Mexican Peso rallies against USD after cooler US inflation data

Most recent article: Mexican Peso rises amid speculation of September Fed rate cut

- The Mexican Peso rallies against the US Dollar after the release of cooler-than-expected US inflation data.

- The next major event for the currency is the release of Banxico’s June meeting Minutes.

- Uncertainty over the trajectory of future monetary policy in Mexico is making traders hesitant to place bets.

- The Peso weakens the most against the Pound after the release of better-than-expected UK GDP data.

The Mexican Peso (MXN) trades higher against the US Dollar (USD) on Thursday after the release of US Consumer Price Index (CPI) data indicates cooling inflationary pressures in the US. The CPI data suggests the Federal Reserve (Fed) will be more inclined to cut interest rates in the near term. This, in turn, is negative for USD since lower interest rates attract less foreign capital inflows.

MXN trades flat versus the Pound after early weakness, attributed to the release of better-than-expected UK Gross Domestic Product (GDP) data for May, which came out at 0.4% month-over-month, roundly beating economist’s estimates of 0.2%.

Traders are also hesitating ahead of the release of the Minutes of the Bank of Mexico’s (Banxico) last policy meeting. Uncertainty regarding the trajectory of interest rates has increased after the release of higher-than-expected headline Mexican inflation data for June. The impact of the Peso’s devaluation following the June election and the imported disinflation thus anticipated, are further factors complicating the outlook.

At the time of writing, one US Dollar (USD) buys 17.77 Mexican Pesos, EUR/MXN trades at 19.35, and GBP/MXN at 22.99.

Mexican Peso rallies against Dollar after US inflation data misses mark

The Mexican Peso appreciated against the US Dollar on Thursday after the release of US CPI data for June.

US CPI rose 3.0% year-on-year in June, falling below estimates of 3.1% and the previous month's 3.3%. CPI declined 0.1% on a month-over-month basis in June, when economists had expected a 0.1% rise from 0.0% in May.

Core CPI, which excludes volatile food and energy components, meanwhile cooled to 3.3%, falling below expectations of 3.4% from 3.4% previously. On a monthly basis core CPI rose 0.1%, which was below the 0.2% forecast and 0.2% of May.

The data is further evidence that inflation is falling to the Fed's target of 2.0% and makes it more likely the central bank will begin cutting interest rates – a negative for the USD as it is likely to reduce foreign capital inflows.

Mexican Peso lower ahead of Banxico Minutes

The Minutes of Banxico’s June meeting, scheduled for 15:00 GMT, are the next major release for the Mexican Peso.

The Minutes ought to provide more information on the Banxico’s stance in terms of the economy and the direction of future policy. These, in turn, could influence the Peso.

“We expect the minutes to elaborate on both disinflation forces and some of the upside risks embedded in the ongoing MXN re-adjustment, and the forces behind growth disappointments,” say analysts at JP Morgan.

Banxico’s board is expected to acknowledge the “underwhelming growth dynamics and downgrade its growth outlook — now openly underscoring downside risks to economic activity,” they added.

If accurate, JP Morgan’s preview suggests the Peso is at risk of weakening following the release, since a downgrade in the growth outlook will put more pressure on Banxico to cut interest rates despite the above-consensus rise in the June headline inflation data. Lower interest rates are negative for a currency as they reduce foreign capital inflows.

Mixed reaction to inflation data causes uncertainty

The 12-month inflation rate in June came out at 4.98%, which was higher than the 4.84% expected by economists and the 4.69% previously, according to data from INEGI.

Banxico Deputy Governor Jonathan Heath wrote on X that June’s inflation data was “very worrying.” Heath is seen as a monetary “hawk” of the Banxico board – in favor of higher interest rates – similar to Deputy Governor Irene Espinosa.

“Headline inflation reached 4.98% in June, the highest inflation rate in the last 12 months. On the margin, the annual rate for the second half of June registered 5.17%. Very worrisome,” wrote Heath.

This comes after Heath’s comments comparing his stance to that of the Chairman of the Federal Reserve, Jerome Powell, in terms of its data dependency. The effect of his words was to lower rate-cut bets and further fuel the rally in the Peso.

Deputy Governor of the Bank of Mexico Galia Borja urged caution in recent remarks.

“It's prudent not to make hasty decisions” regarding monetary policy, Borja said, adding that officials must be patient and current policy was “undoubtedly restrictive.”

Slowdown in core inflation could be key – Capital Economics

Whilst headline inflation in Mexico rose in June, core inflation, which excludes volatile food and energy components, came out below expectations at 0.22%, when economists had estimated 0.24%. Nevertheless, the June reading was above the 0.17% in May.

The slower increase in core inflation, however, makes economists at Capital Economics less concerned about the rise in headline inflation.

“Core inflation edged down last month. While there’s still a lot of uncertainty around the next rate decision in August, we think that the easing of core price pressures, alongside the weak run of activity data and the rebound in the Peso leave an August rate cut in play,” says Kimberley Sperrfechter, Emerging Markets Economist at Capital Economics.

