Mexican Peso bounces up as profit taking hits the US Dollar

- The Mexican peso bounces up from daily lows and turns positive on the day.

- Mexican economic figures disappointed this week, boosting speculation of a Banxico rate cut on Thursday.

- The USD/MXN pair keeps trading within the weekly range, with upside attempts limited below 20.30.

The Mexican Peso (MXN) has turned positive on the daily chart and is posting marginal gains on Friday favored by a US Dollar reversal. This keeps the USD/MXN pair practically flat on the week after having wavered above the key 20.00 level with the US Dollar supported by a sharp recovery of US Treasury yields.

US Jobless Claims figures released on Thursday cemented hopes that the Federal Reserve (Fed) will cut rates next week, but the higher Producer Price Index (PPI) figures made traders increasingly convinced that next year's easing will be very gradual.

Mexican data, on the contrary, disappointed this week. The Industrial Output in October deteriorated beyond expectations, and consumer inflation eased more than forecasted in November. These figures have endorsed the view that the Bank of Mexico will cut rates for the fourth consecutive time next week.

Daily digest market movers: MXN suffers on downbeat Mexican data and USD strength

- The US Dollar Index keeps marching higher, on track for a 1% increase this week, boosted by higher US yields. The benchmark 10-year yield has gained 20 basis points this week to reach levels above 4.30% for the first time in three weeks.

- US Consumer and Producer inflation accelerated this week, showing that price pressures are picking up. This scenario is likely to limit the scope for Fed easing next year.

- The CME Fed Watch tool shows that the market is nearly fully pricing a 25 bps rate cut after the December 17-18 meeting. However, for next year, the market is leaning toward two more cuts, with the option of three cuts losing support.

- In Mexico, Thursday’s data revealed that the Industrial Production contracted by 1.2% in October, beyond market expectations of a 0.2% decline. Year-on-year, the Industrial Output declined 2.2% instead of the 0.6% expected. Data released in September showed a 0.6% monthly increase and a 0.3% decline in the previous 12 months.

- Earlier this week, Mexican consumer prices eased at a 4.55% yearly rate from 4.76% in October, beyond market expectations of a 4.59% reading. Likewise, the monthly CPI eased 0.44%, below the 0.48% expected, from 0.55% in the previous month.

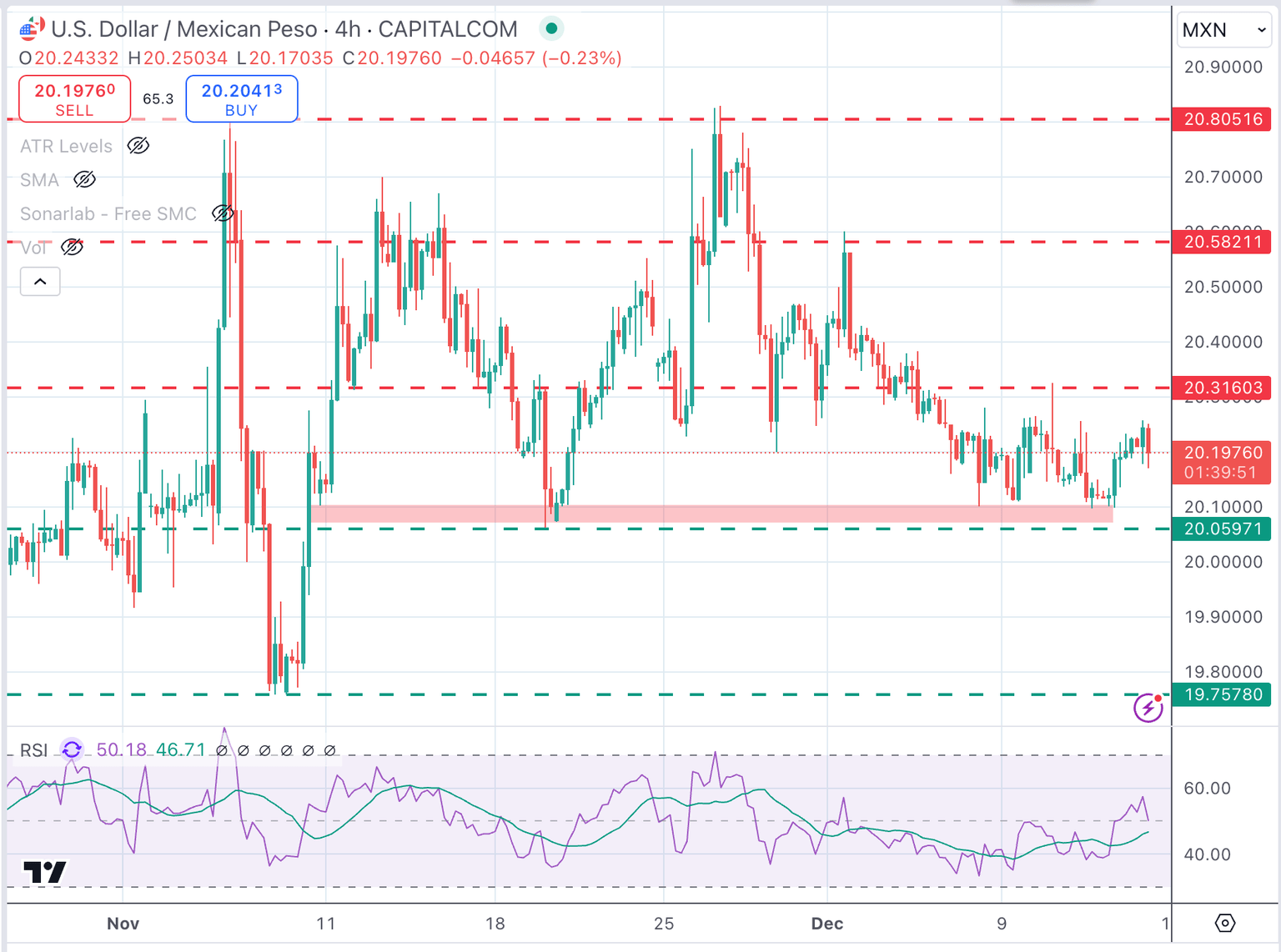

Mexican Peso technical outlook: USD/MXN remains trading capped below the 20.30 area

The USD/MXN pair has bounced up from an important support level at the psychological 20.00 area, but it remains trading within the weekly range below the December 5 and 10 high at 20.30.

The pair’s short-term bias remains bearish as long as the mentioned 20.30 resistance remains in place. The double top at 20.80 suggests the possibility of a deeper correction.

A confirmation above 20.30 would shift the focus towards the December 2 high at 20.60 before November’s peak at around 20.80. On the downside, the 20.00 level is holding bears. Below here, the October 24 and November 7 low at 19.75 is likely to be targeted.

USD/MXN 4-Hour Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from the Bank for International Settlements. Following the Second World War, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold until the Bretton Woods Agreement in 1971, when the Gold Standard went away.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.