Gold price rises as US dollar drops, focus shifts to US Retail Sales

- Gold price attempts for a firm footing, although the near-term outlook remains uncertain.

- Stubborn US inflation for February has increased the uncertainty over Fed rate cuts in June.

- Investors will shift focus to the US PPI and Retail Sales data for February.

Gold price (XAU/USD) trades slightly in the green in Wednesday’s early New York session but has an uncertain outlook in the near term as investors have scaled down expectations of Federal Reserve (Fed) rate cuts in June. The precious metal recorded its second-largest single-day decline in a month on Tuesday after the United States Consumer Price Index (CPI) data for February turned out surprisingly hotter than expected.

The annual headline and core CPI grew at a higher pace than what market participants had anticipated due to higher gasoline and shelter prices. The opportunity cost of holding an investment in non-yielding assets, such as Gold, rose as stubborn price pressures have negatively influenced market expectations for the Fed cutting interest rates in June’s policy meeting. An increase in expectations of the Fed delaying rate cuts beyond June could weigh heavily on the Gold price.

The 10-year US Treasury yields, which are positively influenced by the Fed’s hawkish policy stance, jumped to 4.16% as the last leg of high inflation turns out to be a hard nut to crack. Meanwhile, the US Dollar Index (DXY), which tracks the value of the US Dollar against six major currencies, drops to 102.80.

Daily digest market movers: Gold, US yields are positive while US Dollar drops

- Gold price finds temporary support near $2,160 after a sharp decline from all-time highs at $2,195. The surprisingly stubborn United States inflation data for February has cast doubts over expectations for the Federal Reserve reducing interest rates in the June policy meeting.

- The monthly core inflation data rose steadily by 0.4% against expectations of 0.3%. The annual core CPI rose 3.8%, higher than expectations of 3.7% but lower than the former reading of 3.9%. Fed policymakers generally consider the core inflation figures for decision-making on interest rates as the data strips off volatile food and energy prices, which are also impacted by external factors.

- The hotter-than-expected inflation data would not allow Fed policymakers to consider rate cuts in the near term. Fed policymakers have been reiterating that rate cuts would be appropriate only if they are confident that inflation will sustainably return to the 2% target.

- The impact of the latest US inflation report is visible in the traders’ bets on when the Fed will cut interest rates. According to the CME Fedwatch tool, the chances for a rate cut in June have dropped to 65% from above the 72% seen before the release of February’s inflation data.

- Meanwhile, investors shift their focus to the US Producer Price Index (PPI) and Retail Sales data for February, which will be published on Thursday. The PPI data will show the pace at which producers change prices of goods and services at factory gates. The Retail Sales data will indicate the strength in households’ spending, which feeds consumer price inflation. Retail Sales are forecasted to have increased by 0.8% after declining by 0.8% in January.

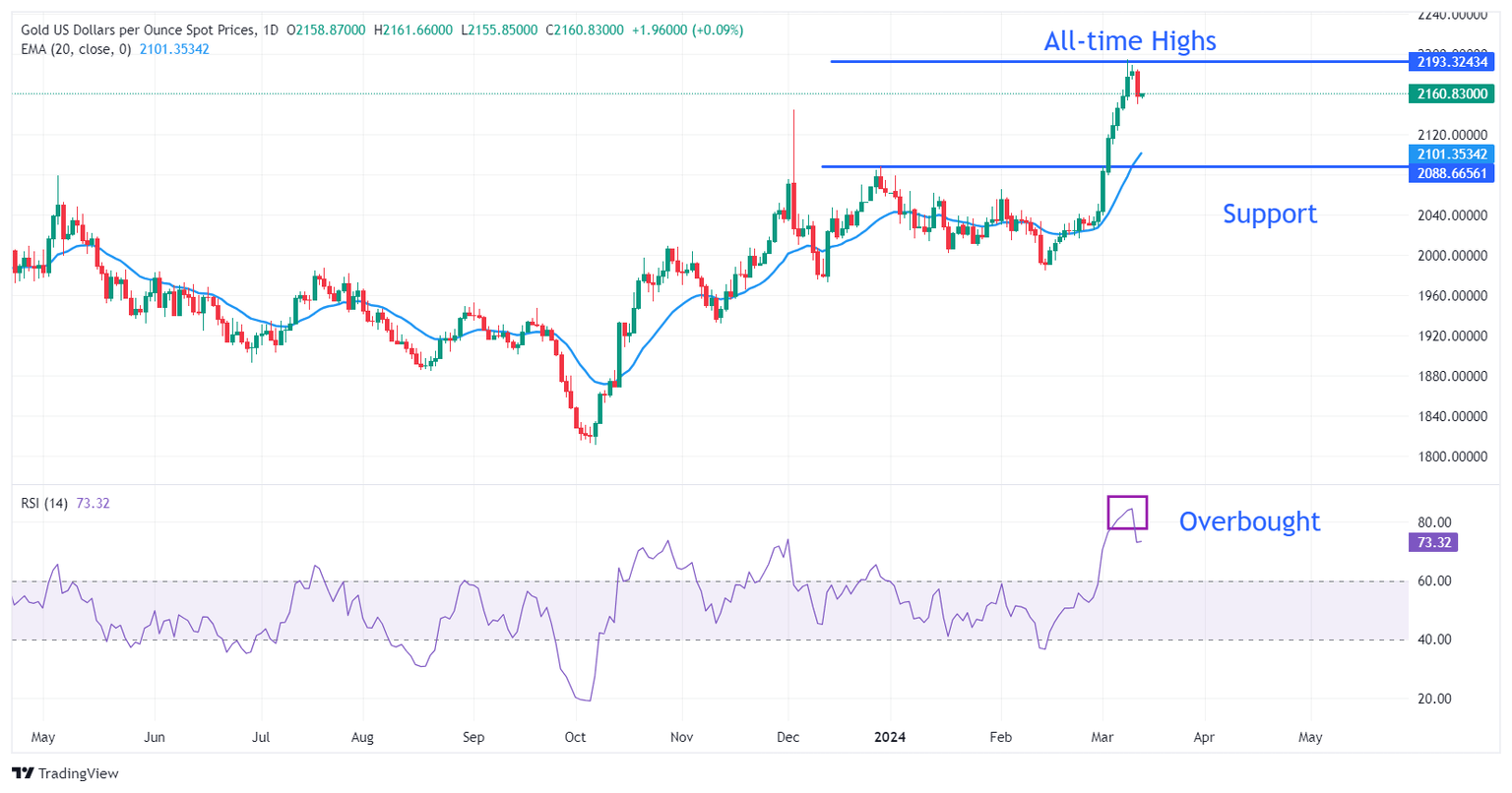

Technical Analysis: Gold price climbs above $2,160

Gold price faced a sharp sell-off after failing to sustain near all-time highs around $2,195. The precious metal has dropped to $2,160 and may continue its downside towards the 20-day Exponential Moving Average (EMA) at $2,097 as the divergence between them wanes. The asset tends to face a mean-reversion move after a wide divergence, which results in a price or a time correction.

On the downside, December 4 high near $2,145 and December 28 high at $2,088 will act as major support levels.

The 14-period Relative Strength Index (RSI) dropped to 73.00 after reaching the overbought territory, resulting in a correction.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.