Mexican Peso slides amid slowing economy and higher inflation

For the latest news about the Mexican Peso click here.

- Mexican Peso drops versus US Dollar amid GDP slowdown and Banxico Minutes highlighting inflationary pressure.

- Banxico revises inflation outlook and expects convergence to 3% target by Q4 2025.

- Mexico's quarterly GDP exceeds expectations but slowed down; mid-month inflation data reflects ongoing disinflation.

- US economic data shows resilience with fewer unemployment claims and strong activity in manufacturing and service sectors.

The Mexican Peso tumbles against the US Dollar on Thursday amid a busy economic docket in Mexico and the United States. Mexico's Gross Domestic Product (GDP) shows the economy slowing, while business activity in the US improved. That, alongside the release of Banxico’s Meeting Minutes, exerts pressure on the Mexican currency. The USD/MXN trades at 16.74, up 0.53 %.

The Bank of Mexico revealed its latest Meeting Minutes. The board revealed that headline inflation most likely edged up due to persistent inflationary pressure in the services sector. Regarding underlying prices, “Most members noted that core inflation continued decreasing at the margin, having declined from 4.64[%] to 4.37% between February and April.”

In the minutes, all the members expect inflation to converge to Banxico’s target of 3% in the fourth quarter of 2025. Alongside that, "All members highlighted that, considering that inflationary shocks are foreseen to take longer to dissipate, the forecasts for headline and core inflation have been revised upwards.”

Earlier, the National Statistics Agency (INEGI for its acronym in Spanish) revealed that GDP figures exceeded forecasts on a quarterly basis, but on a yearly basis they decelerated as expected in the first quarter of 2024.

At the same time, headline inflation for the first half of May slowed on a monthly basis but increased on an annual basis, compared to the last reading. Mid-month core inflation was aligned with the consensus in monthly and yearly numbers, depicting the evolution of the disinflation process.

Across the border, the US economic docket was also busy. Unemployment claims came in below estimates, while business activity in the manufacturing and services segments smashed the consensus, expanding sharply and showing the US economy’s resilience.

Daily digest market movers: Mexican Peso depreciates as core inflation slows and US business activity reaccelerates

- Mexico’s Gross Domestic Product (GDP) for the first quarter of 2024 was 1.6% YoY as expected, down from Q4 2023’s 2.5% growth. On a quarterly basis, the country expanded 0.3% above estimates and the previous reading of 0.1%.

- Mid-month inflation for May was 4.78% YoY, up from 4.63% estimate. On a monthly basis, it decreased from 0.09% to -0.21%. Core inflation for the same period dipped from 4.39% to 4.31% YoY, as expected, and edged down from 0.16% to 0.15% MoM, in line with consensus.

- Across the border, the May Citibanamex survey showed that 26 analysts estimate Banxico will lower rates at the upcoming meeting on June 27. Eight estimate the Mexican central bank will lower rates until the second half of 2024. Inflation expectations for 2024 were revised upward from 4.17% to 4.21%, while underlying prices are expected to fall from 4.10% to 4.07%.

- Initial Jobless Claims in the US reached 215K in the week ending May 18, below the estimate and the previous reading of 220K and 223K, respectively.

- S&P Global revealed May’s final readings of US PMIs. The Manufacturing PMI expanded to 50.9, exceeding estimates and April’s 50.0, while the Services PMI crushed forecasts and April’s 51.3, improving to 54.8. The Composite PMI improved from 51.3 to 54.4, exceeding forecasts of 51.1.

- The latest Federal Open Market Committee minutes highlighted, "Various participants mentioned willingness to tighten policy further should risks to outlook materialize and make such action appropriate.” Regarding the tightness of the monetary policy, officials remained uncertain, adding that “it would take longer than previously anticipated to gain greater confidence in inflation moving sustainably to 2%.”

- Data from the Chicago Board of Trade shows investors are expecting 27 basis points (bps) of Fed easing, down from 31 bps estimated on Wednesday toward the end of 2024.

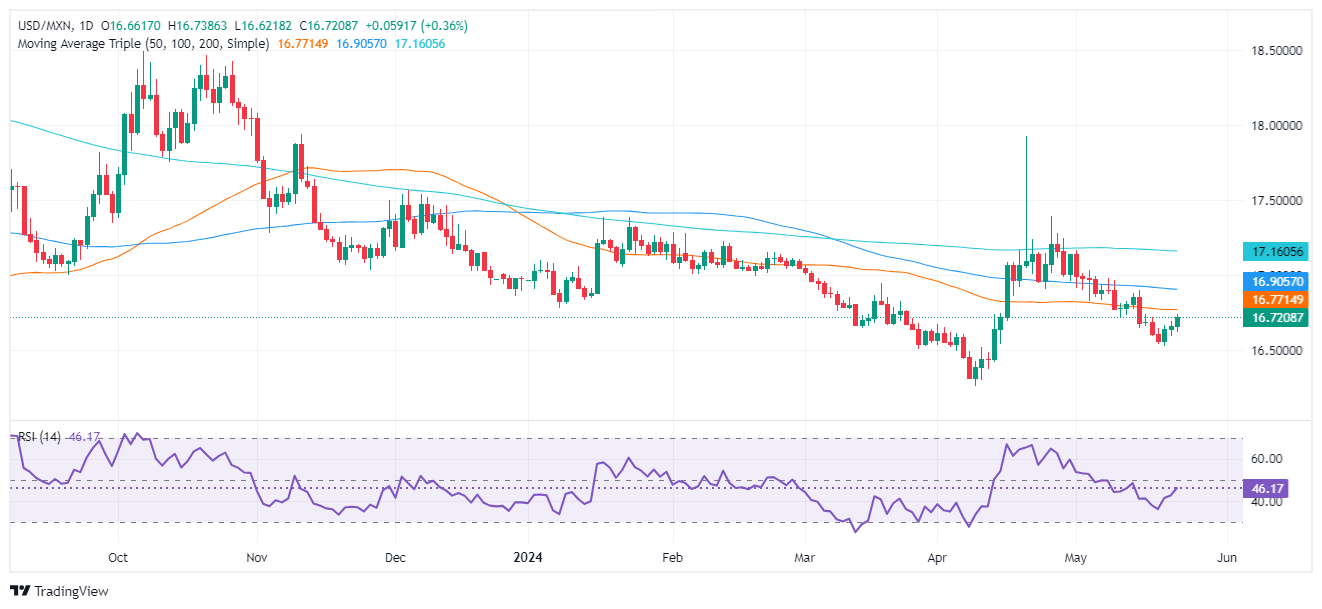

Technical analysis: Mexican Peso loses ground as USD/MXN hovers near 16.70

Despite remaining downwardly biased, the USD/MXN has printed three days of consecutive gains, opening the door to challenging higher prices. Once the exotic pair breached 16.60, momentum showed that selling pressure was waning as the Relative Strength Index (RSI) aims for the 50-midline.

For a bullish continuation, USD/MXN must clear the 50-day Simple Moving Average (SMA) at 16.76. A breach of the latter would exacerbate a rally toward the 100-day SMA at 16.91, followed by the 17.00 psychological level. In that event, the next stop would be the 200-day SMA at 17.17.

Conversely, a drop below 16.52 could exacerbate a challenge of the 16.50 psychological level, ahead of the year-to-date low of 16.25.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.