Moderna Stock Price and Forecast: MRNA collapses as US and UK go back to normal life

- Moderna stock slides again as investors lose faith.

- MRNA shares also suffering as UK fully opens up and Biden says normal is on the way.

- Moderna lacks alternative revenue streams.

FXStreet had turned bearish on this stock after resutls in November, but the emergence of the Omicron variant did change things somewhat. Moderna (MRNA) shares spiked as panic gripped markets and Omicron was an unknown entity.

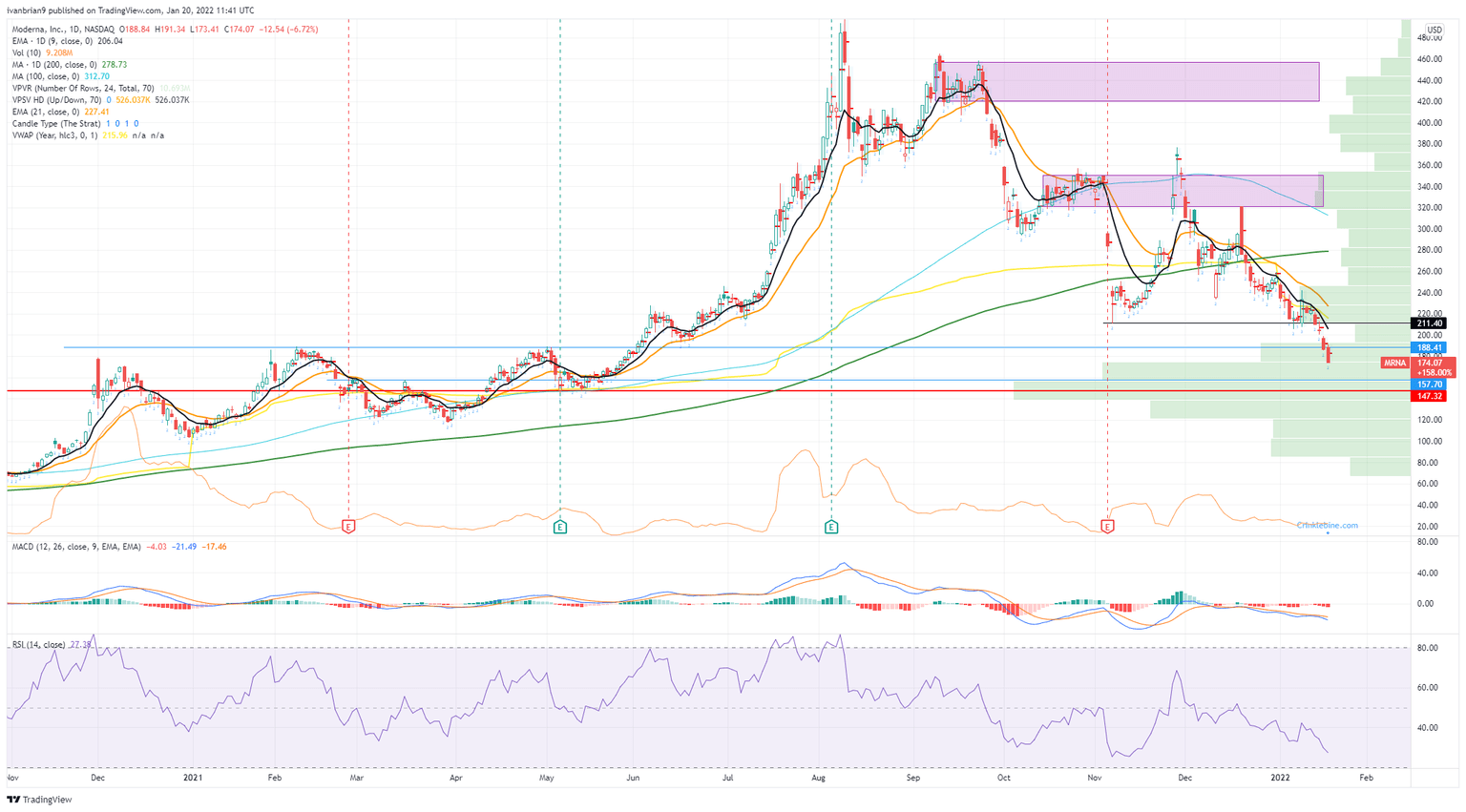

The shares quickly spiked to nearly $380 from a post-earnings low of $220. However, Moderna put in a bearish shooting star candle that signified impending losses. The news was finally confirmed in our view when on December 20 Moderna said its jab was effective against Omicron. Moderna shares spiked intraday but actually closed 6% lower as investors ditched the name.

The reason as we now apparently know is that it appears Omicron is much less serious that other variants. More transmissable, yes, but the variant results in much fewer hospitalizations. Experts have now come to the conclusion that this is the end game for covid. This will be the final covid winter. This appears to have gotten confirmtaion from the UK yesterday as emabttled Prime Minister Johnson gets to luckily deflect attention away from him by announcing an end to restrictions. In the US President Biden says things are nearly back to normal. Europe is a little further behind, but already some countries such as Ireland are significantly easing restrictions.

