Mexican Peso soars against US Dollar ahead of Fed's decision

- Mexican Peso strenghtens despite US Retail Sales, Industrial Production beat estimates.

- Mexico’s Q2 Aggregate Demand and Private Spending data will be released Wednesday, while the Fed’s rate decision looms.

- US Dollar Index climbs 0.20% to 100.92, as traders maintain 61% odds for a 50 bps Fed rate cut.

The Mexican Peso erased some of its losses against the US Dollar, gains some 0.40% after US Retail Sales data was better than expected. Despite that, expectations that the Federal Reserve (Fed) will cut rates by 50 basis points (bps) remained unchanged as the Fed begins its two-day meeting. The USD/MXN trades at 19.11 after hitting a daily high of 19.40.

The US Commerce Department revealed that August Retail Sales fared better than the consensus. The data revealed that consumers remain resilient even though hiring and wage growth show signs of moderation. Other data showed that Industrial Production in August rose after posting a contraction in July.

Following the data, the Greenback extended its gains, as seen by the USD/MXN pair. According to the US Dollar Index (DXY), it climbed some 0.20% to 100.92, even though odds for a 50 bps rate cut by the Fed remained at 61%, while the chances for a quarter of a percentage point are 39%.

In the meantime, the Atlanta Fed GDP Now Index, which calculates estimates for Q3 Gross Domestic Product (GDP) figures, rose from 2.5% to 3%.

On Wednesday, Mexico’s economic docket will feature Aggregate Demand for Q2 alongside Private Spending figures. Across the border, the US economic schedule will feature housing data ahead of the Federal Open Market Committee (FOMC) monetary policy decision. After that, Fed Chairman Jerome Powell will cross the wires.

Daily digest market movers: Mexican Peso advances despite solid US data

- USD/MXN would continue to be driven by market mood and expectations for a bigger Fed rate cut.

- US Retail Sales in August rose 0.1% MoM above estimates of -0.2%. Every year, the figures expanded by 2.1%, down from 2.9% in July.

- Industrial Production rose by 0.8% MoM in August, up from a -0.9% contraction in the previous month.

- Data from the Chicago Board of Trade suggests the Fed will cut at least 111 basis points this year, according to the fed funds rate futures contract for December 2024.

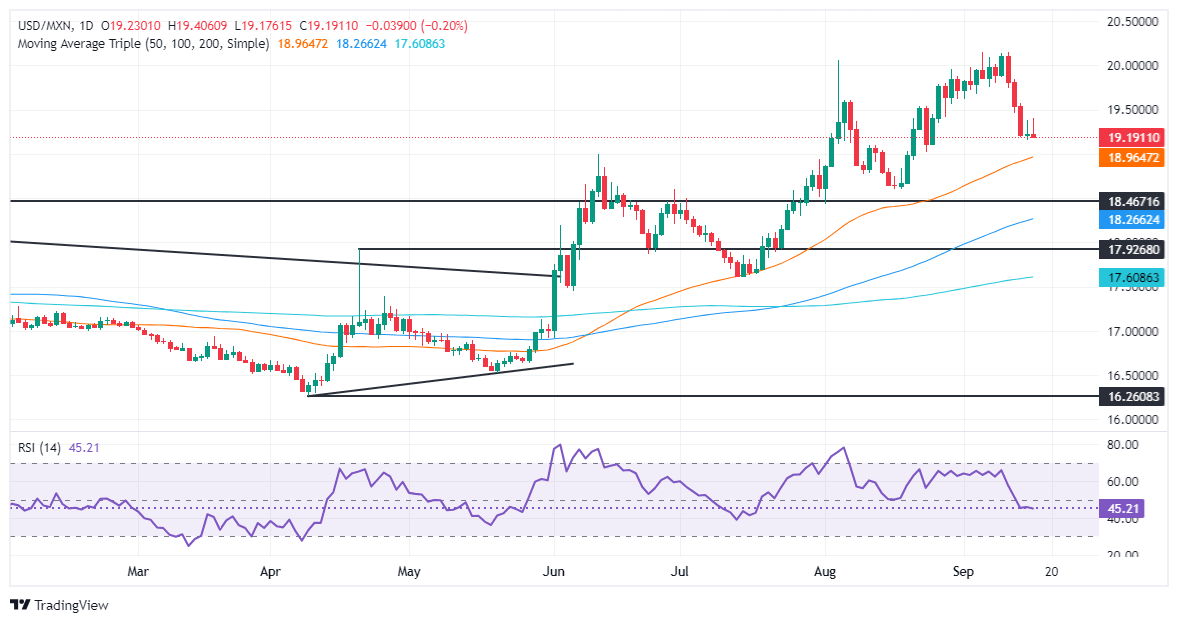

USD/MXN technical outlook: Mexican Peso rises as USD/MXN drops below 19.20

The USD/MXN remains upwardly biased despite dipping to 19.15 last week. Momentum suggests that the exotic pair might consolidate in the near term as depicted by the Relative Strength Index (RSI) turning flat.

That said, if USD/MXN climbs above 19.50, the next resistance would be the 20.00 psychological figure. Conversely, if USD/MXN drops below 19.15, key support levels emerge like the August 23 daily low of 19.02, ahead of the 50-day Simple Moving Average (SMA) at 18.99.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Sep 18, 2024 18:00

Frequency: Irregular

Consensus: 5.25%

Previous: 5.5%

Source: Federal Reserve

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.