Japanese Yen remains on the front foot; USD/JPY holds above 156.00 ahead of US data

- The Japanese Yen gains positive traction for the second straight day amid BoJ rate hike bets.

- The risk-on mood caps the JPY and helps USD/JPY to rebound from a multi-week low.

- A modest USD uptick contributes to the pair's bounce, though the upside seems limited.

The Japanese Yen (JPY) attracts some intraday sellers after touching a four-week high against its American counterpart earlier this Thursday, though the downside remains cushioned amid bets for a Bank of Japan (BoJ) rate hike next week. Moreover, signs of broadening inflationary pressures in Japan support prospects for further policy tightening by the BoJ, pushing yields on Japanese Government Bonds (JGBs) to multi-year highs. In contrast, the US Treasury bond yields retreated sharply on Wednesday in reaction to benign US inflation data. The resultant narrowing of the US-Japan yield differential continues to underpin the JPY.

Meanwhile, easing fears about US President-elect Donald Trump's disruptive trade tariffs remain supportive of the risk-on mood and dent demand for traditional safe-haven assets, including the JPY. Adding to this, growing acceptance that the Federal Reserve (Fed) will pause its rate-cutting cycle later this month helps revive the US Dollar (USD) demand and lifts the USD/JPY pair back above the 156.00 mark. That said, benign US inflation data lifts bets that the Fed could cut rates twice this year, which might cap the Greenback. This, along with a bullish JPY fundamental backdrop, keeps a lid on the currency pair ahead of the US macro data.

Japanese Yen bulls have the upper hand amid bets for BoJ rate hike next week

- Bank of Japan Governor Kazuo Ueda reiterated that the central bank will debate whether to hike rates next week and will raise policy rate this year if economic, price conditions continue to improve.

- Ueda’s remarks echoed Deputy Governor Ryozo Himino’s comments earlier this and lift bets for an interest rate hike at the end of the January 23-24 meeting, providing a strong boost to the Japanese Yen.

- The yield on the benchmark 10-year Japanese government bond advanced to its highest level since 2011 amid the prospects for further monetary policy tightening by the BoJ.

- In contrast, the US Treasury bond yields fell on Wednesday following the release of the US Consumer Price Index (CPI), which eased fears that inflation was accelerating.

- The US Bureau of Labor Statistics (BLS) reported that the headline CPI rose 0.4% in December and the yearly rate accelerated to 2.9% from 2.7% in the previous month.

- The core gauge, which excludes volatile food and energy prices, rose 3.2% on a yearly basis as compared to the 3.3% increase recorded in November and expectations.

- The US Dollar dived to a one-week low following the release of the latest US consumer inflation figures and contributed to the USD/JPY pair's decline on Wednesday.

- Richmond Fed President Tom Barkin said that fresh inflation data show progress on lowering inflation to the central bank's 2% goal, but added that rates should remain restrictive.

- Against the backdrop of easing fears about US President-elect Donald Trump's disruptive trade tariffs, softer US inflation data remains supportive of the upbeat market mood.

- Traders look to the US macro data for a fresh impetus later during the North American session, though the focus will remain glued to the upcoming BoJ policy meeting.

