Japanese Yen extends its consolidative price move near multi-week low against USD

- The Japanese Yen continues to be weighed down by reduced bets for a December BoJ rate hike.

- Elevated US bond yields and a positive risk tone also undermine demand for the safe-haven JPY.

- Investors, however, seem reluctant ahead of the crucial FOMC/BoJ policy meetings this week.

The Japanese Yen (JPY) continues with its struggle to attract any meaningful buyers and hangs near a three-week low against its American counterpart heading into the European session on Tuesday. Firming expectations that the Bank of Japan (BoJ) will keep short-term interest rates unchanged later this week, along with a positive risk tone, continue to undermine the safe-haven JPY. Adding to this, bets for a less dovish Federal Reserve (Fed) remain supportive of elevated US Treasury bond yields, which turns out to be another factor weighing on the lower-yielding JPY.

The JPY bears, however, now seem reluctant to place aggressive bets and opt to move to the sidelines ahead of the key central bank event risks. The Fed is scheduled to announce its policy decision on Wednesday, followed by the BoJ on Thursday. In the meantime, a bullish US Dollar (USD) should act as a tailwind for the USD/JPY pair. Traders now look to the US Retail Sales for short-term impetus. Nevertheless, the fundamental backdrop suggests that the path of least resistance for the JPY is to the downside and supports prospects for additional gains for the currency pair.

Japanese Yen struggles to lure buyers amid BoJ uncertainty

- Expectations that the Bank of Japan will keep interest rates unchanged at the end of a two-day meeting on Thursday continue to undermine the Japanese Yen and lift the USD/JPY pair to a three-week high on Monday.

- Japan's economy minister, Ryosei Akazawa said this Tuesday that the BoJ and the government will work together to conduct appropriate monetary policy and that the central bank should handle the specifics of monetary policy.

- The yield on the benchmark 10-year US government bond rose to its highest level since November 22 in reaction to data showing that a big part of the US economy expanded at the fastest pace in more than three years.

- The S&P Global flash US Services Purchase Managers Index (PMI) rose from 56.1 to 58.5 in December – the highest level in 38 months – and the Composite PMI surged from 54.9 in November to 56.6, or a 33-month high.

- This overshadowed a fall in the flash US Manufacturing PMI to a three-month low of 48.3 in December and reaffirmed market bets that the Federal Reserve will likely signal a slower pace of policy easing going forward.

- According to the CME Group's FedWatch Tool, markets have fully priced in that the Fed will deliver a 25-basis-points rate cut on Wednesday, which keeps the US Dollar bulls on the defensive and caps the USD/JPY pair.

- Traders now look forward to the release of the US monthly Retail Sales data, which, along with the US bond yields, will drive the USD demand and produce short-term opportunities around the currency pair.

- The focus, however, will remain glued to the outcome of the highly-anticipated FOMC meeting on Wednesday and the crucial BoJ decision on Thursday, which should provide a fresh directional impetus to the JPY.