Moderna Stock News

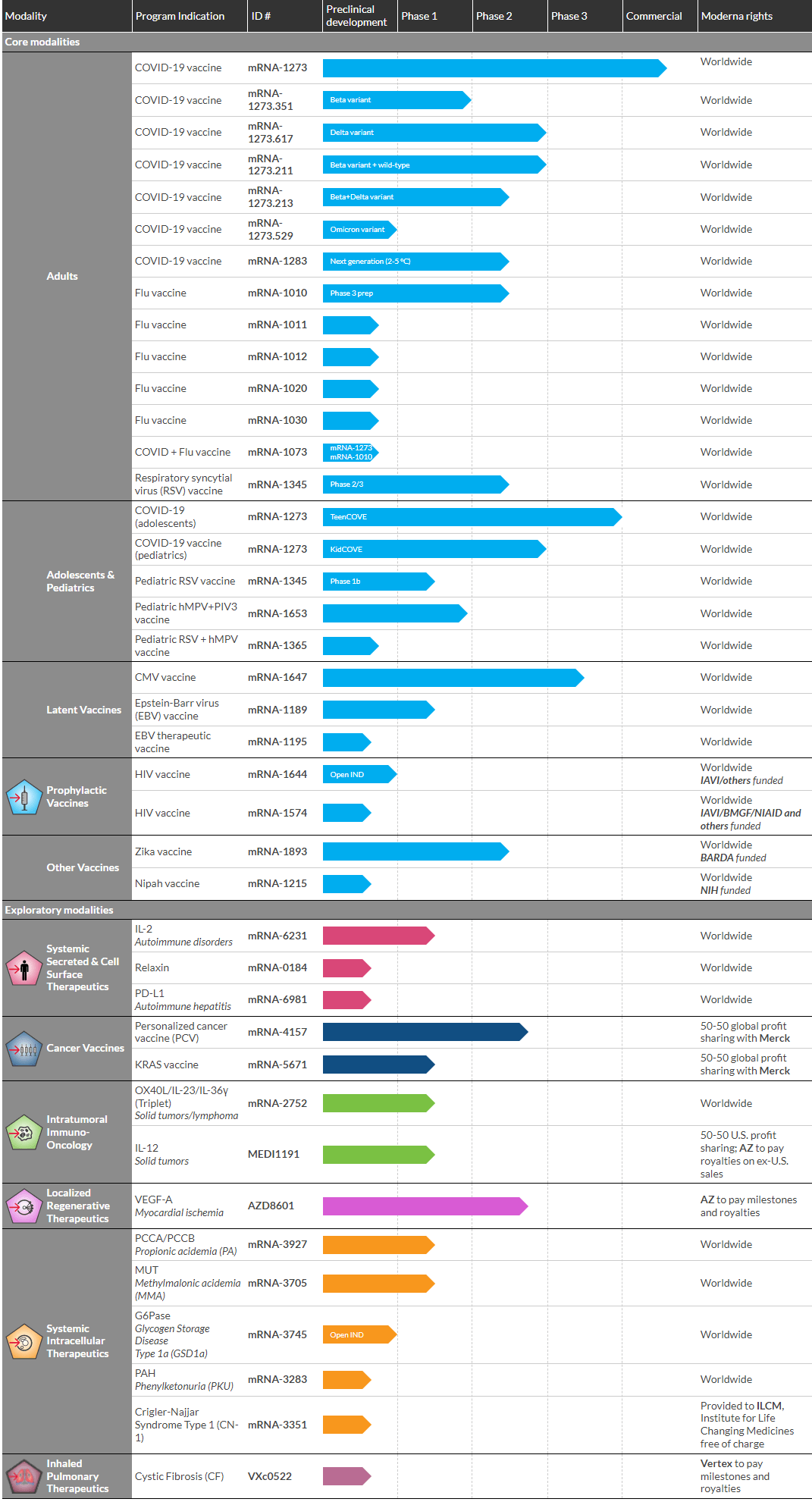

Moderna cracked below key support at $188 when it lost nearly 7% yesterday. Markets are not in a charitable mood, and increased attention is now being focused on potential short names and dumping high growth stocks. FXStreet has identified before the one-trick pony that MRNA potentially is. It is hugely reliant on covid vaccines for revenue. It does have some other products in the pipeline as shown below, but none are yet commercial.

Source: Moderna www.modernatx.com/pipeline

Moderna Stock Forecast

$188.40 was a big level going back to February of last year. The stock eventually broke above in summer 2021 and staged a successful pullback test before marching higher. Now that it is broken, the next target is $157.70 and then some decent volume support at $147. Resistance at $211 is the short-term pivot.

Moderna (MRNA) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.