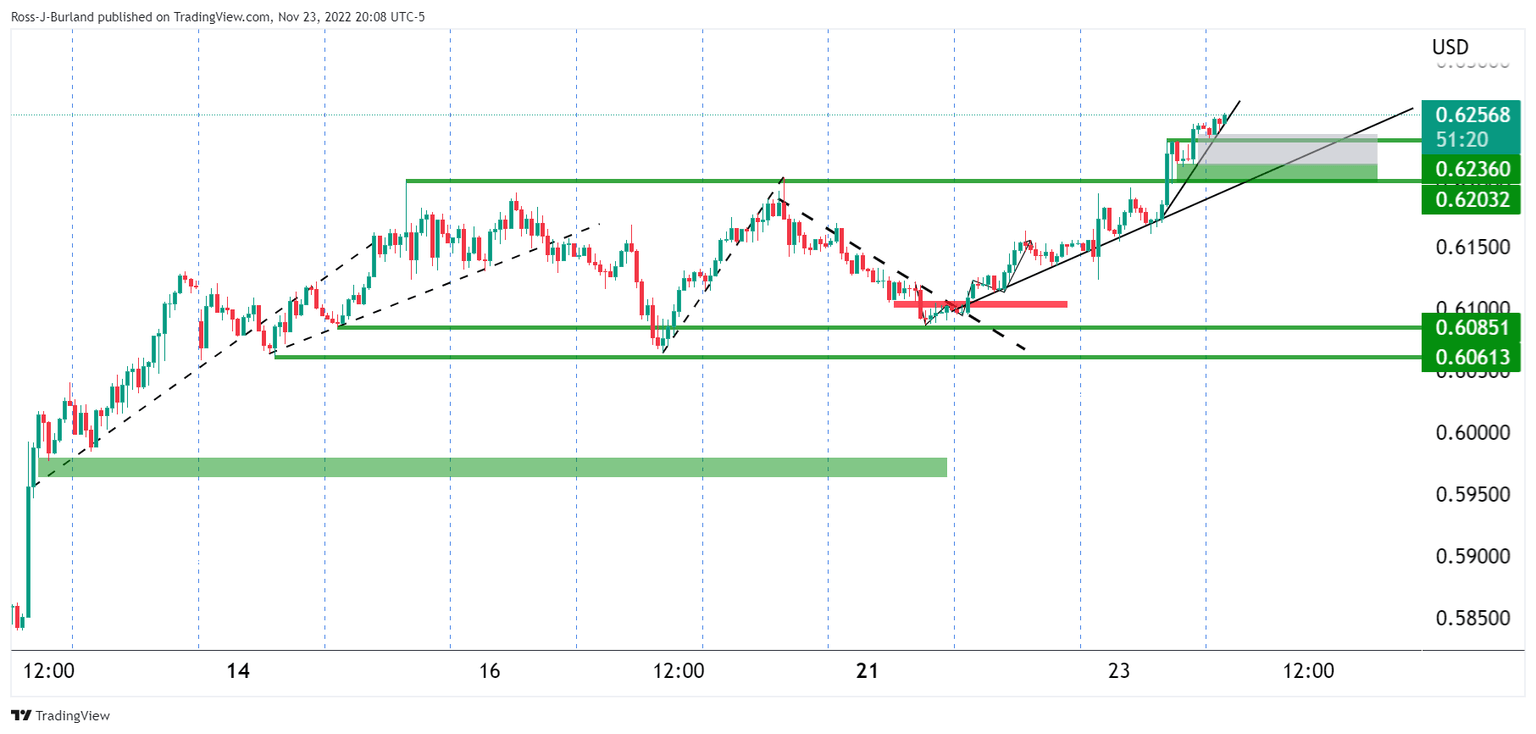

NZD/USD H1 chart zoomed out

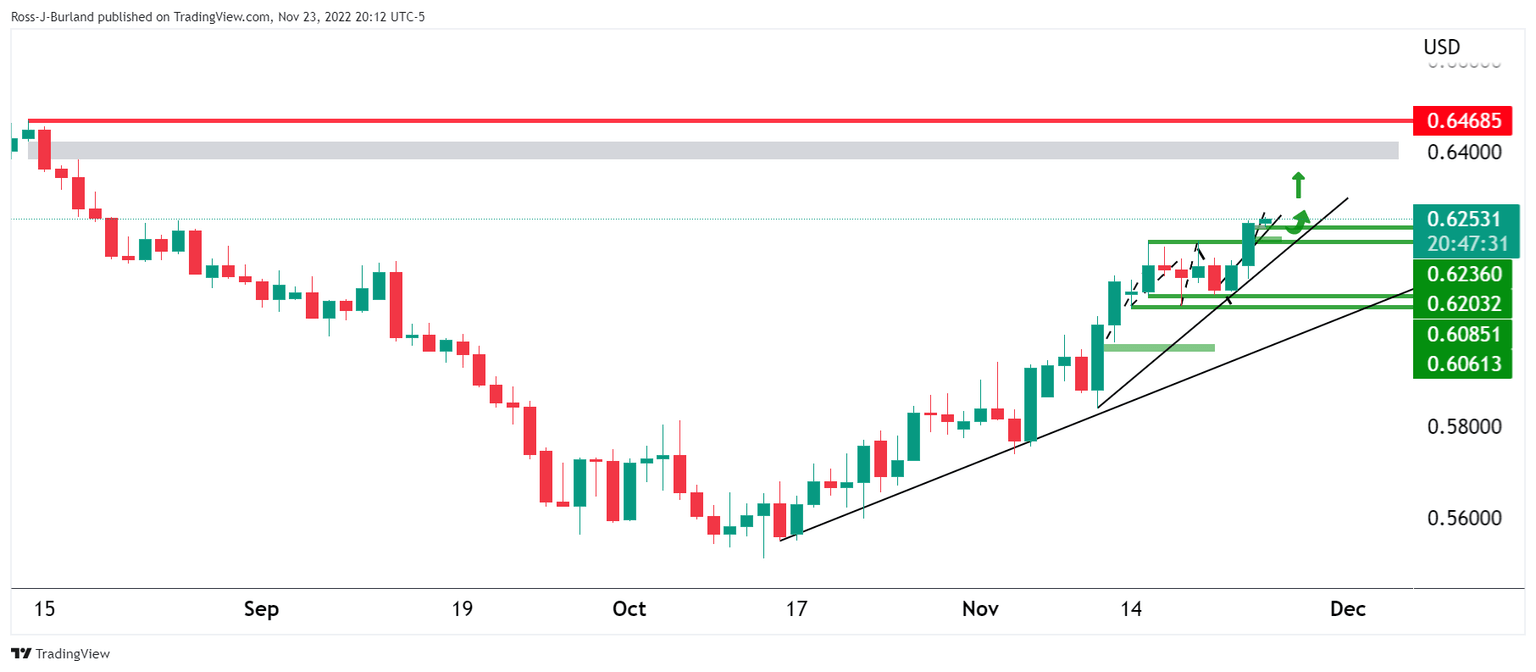

This has happened with a move that has been in development for some time given the coil and breakout of the 0.6000 and 0.6100 areas. This has the potential to move towards the daily highs as illustrated below on the daily;y time frame all the while the bulls stay front side of the daily trendlines:

NZD/USD daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.