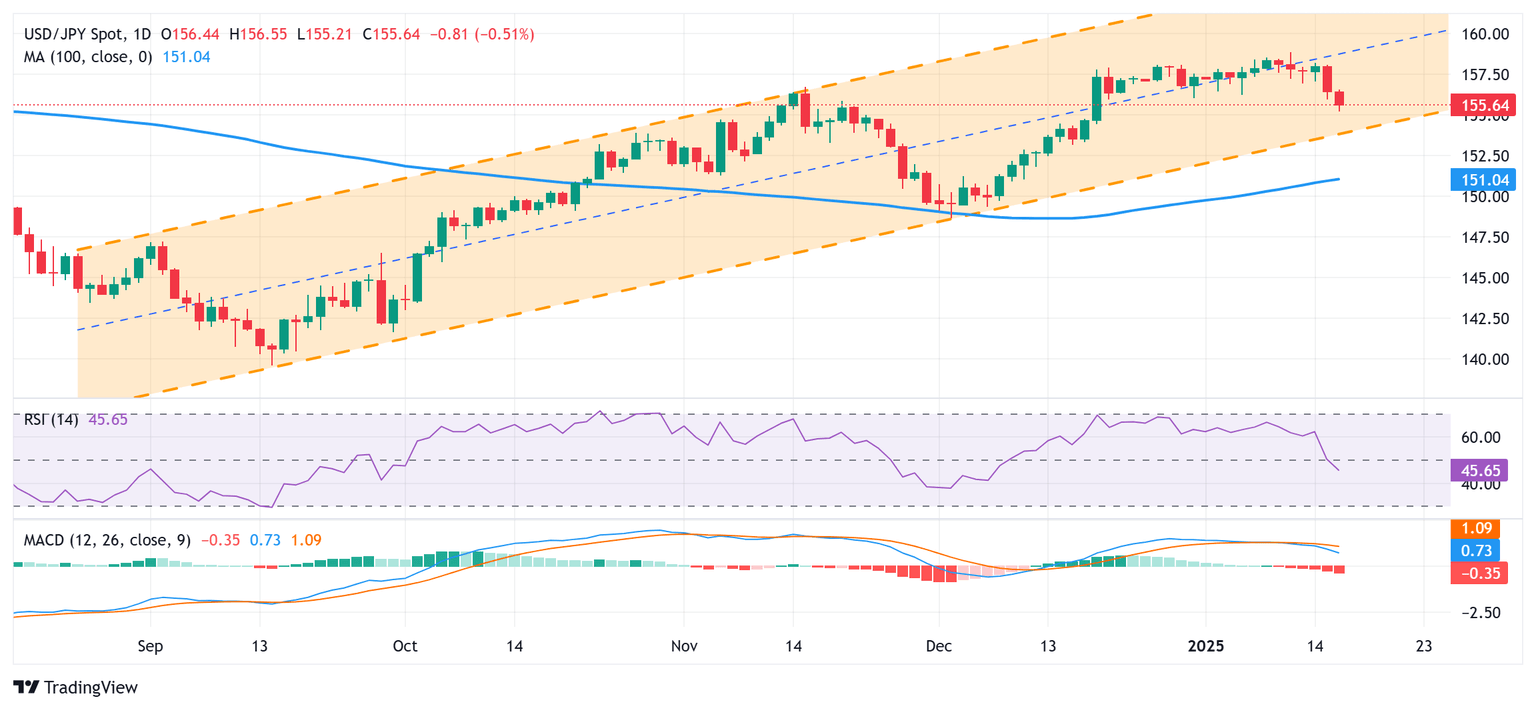

USD/JPY seems vulnerable while below 156.35-156.40 support-turned-resistance

Any further slide is likely to find some support near the 155.00 psychological mark, below which the USD/JPY pair could slide to the 154.55-154.50 region. The latter represents the lower boundary of a four-month-old upward-sloping channel and should act as a key pivotal point. A convincing break below will be seen as a fresh trigger for bearish traders and pave the way for an extension of the recent retracement slide from a multi-month peak touched last Friday. Spot prices might then weaken further below the 154.00 mark and test the next relevant support near the 153.40-153.35 horizontal zone.

On the flip side, any attempted recovery might now confront resistance near the 156.00 mark ahead of the 156.35-156.45 region and the 156.75 area. Some follow-through buying, leading to a subsequent strength beyond the 157.00 mark, might shift the bias back in favor of bullish traders and lift the USD/JPY pair to the 155.55-155.60 intermediate hurdle en route to the 158.00 round figure. The momentum could extend further towards challenging the multi-month peak, around the 158.85-158.90 region.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Jan 16, 2025 13:30

Frequency: Monthly

Consensus: 0.6%

Previous: 0.7%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.