Mexican Peso pulls back after strong rally following US data miss

- The Mexican Peso retreats on Thursday after rallying strongly against the US Dollar following key US data.

- US CPI and Retail Sales missed analysts expectations and showed a slow down from previous readings.

- The data puts back on the table the possibility of an early interest rate cut from the Fed, weighing on USD.

The Mexican Peso (MXN) edges lower on Thursday as traders press pause after the Peso’s strong rally on the previous day. Lower-than-expected Consumer Price Index (CPI) and Retail Sales data for April in the US revealed a cooling down of inflation and economic activity that recalibrated interest-rate expectations.

The data suggests the Federal Reserve (Fed) may be more inclined to lower borrowing costs – a negative for the US Dollar (USD) but overall positive for the Mexican Peso.

At the time of writing USD/MXN is trading at four-week lows of 16.71, EUR/MXN is trading at 18.18 and GBP/MXN at 21.19.

Mexican Peso reverses after US data

The Mexican Peso rebounded against the USD in particular – but other major currencies too – after US CPI data undershot expectations, thereby increasing the chances the Fed might lower interest rates sooner than previously expected. Lower interest rates are negative for the USD as they reduce foreign capital inflows.

US headline CPI dropped by 0.3% on a month-on-month (MoM) basis in April, which was below the 0.4% forecast by experts and the 0.4% registered in March, according to data from the US Bureau of Labor Statistics. The year-over-year (YoY) reading came out at 3.4% as estimated, though below the 3.5% of March.

The data for CPI ex Food and Energy, meanwhile, came out in line with expectations of 0.3% MoM, but this too was below the 0.4% of March. YoY, the gauge fell to 3.6% as forecast, from 3.8% previously.

US Retail Sales showed flat consumer spending, with a 0.0% reading in April, which was well below estimates of 0.4% and the downwardly revised 0.6% of the previous month, according to data from the US Census Bureau.

USD/MXN rose almost a percentage point after the news as investors recalibrated their expectations of the future course of US interest rates.

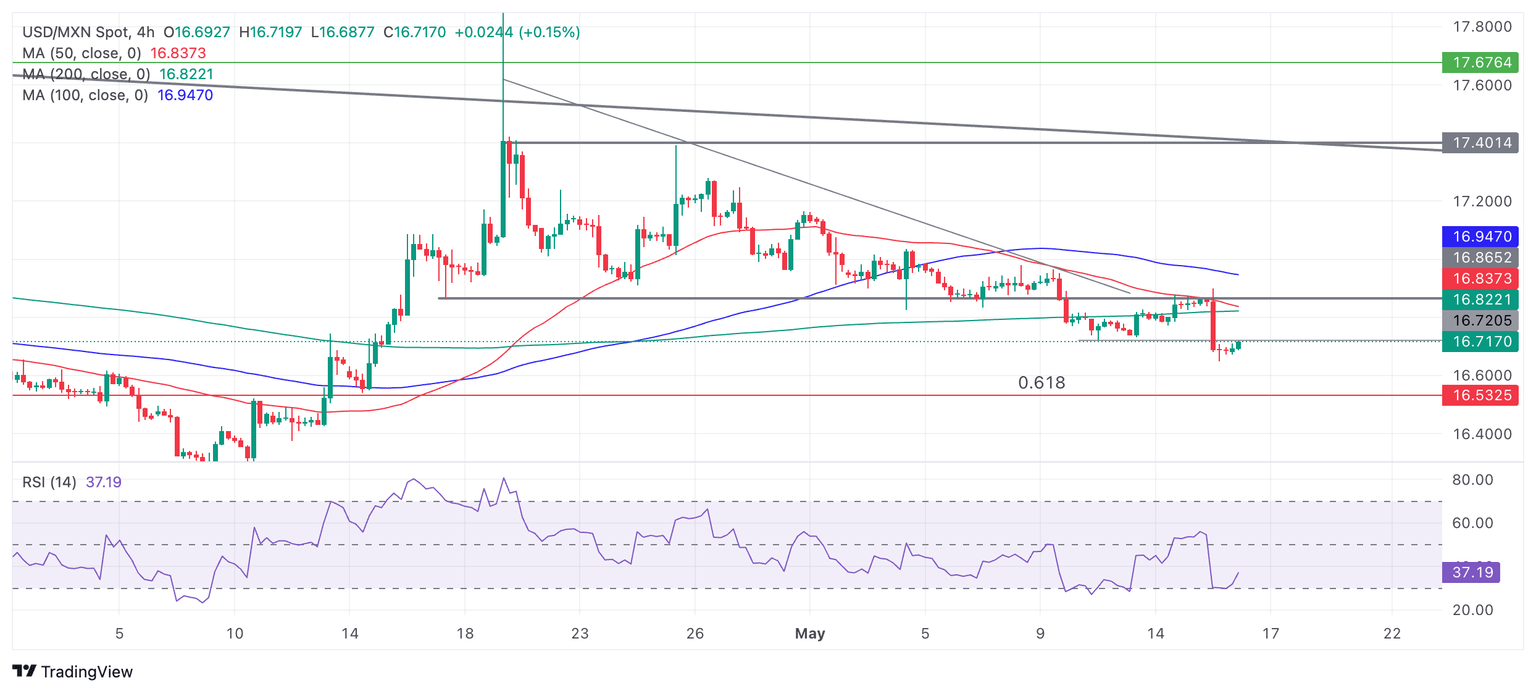

Technical Analysis: USD/MXN resumes downtrend

USD/MXN – the value of one US Dollar in Mexican Pesos – “air-kissed goodbye” the key resistance level at roughly 16.86, which it had returned to after its range breakout, and descended on Wednesday, clocking substantial losses in the progress.

USD/MXN 4-hour Chart

The pair has now resumed its short-term downtrend towards the conservative target for the breakout at 16.54, the 0.681 Fibonacci ratio of the height of the range extrapolated lower. Further bearishness could even reach 16.34, the full height of the range extrapolated lower.

Given the medium and long-term trends are bearish, the odds further favor more downside for the pair in line with those trends.

It would take a recovery and decisive break back inside the range (above 16.86), to reverse the downtrending bias.

A decisive break would be one accompanied by a longer-than-average green candlestick that closed near its high or three green candlesticks in a row.

Economic Indicator

Consumer Price Index (MoM)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The MoM figure compares the prices of goods in the reference month to the previous month.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed May 15, 2024 12:30

Frequency: Monthly

Actual: 0.3%

Consensus: 0.4%

Previous: 0.4%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.