Assuming Banxico does go ahead and cut interest rates in August, this could have a negative impact on the Peso.

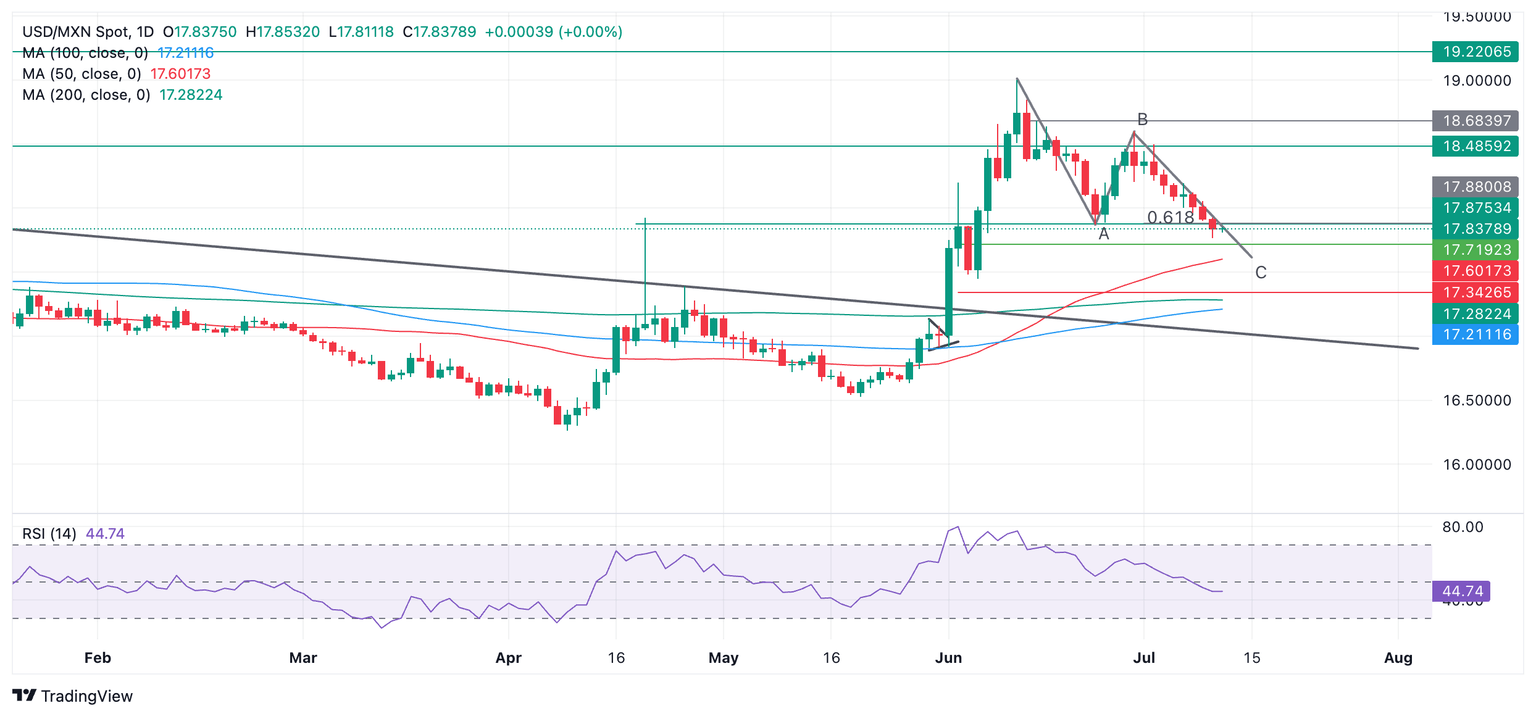

Technical Analysis: USD/MXN possible in ABC correction

USD/MXN is possibly falling in the wave C of an ABC correction that started after the June 12 high. The short-term trend is bearish, and given “the trend is your friend” the odds favor more downside.

USD/MXN Daily Chart

USD/MXN has broken support at the 17.87 (June 24 low), however, the break was not decisive, indicating the possibility it may be false and the pair could recover.

USD/MXN has also fallen to the conservative target for wave C, which is measured by taking the 0.618 Fibonacci ratio of wave A as a guide since C is often equal to A or a Fibonacci ratio of it. Given that the pair has reached this lesser target, there is a further risk of a recovery evolving.

If USD/MXN breaks below Wednesday’s low at 17.76, however, it would reinvigorate bears and probably lead to a move down to the target at the end of wave C, at roughly the level of the 50-day Simple Moving Average (SMA) situated at 17.60.

Meanwhile, the direction of the medium and long-term trends remain in doubt.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Jul 11, 2024 12:30

Frequency: Monthly

Actual: 3.3%

Consensus: 3.4%

Previous: 3.4%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.