Mexican Peso weakens after Mexican congress votes through controversial reforms

Most recent article: Mexican Peso sinks to four-week low as judicial reform spurs sell-off

- The Mexican Peso weakens after the Mexican lower house votes through a set of controversial reforms.

- Investors are concerned about the negative impact of the reforms on the economy.

- USD/MXN restarts its uptrend after a pause and breaks above 20.00.

The Mexican Peso (MXN) depreciates in its most-traded pairs on the day named after the Norse god of thunder, extending the over-one-percent decline clocked up on Wednesday.

The Peso is being sold because investors are fretting about the Mexican parliament passing a controversial bill of reforms that critics say will compromise the independence of the judiciary, undermine democracy and damage international trade and foreign investment.

Mexican Peso depreciates after Mexican congress passes reforms

The Mexican Peso weakened in its key pairs on Wednesday after lawmakers in Mexico’s lower house voted through a controversial bill of reforms to the judiciary.

The reforms seek to counter the perceived corruption in the judiciary by electing judges through popular vote, rather than by appointment. However, critics argue the bill will compromise the independence of judges and fail to combat corruption, which is more located amongst lower-ranking officials and members of law enforcement agencies.

Despite protests and strikes from court employees against the reforms, who blocked the entrance to congress on Wednesday – forcing lawmakers to relocate to a sports hall for the debate and subsequent vote – the government managed to get the bill passed, winning a vote of 357 in favor versus 130 against.

The reforms will now be debated in Mexico’s upper house, where the government is one seat short of a majority. Most experts believe, however, that it will still get voted through.

From a financial perspective, the reforms run the risk of leading to a decline in foreign investment. This, in turn, would reduce demand for the Peso, leading to a further depreciation of the currency.

The US ambassador for Mexico, Ken Salazar, said that although reforms to the judiciary were needed the current bill was raising concerns among investors in his country. He warned it could jeopardize the two countries’ close relationship, which includes a free trade deal.

“If it is not done in the right way, it could cause a lot of damage to the relationship,” said Salazar at a press conference on Tuesday.

At the time of writing, one US Dollar (USD) buys 20.00 Mexican Pesos, EUR/MXN trades at 22.20, and GBP/MXN at 26.34.

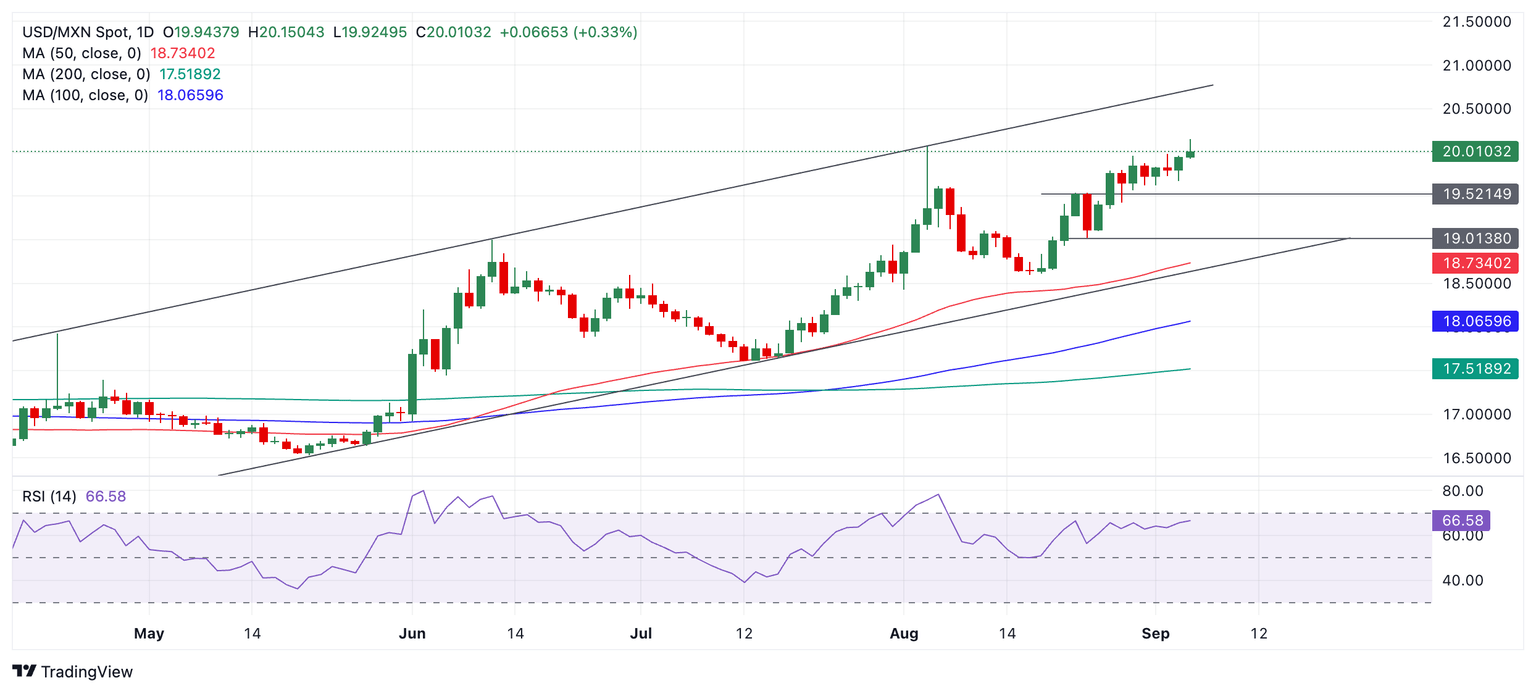

Technical Analysis: USD/MXN breaks above 20.00

USD/MXN restarts its uptrend, climbing within a broader rising channel. Given that, according to technical analysis, “the trend is your friend” the odds favor more upside.

On Tuesday, the pair broke briefly above the 19.96 high of the mini-range, making a higher high at 19.98 – on Thursday it breaks above that and touches 20.00.

USD/MXN Daily Chart

This supplies further confirmation of a continuation of the bull trend, with the next target at the upper channel line in the 20.60s.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.