Mexican Peso edges higher, staunching sell-off from retail sales miss

Most recent article: Mexican Peso slumps amid weak Retail Sales ahead of GDP data

- The Mexican Peso recovers on Wednesday after Tuesday’s sell-off following weak retail sales data.

- Carry trade outflows and investor concerns regarding judicial reforms are also weighing on the MXN.

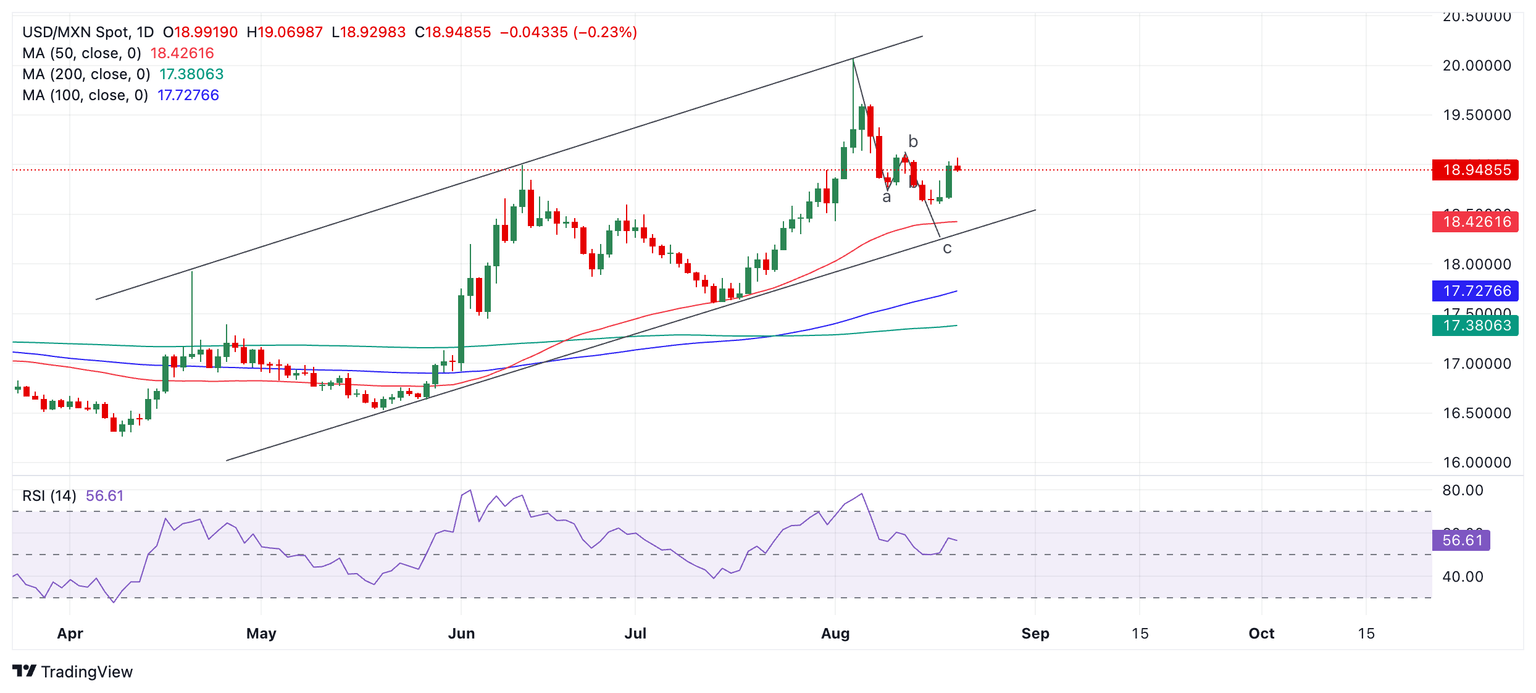

- Technically, USD/MXN may be starting a new leg higher within its rising channel.

The Mexican Peso (MXN) recovers in its most heavily-traded pairs on Wednesday. The bounce comes after the Peso fell between 1.50% and 2.00% in its key pairs on Tuesday after the release of Retail Sales data showed shoppers curtailed their spending in June.

The weak retail sales data could suggest inflation may be set to fall further, increasing the chances of the Banco de Mexico (Banxico) cutting interest rates further – a negative for the Peso, since lower interest rates attract less foreign capital inflows.

Lower interest rates could increase speculation investors are pulling out of their long Peso carry trade positions. With interest rates falling in Mexico and the Peso starting to trend lower too – whilst the opposite happens in Japan – the carry trade, which capitalizes from the interest rate differential between the two currencies, could see more outflows from the MXN.

Mexican Peso reverses trend after news of judicial reforms

The Mexican Peso reversed its temporary recovery rally from the August 5 lows after the Mexican government announced more details about their controversial judicial reforms on Friday, according to Commerzbank. These concerns, which some investors have interpreted as market unfriendly, led to a rapid depreciation in the currency after the June elections, and may have also contributed to the Peso’s generally weak tone over recent days.

USD/MXN in particular may see volatility on Wednesday with the publication in the US of the Quarterly Census of Employment and Wages (QCEW) for March. The data is benchmarked against US Nonfarm Payrolls (NFP) for comparison. If the census data differs from the NFPs it may lead to revisions in the latter.

Although the data will only cover the period to March 2024 (avoiding the latest and weakest payrolls), a big downward revision could revive fears that the US economy is heading for a hard landing. This, in turn, could weaken the US Dollar (USD). Additionally, the Federal Reserve will release the minutes from its July policy meeting.

For more macroeconomic news from Mexico, traders will have to wait for Thursday when 1st Half-Month Inflation for August and Q2 Gross Domestic Product (GDP) data will be published by INEGI.

At the time of writing, one US Dollar (USD) buys 18.99 Mexican Pesos, EUR/MXN trades at 21.08, and GBP/MXN at 24.71.

Technical Analysis: USD/MXN could be starting new up leg

USD/MXN gained over 1.7% on Tuesday, reversing the prior evolving down leg within the pair’s broader rising channel.

The long green up day posted on Tuesday means that the bearish Shooting Star candlestick pattern of the prior day failed to gain bearish confirmation. This could indicate the short-term trend is changing and the pair may be about to begin a new up leg within the channel.

USD/MXN Daily Chart

USD/MXN had been looking like it was unfolding in a bearish abc pattern within its rising channel, however, wave “c” has so far failed to extend all the way down to the lower channel line.

It is not clear what will happen next: it is possible the pair could recapitulate and start to move back down again, eventually reaching the lower channel line or at least the 50-day Simple Moving Average (SMA) lying just above at 18.43.

Alternatively wave “c” may have extended as far as it is going to go and the start of a new up leg is now unfolding. A break above the top of wave “b” at 19.10 would provide extra confirmation that a stronger up move was underway.

The overall trend on the medium and longer-term time frames is arguably up, suggesting a bullish backdrop that provides extra support to the view that a new upward move is underway.

Economic Indicator

Retail Sales (MoM)

The Retail Sales released by INEGI measures the total receipts of retail stores. Monthly percent changues reflect the rate of changes of such sales. Changes in retail sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive or bullish for the Mexican peso, while a low reading is seen as negative or bearish.

Read more.Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.