Mexican Peso soars as US stellar jobs data eases recession fears

- Mexican Peso rises after strong US Nonfarm Payrolls data for September crushed estimates.

- Mexico’s data showed an uptick in unemployment, while Automobile Exports and Production increased in September.

- US Unemployment Rate edged lower, easing recession fears.

- The Federal Reserve is expected to cut rates by 25 bps in the coming meetings.

The Mexican Peso appreciated against the US Dollar on Friday, sponsored by an outstanding jobs report in the United States (US) that set aside recessionary fears in the largest economy in the world. Meanwhile, market participants seem confident that President Claudia Sheinbaum’s government could be “market-friendly” despite backing controversial measures that could threaten the state of law. The USD/MXN trades at 19.17, down 0.83%.

Sentiment improved as Wall Street rallied after US Nonfarm Payrolls data for September, which crushed estimates and upward revised July and August figures. Consequently, the Unemployment Rate edged lower, a relief for the Federal Reserve, which slashed rates by 50 basis points at the September meeting, due to risks on the employment mandate, tilted to the upside.

This boosted the Greenback against most G8 FX peers but still not against the Peso. The Mexican currency is set to finish the week with gains of over 2%.

Furthermore, traders trimmed the chances of a 50 bps Fed rate cut in November, and they estimate 25 bps in the subsequent four meetings. Bank of America changed its November Fed call from a 50 to 25 bps cut.

Chicago Fed President Austan Goolsbee, not a voter in 2024 but one of the most dovish members at the Federal Open Market Committee (FOMC), said that more reports like this “will make me more confident we are settling in at full employment.” He said most Fed officials expect rates to decrease over the next 18 months.

Across the south of the border, Mexico’s jobs report showed that the Unemployment Rate ticked up in non-seasonally adjusted rate during August. Automobile Exports and Production increased in September, revealed the Instituto Nacional de Estadistica, Geografia e Informatica (INEGI).

Daily digest market movers: Mexican Peso shrugs off bad jobs report as US NFP data improved risk appetite

- Mexico’s Auto Production and Exports rose in September. Auto Production climbed 11.71% from 8.3% in the previous month. Exports grew by 4.8%, up from 1.7% in August.

- Mexico’s Jobless Rate in August hit 3%, higher than July’s 2.9%.

- US Nonfarm Payrolls grew by 254K in September, exceeding estimates of 140K and upward revised figures for August, at 159K. The Unemployment Rate edged lower from 4.2% to 4.1%, less than estimates.

- Banxico’s September poll of analysts and economists revealed that inflation expectations were reviewed to the downside, with headline prices down from 4.69% to 4.48% YoY. Underlying inflation is expected to hit 3.84% from 3.94%.

- The same survey showed the USD/MXN exchange rate is projected to end 2024 at 19.69, while Banxico’s main reference rate is foreseen to end at 10%.

- Mexico’s economy is foreseen to grow by 1.45% in 2024, lower than August’s by 1.57%.

- Market participants have disregarded a Fed 50 bps cut. The odds of a 25-bps cut are 94.9%, while the chances for holding rates unchanged are at 5.1%, according to the CME FedWatch Tool data.

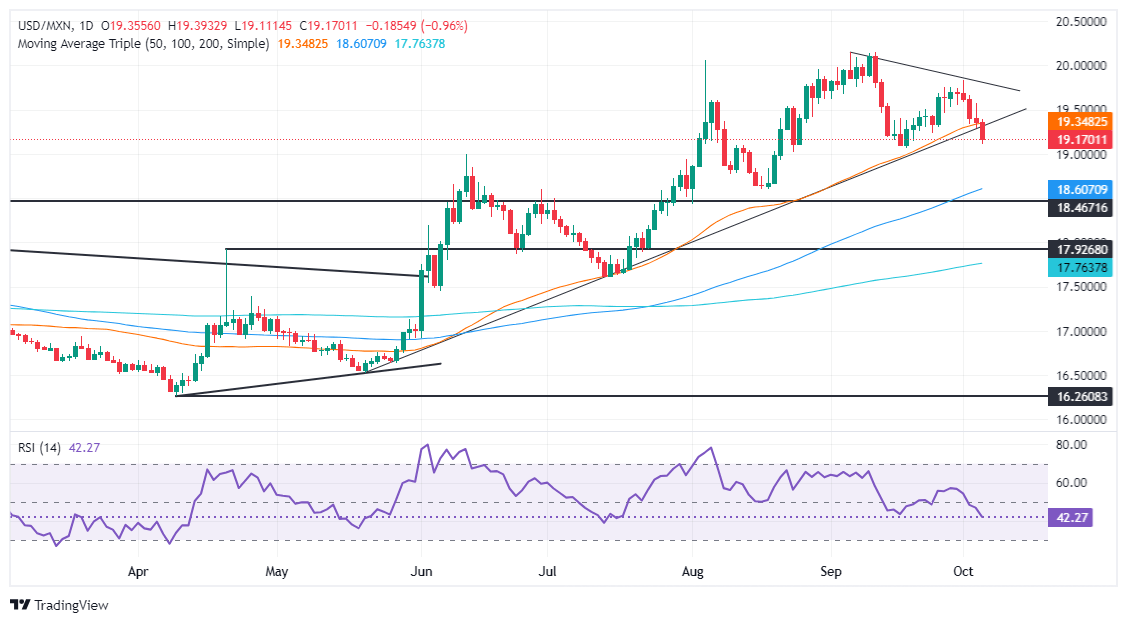

USD/MXN Technical outlook: Mexican Peso rallies as USD/MXN tumbles below 19.20

The USD/MXN uptrend is doubtful as the pair cleared the 50-day Simple Moving Average (SMA) at 19.33, with sellers gathering momentum. The Relative Strength Index (RSI) shifted bearish with an almost vertical slope aiming downwards. Hence, the exotic pair path of least resistance, is tilted to the downside.

That said, the USD/MXN first support would be the 50-day Simple Moving Average (SMA) followed by the September 24 swing low of 19.23. The next floor is the September 18 daily low of 19.06, ahead of the psychological 19.00 figure.

Conversely, for a bullish resumption, the USD/MXN must surpass the 19.50 mark and October’s 1 daily high of 19.82. Once surpassed, the next resistance will be 20.00, followed by the YTD peak of 20.22.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.