Mexican Peso depreciates as looming constitutional changes spark investor fears

- Mexican Peso on defensive as political turmoil deepens, ignoring foreign investors.

- AMLO’s judicial overhaul bill passes Mexico’s lower house, awaiting Senate approval amid fierce opposition.

- USD/MXN trades in 19.67-19.92 range with political uncertainty overshadowing US JOLTS impact.

The Mexican Peso depreciated against the Greenback on Wednesday during the North American session as the Mexican lower house voted and approved President Andres Manuel Lopez Obrador's (AMLO) bill to overhaul the judicial system. At the time of writing, the USD/MXN traded at 19.92, rising over 0.70%.

Mexico’s political turmoil continued on Wednesday. After more than 17 hours of discussion, Morena’s ruling party and its allies approved AMLO’s bill with 357 votes in favor and 130 against. Now it’s the turn of the Senate, where Morena is one vote short of what’s needed to pass the bill into law as part of the Mexican Constitution.

Although foreign governments, workers of the Mexican court system, and international companies expressed concerns that the reform threatened the rule of law, Mexico’s Chamber of Deputies approved it.

It is worth noting that on Tuesday, the US Ambassador in Mexico, Ken Salazar, expressed that the approval of the judiciary reform could damage relations between Mexico and the United States.

Despite that, as traders digested the latest US JOLTS report, the USD/MXN remains anchored in the middle of the 19.67-19.92 range. Job openings in July fell to their lowest level in three-and-a-half years, sparking speculation that the US Federal Reserve (Fed) might cut rates by 50 basis points (bps) at the upcoming September meeting.

According to the CME FedWatch Tool, odds for a 50 bps Fed rate cut are at 43%; while for a quarter of a percentage point, 57%.

Ahead this week, the US economic docket will feature the release of the ADP National Employment Change, Initial Jobless Claims, S&P and ISM Services PMI data, and the Nonfarm Payrolls (NFP) report on Friday.

Daily digest market movers: Mexican Peso on backfoot on scarce economic docket

- Mexico’s data revealed during the week show the economy is decelerating, due in part to higher interest rates set by the Bank of Mexico.

- On Tuesday, the Unemployment Rate ticked close to the 3% threshold, while business activity in the manufacturing sectors shrank.

- The docket will feature Mexico’s automobile industry data on Friday, ahead of next week’s inflation data.

- Most banks expect the Bank of Mexico (Banxico) to reduce rates by at least 50 basis points (bps) for the remainder of 2024. This would pressure the Mexican currency, which has already depreciated 17.38% year to date (YTD).

- US JOLTS Job Openings in July dropped from June’s 7.910 million downward revision to 7.673 million.

- US Factory Orders for the same period rose sharply from a -3.3% plunge on June 5 to 5% growth.

- US Nonfarm Payrolls in August are expected to grow from 114K to 163K, while the Unemployment Rate is foreseen to tick lower from 4.3% to 4.2%.

- Data from the Chicago Board of Trade (CBOT) suggests the Fed will cut at least 103 basis points this year, up from a day ago’s 96.5 bps, according to the fed funds rate futures contract for December 2024.

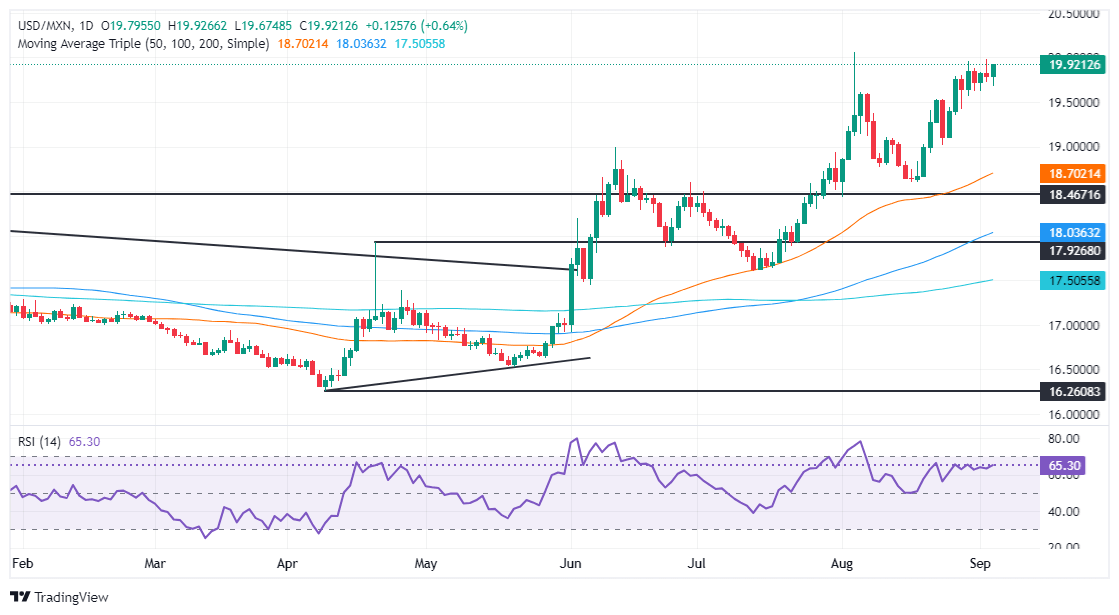

Technical outlook: Mexican Peso weakens as USD/MXN rallies above 19.85

Political development sponsored a leg-up in the USD/MXN, which retreated somewhat after hitting a weekly high of 19.98. As the judicial reform overcame the first obstacle, traders ditched the Mexican currency and began to buy the Greenback.

USD/MXN buyers need to clear the weekly high before testing the 20.00 figure. A breach of the latter will expose the YTD high at 20.22, followed by the September 28, 2022 daily high at 20.57. If those two levels are surrendered, the next stop would be August 2, 2022 swing high at 20.82, ahead of 21.00.

Conversely, if USD/MXN weakens further, the first support would be 19.50. A breach of the latter will expose the August 23 swing low of 19.02 before giving way for sellers eyeing a test of the 50-day Simple Moving Average (SMA) at 18.65.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.