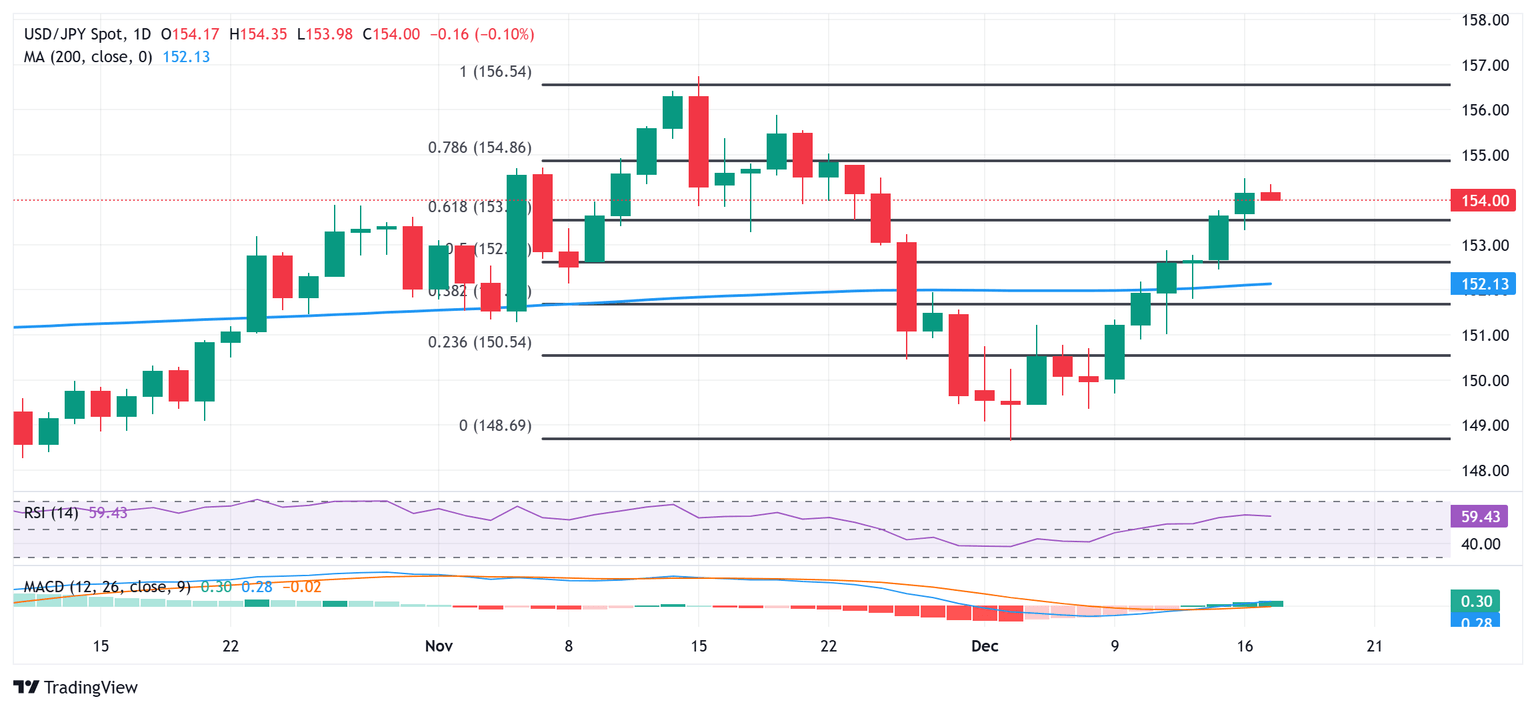

USD/JPY technical setup supports prospects for additional gains

From a technical perspective, Monday's breakout through the 61.8% Fibonacci retracement level of the November-December fall from a multi-month peak and acceptance above the 154.00 round figure could be seen as a key trigger for bulls. Moreover, oscillators on the daily chart have just started gaining positive traction and support prospects for a further appreciation for the USD/JPY pair. Hence, some follow-through buying beyond the overnight swing high, around the 154.45-154.50 area, should pave the way for a move towards reclaiming the 155.00 psychological mark. The momentum could extend further towards the next relevant hurdle near mid-155.00s en route to the 156.00 mark and the 156.25 resistance zone.

On the flip side, the 61.8% Fibo. resistance breakpoint, around the 153.65 area, now seems to protect the immediate downside ahead of the overnight low, around the 153.35 region. This is closely followed by the 153.00 mark, below which the USD/JPY pair could accelerate the fall towards the very important 200-day Simple Moving Average (SMA) pivotal support near the 152.10-152.00 region. A convincing break below the latter might shift the bias in favor of bearish traders and drag spot prices to the 151.00 round figure en route to the 150.00 psychological mark.

US Dollar PRICE This month

The table below shows the percentage change of US Dollar (USD) against listed major currencies this month. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.52% | 0.13% | 1.77% | 1.80% | 2.43% | 2.30% | 1.45% | |

| EUR | -0.52% | -0.40% | 1.21% | 1.28% | 1.90% | 1.76% | 0.92% | |

| GBP | -0.13% | 0.40% | 1.58% | 1.67% | 2.30% | 2.17% | 1.32% | |

| JPY | -1.77% | -1.21% | -1.58% | 0.05% | 0.66% | 0.52% | -0.31% | |

| CAD | -1.80% | -1.28% | -1.67% | -0.05% | 0.61% | 0.48% | -0.34% | |

| AUD | -2.43% | -1.90% | -2.30% | -0.66% | -0.61% | -0.13% | -0.96% | |

| NZD | -2.30% | -1.76% | -2.17% | -0.52% | -0.48% | 0.13% | -0.83% | |

| CHF | -1.45% | -0.92% | -1.32% | 0.31% | 0.34% | 0.96% | 0.83% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.