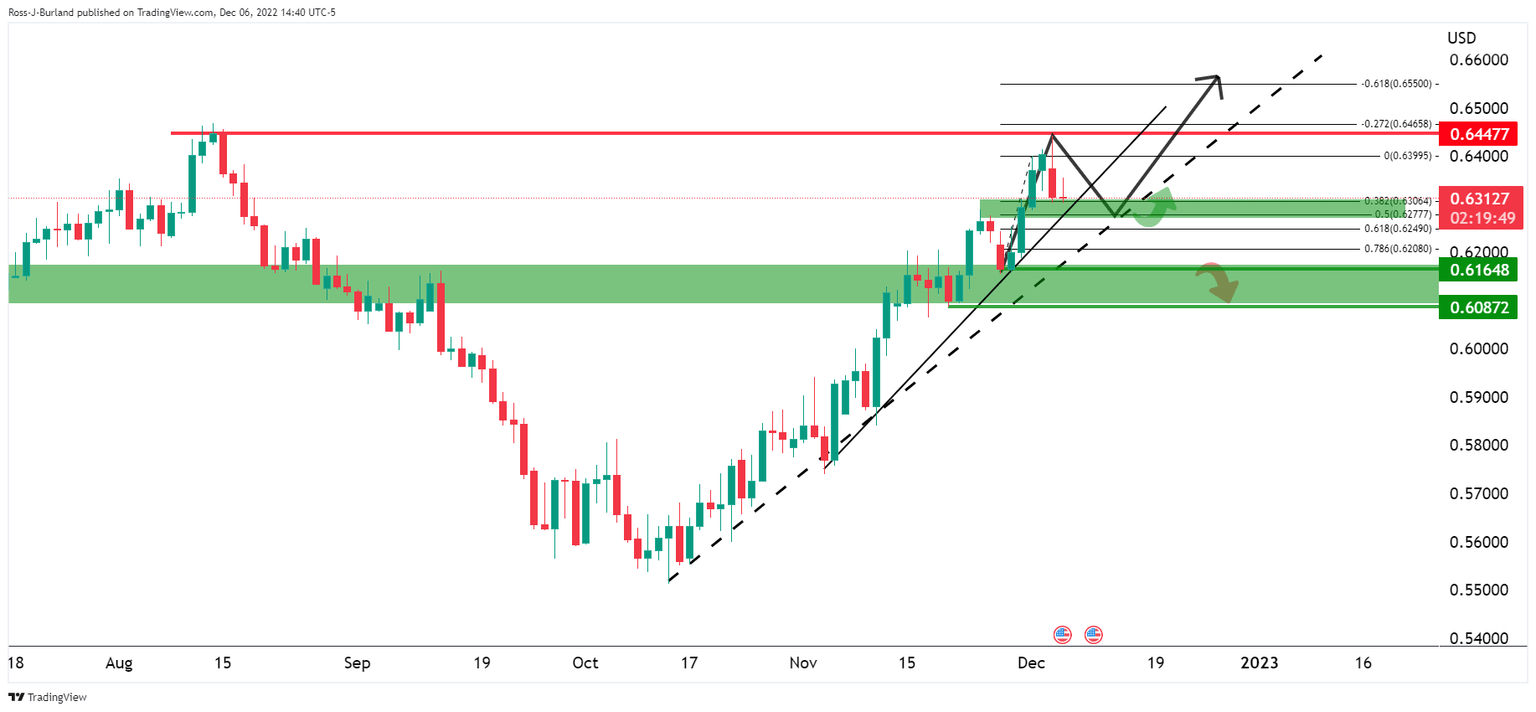

NZD/USD bears move in and eye key trendline support

- NZD/USD bulls could be throwing in the towel here.

- Bears eye a move to test the trendline support.

NZD/USD is trading around flat on the day, sitting near 0.6320 having stuck to a tight range of 0.6303 and 0.6354. There has been little in the way of a catalyst this week so far, instead the bird has been inching away from the recent highs in what has been a fragile risk environment for financial markets so far, weighing on the high beta currencies such as NZD.

Friday's Nonfarm Payrolls data combined with the start of the week's US Services PMIs have surfaced the prospects of a hawkish Federal Reserve interest rate decision at next week's meeting. In turn, the stock markets and commodity complex have been pressured at the start of the week.

Analysts at ANZ Bank think that the meeting will be tricky to interpret. ''A smaller hike is all but assured, leaving the focus on the terminal rate, which will have to strike the right balance: high enough to credibly bring down inflation, but not so high that it stokes recession fears. We still think it speaks mostly of US dollar volatility into year-end, with a good chance of a correction higher, but let’s see,'' the analysts explained.

''Next week’s HYEFU is also important for the NZD. It’s unlikely to be bond friendly, but potentially higher bond yields and the need for offshore buyers may translate to NZD buy flows,'' the analysts added.

NZD/USD technical analysis

If the bulls commit at this juncture, then there could be the case being made for another rejection at resistance as the bull cycle begins to decelerate and teeter out in the 0.6400s.

However, should there be a significant correction into liquidity near 0.6250, then if the bulls were to re-engage, then there could be a build-up for momentum to run the bird through resistance in the coming days/weeks.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.