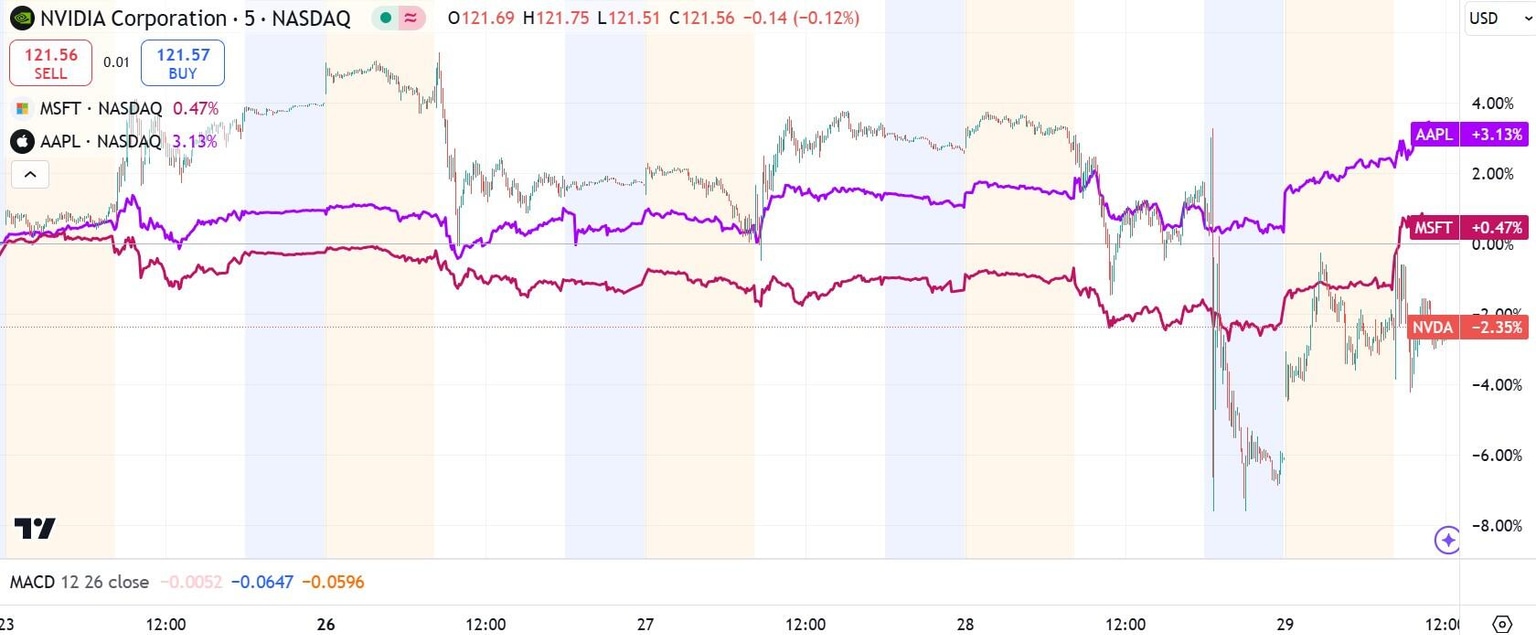

Microsoft, Apple remain only $3 trillion companies as Nvidia earnings push it below threshold

- Nvidia earnings late Wednesday have pushed NVDA out of $3 trillion market cap.

- Microsoft and Apple gain on Thursday, with both mega caps benefiting from AI offerings.

- Dow Jones gains ground due to MSFT, AAPL advancing.

- iPhone 18 announcement expected on September 9.

The broad market was unimpressed with Nvidia’s (NVDA) Q2 results late Wednesday, and shares of the semiconductor sold off more than 3% on Thursday. But most other tech stocks made gains simply because the uncertainty surrounding the “most important stock” are now behind them. Investors stopped bracing for a terrible earnings result from Nvidia that would have had the ability to wreck the market.

Both Microsoft (MSFT) and Apple (AAPL) added more than 2%. The Dow Jones Industrial Average (DJIA), of which they are both constituents, advanced as much as 1% before pulling back in the afternoon.

The Dow was greatly aided by positive data for the US economy. FXStreet's Joshua Gibson writes:

"US Q2 GDP beat forecasts Thursday morning, propping up market sentiment and sending investors back into a bidding stance. Annualized Q2 GDP came in at 3.0% compared to the expected hold at 2.8%, and Initial Jobless Claims also ticked down to 231K for the week ended August 23. Investors had expected a print of 232K compared to the previous week’s revised 233K."

Microsoft, Apple stock news

Microsoft and Apple are momentarily the only members of the $3 trillion market cap crew. Despite handily beating Wall Street consensus, Nvidia slipped enough to fall below that threshold. There was little negativity surrounding Nvidia, except for its sky high gross margin slipping slightly below expectations to 75.1%.

Microsoft’s Charles Lamanna, Corporate Vice President for Business Apps & Platforms, was interviewed by Brad Zelnick of Deutsche Bank on Wednesday at the bank’s tech conference.

Lamanna said that enterprise customers were now focused on how artificial intelligence (AI) can be incorporated into their customer relationship management (CRM) and resource management software offerings from Microsoft.

“Everybody that has Office software today or productivity software today should have Copilot for Microsoft 365 or an equivalent,” said Lamanna. “And then, we've layered on top of that Copilot for sales, Copilot for service, Copilot for finance or in Dynamics 365.”

Copilot is Microsoft’s version of partner firm OpenAI’s large language model. OpenAI has been in the news this week as it is looking to raise money at a $103 billion valuation, well above last round’s $86 billion valuation. Microsoft, OpenAI’s largest investor, is reportedly going to once again be part of the funding round.

Cit has named Apple its top AI pick on Thursday. The surprise pick placed Apple ahead of Nvidia heading into 2025, because analysts said the AI features in the new operating system for the iPhone 18 are attractive enough to cause an impressive upgrade round. Apple is expected to unveil the new iPhone at its product event on September 9.

5-day comparison chart of Microsft, Apple and Nvidia

5-minute chart detailing peformance of NVDA, AAPL and MSFT over past five trading sessions

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.