Gold maintains gains after ECB's decision to cut interest rates

- Gold trades higher as bets the Fed will cut rates in September remain elevated despite strong US service sector data.

- The BoC and ECB have both cut interest rates in recent days and the SNB could later in June – all positives for non-yielding Gold.

- Gold breaks out of its range higher, muddying the short-term technical picture.

Gold (XAU/USD) is trading up by about 0.2% in the $2,360s on Thursday just after the European Central Bank (ECB) decides to cuts interest rates by 0.25% at its June policy meeting. The decision to lower interest rates is positive for Gold as it broadly reduces the opportunity cost of holding the non-yielding asset.

Gold is further supported by continued elevated expectations that the Federal Reserve (Fed) will cut interest rates as soon as September, despite the release of higher-than-expected US Institute for Supply Management’s (ISM) Services PMI data on Wednesday.

Gold rises as markets anticipate lower interest rates

Gold pushes higher on Thursday as investors continue to bet on the Fed cutting interest rates, with the probabilities standing at 69% that the rate being lower than the current level in September, based on the CME FedWatch tool, which bases its estimates on 30-day US Fed Fund Futures pricing data. The anticipation of lower interest rates is positive for Gold as it reduces the opportunity cost of holding the non-yielding asset.

Globally, interest rate expectations are falling. On Wednesday, the Bank of Canada (BoC) cut its overnight rate to 4.75% from 5.00% and on Thursday the European Central Bank (ECB) did the same, cutting its main refinancing rate by 0.25% to 4.25%. After the release of lower inflation data in Switzerland, speculation is also rising for the Swiss National Bank (SNB) to cut its key rate when it makes its decision on June 20.

Service sector data ends poor run, Nonfarm Payrolls eyed

The outlook for the US economy gained a lift on Wednesday after a combination of higher-than-expected ISM Services PMI data for May and tech-sector optimism. The move led to a rebound in the US Dollar (USD).

US employment data on Friday is keenly awaited and could impact Gold price. The US Nonfarm Payrolls (NFP) report is expected to show a rise of 185K in May, however, negative JOLTS Job Openings data and a lower-than-expected ADP Employment Change this week have reduced investor-optimism regarding the US Bureau of Labor Statistics report.

If the NFPs also show weakness, it would probably weigh on the USD and further increase bets the Fed will cut interest rates early, providing a backwind to Gold price.

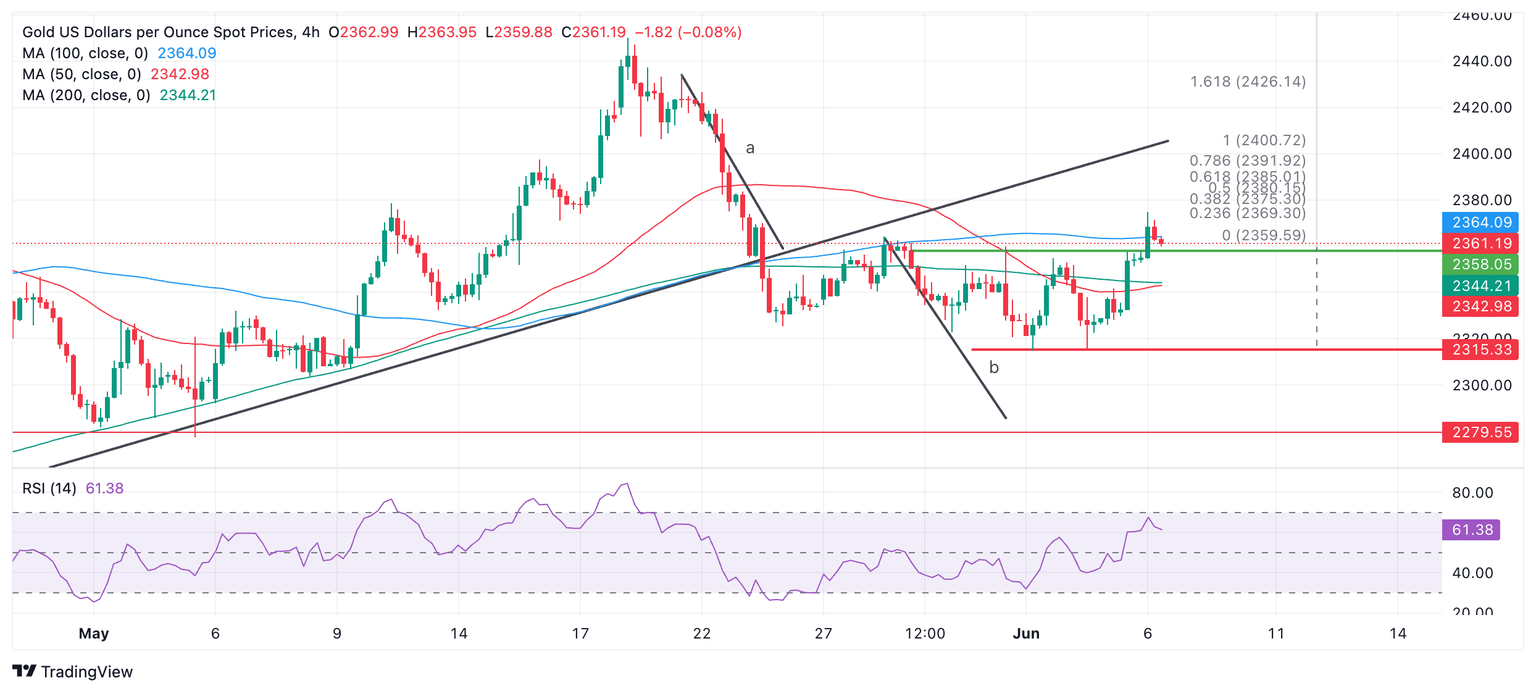

Technical Analysis: Gold breaks out of range, bringing downtrend into doubt

Gold price has broken out of the mini-range that stretches between $2,315 and $2,358. The upside break brings the short-term downtrend into doubt and could mark a reversal.

XAU/USD’s break above the range high generates a target at $2,385, the 0.618 Fibonacci extrapolation of the height of the range from the breakout point higher. A move above $2,375 would increase confirmation the target will get hit.

XAU/USD 4-hour Chart

The break below the trendline in May generated downside targets. These are now brought into doubt by the upside break, however, a move back inside the range and then a break below the $2,315 range low would reactivate them.

The length of the move prior to a break can be used as a guide to the follow-through move after a break, according to technical analysis. The first target for the follow-through is at $2,303 – the 0.618 Fibonacci extrapolation of “a”. A stronger move down could even see Gold reach support at $2,279.

The precious metal’s medium and long-term trends are still bullish, and the risk of a recovery remains high.

Economic Indicator

ECB Main Refinancing Operations Rate

One of the three key interest rates set by the European Central Bank (ECB), the main refinancing operations rate is the interest rate the ECB charges to banks for one-week long loans. It is announced by the European Central Bank at its eight scheduled annual meetings. If the ECB expects inflation to rise, it will increase its interest rates to bring it back down to its 2% target. This tends to be bullish for the Euro (EUR), since it attracts more foreign capital inflows. Likewise, if the ECB sees inflation falling it may cut the main refinancing operations rate to encourage banks to borrow and lend more, in the hope of driving economic growth. This tends to weaken the Euro as it reduces its attractiveness as a place for investors to park capital.

Read more.Last release: Thu Jun 06, 2024 12:15

Frequency: Irregular

Actual: 4.25%

Consensus: 4.25%

Previous: 4.5%

Source: European Central Bank

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.