Mexican Peso remains firm as focus shift to FOMC minutes

Most recent article: Mexican Peso depreciates as Trump's tariff threats boost US Dollar

- Mexican Peso shows resilience, marginally dipping to 20.29 despite strong US services sector growth and job market data.

- Trump denies narrow tariff plans, boosting the US Dollar, yet the Peso maintains its ground against market fluctuations.

- Upcoming Mexican CPI data awaited as economic indicators from the US continue to shape Fed rate expectations.

The Mexican Peso posted minimal gains against the Greenback on Tuesday after data suggested that the United States (US) economy remained solid, while traders pared back the Federal Reserve's (Fed) first interest rate cut until July. At the time of writing, the USD/MXN trades at 20.27, down 0.16%.

The financial markets continued to reflect a positive market tone after The Washington Post published an article mentioning that US President-elect Trump's team is working toward narrowing tariffs that will “only cover critical imports.” Even though Trump refuted the article and boosted the buck, the Mexican Peso shrugged off those comments and appreciated against the US Dollar.

On the data front, the Institute for Supply Management (ISM) revealed that business activity in the Services sector improved sharply. At the same time, the survey showed that a sub-component of the Purchasing Managers Index (PMI) linked to prices hit its highest level since 2023.

At the same time, the US Bureau of Labor Statistics revealed that job vacancies broke above the 8 million threshold, indicating that the labor market is strengthening.

In Mexico, the economic docket remained absent on Tuesday and will resume on Thursday. The Consumer Price Index (CPI) will be revealed, and it is foreseen to continue its downward trajectory toward Banco de Mexico’s (Banxico) 3% target.

On Wednesday, the US economic schedule will feature the ADP Employment National Change, Initial Jobless Claims figures, and the Fed’s last meeting minutes.

Daily digest market movers: Mexican Peso consolidates ahead of Mexico’s CPI data

- The US Dollar Index (DXY) rises 0.17%, up at 108.46, a tailwind for the USD/MXN exotic pair.

- The ISM Services PMI in December increased by 54.1, exceeding forecasts of 53.3 and November’s 52.1 reading.

- The Job Labor & Turnover Survey (JOLTS) revealed that work openings increased from 7.839 million to 8.098 million in November.

- According to the Bureau of Economic Analysis, the US trade deficit widened in November, reaching $78.2 billion compared to $73.6 billion in October.

- Imports climbed by 3.4% to $351.6 billion from $339.9 billion, while exports increased by 2.7% to $273.4 billion from $266.3 billion.

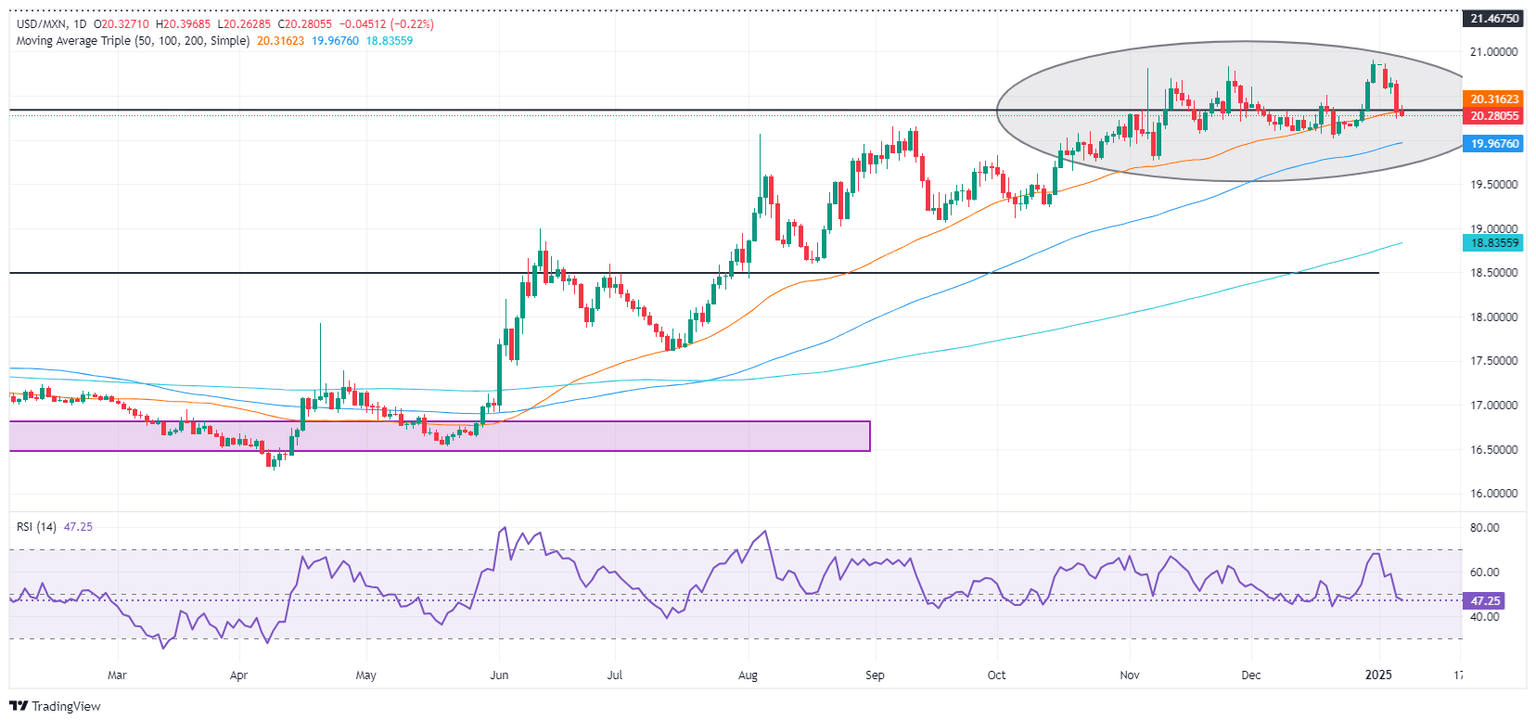

USD/MXN technical outlook: Mexican Peso remains subdued near 20.30

The USD/MXN remains tilted in a vague direction, meandering around the 50-day Simple Moving Average (SMA) at 20.27. The Relative Strength Index (RSI), despite turning flat in bearish territory, indicates the exotic pair might consolidate, awaiting a fresh catalyst.

Therefore, if USD/MXN drops below the 50-day SMA, the next support would be the 20.00 figure. A breach of the latter will expose 100-day SMA at 19.91, followed by the 19.50 figure.

Conversely, if buyers stepped in and lifted the USD/MXN above 20.50, the next ceiling level would be the year-to-date (YTD) high of 20.90, ahead of 21.00 and the March 8, 2022 peak of 21.46.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.