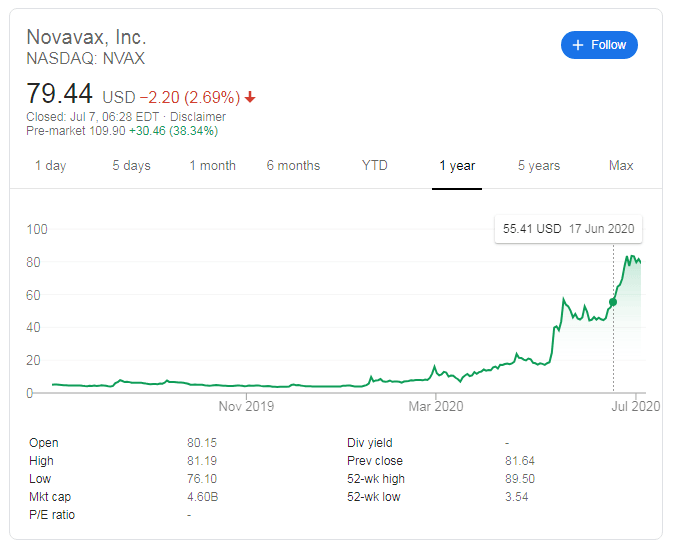

NVAX Stock Price: Novavax Inc.surging 34% after $1.6 billion COVID-19 vaccine candidate grant

- NASDAQ: NVAX is trading at new record highs following a dramatic announcement.

- The US government has awarded Novavax $1.6 billion toward trialing and producing a coronavirus vaccine.

- Novavax may leapfrog its competition in the race against COVID-19.

Novavax Inc. (NASDAQ: NVAX) is trading at $107 in pre-market trading on Tuesday, up some 34% and above the 52-week high of $89.50. The Gaithersburg, Maryland-based firm that also operates in Sweden focuses on producing immunizations and has seen its stocks up some nearly 20 times from the 52-week low of $3.54 – before the most recent surge.

NVAX news

Novavax has been awarded a whopping $1.6 billion sum from the US federal government to develop and manufacture a COVID-19 vaccine candidate. The race to curb coronavirus continues at full force with Moderna, Oxford University, and other companies racing to find a cure.

The government investment is part of Washington's "Operation Warp Speed" project, intended to accelerate and discovering and distribution of a vaccine that would put COVID-19 to rest.

The funds will serve to fund the candidate coded NVX-CoV2373 including the Phase 3 trial and potentially to distribute them by late 2020 – an ambitious target. Nevertheless, the boost from the government may allow NASDAQ: NVAX to bypass the fierce competition.

Phase 1/2 consists of 130 healthy participants and was launched in Australia in May. Results are due out by late July. The third phase is larger, with 30,000 subjects.

Broader markets are set to open lower on Tuesday after surging on Monday. Cooling down in Asian markets and concerns ahead of new COVID-19 statistics from Florida, Texas, and other states are weighing on sentiment.

The US is recording around 50,000 cases per day, with the positive test rate and hospitalizations also on the rise. On the other hand, the death rate has been decline.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.