Gold price bulls seem non-committed amid Fed's hawkish signal

- Gold price attracts haven flows amid worries about Trump’s tariff plans.

- The Fed’s hawkish stance and elevated US bond yields cap the XAU/USD.

- Traders keenly await FOMC minutes and US NFP releases later this week.

Gold price (XAU/USD) struggles to capitalize on its intraday move up and trades with a mild positive bias, just above the $2,640 level during the first half of the European session on Tuesday. Against the backdrop of geopolitical risks stemming from the protracted Russia-Ukraine war and tensions in the Middle East, concerns about US President-elect Donald Trump's tariff plans and protectionist policies weigh on investors' sentiment. This, along with a modest US Dollar (USD) downtick, lends some support to the precious metal.

That said, the Federal Reserve's (Fed) hawkish shift keeps a lid on any meaningful appreciation for the Gold price. In fact, the Fed signaled that it would slow the pace of interest rate cuts in 2025. This remains supportive of elevated US Treasury bond yields, which should act as a tailwind for the USD and cap the upside for the non-yielding bullion. Traders also seem reluctant ahead of this week's release of FOMC meeting minutes and the closely-watched US Nonfarm Payrolls (NFP) report on Wednesday and Friday, respectively.

Gold price benefits from haven flows; lacks bullish conviction amid hawkish Fed

- US President-elect Donald Trump's proposed tariffs and protectionist policies are expected to stoke further inflation and disrupt global trade, offering support to the safe-haven Gold price.

- The Ukrainian military launched a new offensive in the Kursk region of western Russia on Sunday. Russia’s Defence Ministry said that Ukraine lost up to 340 soldiers in the Kursk region.

- As Israel’s relentless bombardment of Gaza continues, the Israeli military said on Sunday that it has been conducting operational raids in Syria amid accusations of cease-fire violations.

- The Federal Reserve's projections in December implied a shift to a more cautious pace of rate cuts in 2025, with the majority of the policymakers expressing concern that inflation could reignite.

- San Francisco Fed President Mary Daly said on Saturday that despite significant progress in lowering price pressures over the past two years, inflation remains uncomfortably above the 2% target.

- Furthermore, Fed Governor Lisa Cook said on Monday that policymakers could be more cautious with further interest rate cuts, citing labor market resilience and still stickier inflation.

- The yield on the benchmark 10-year US government bond rose to an over eight-month high on Monday, assisting the US Dollar to attract some dip-buying on Tuesday and capping the XAU/USD.

- The market focus this week remains glued to the release of the FOMC meeting minutes and the closely-watched US Nonfarm Payrolls (NFP) report on Wednesday and Friday, respectively.

- In the meantime, Tuesday's US economic docket – featuring the ISM Services PMI and JOLTS Job Openings data – could provide some impetus later during the North American session.

- According to the central bank data published today, China's Gold reserves at end-December stood at $191.34 billion vs $193.43 billion at end-November.

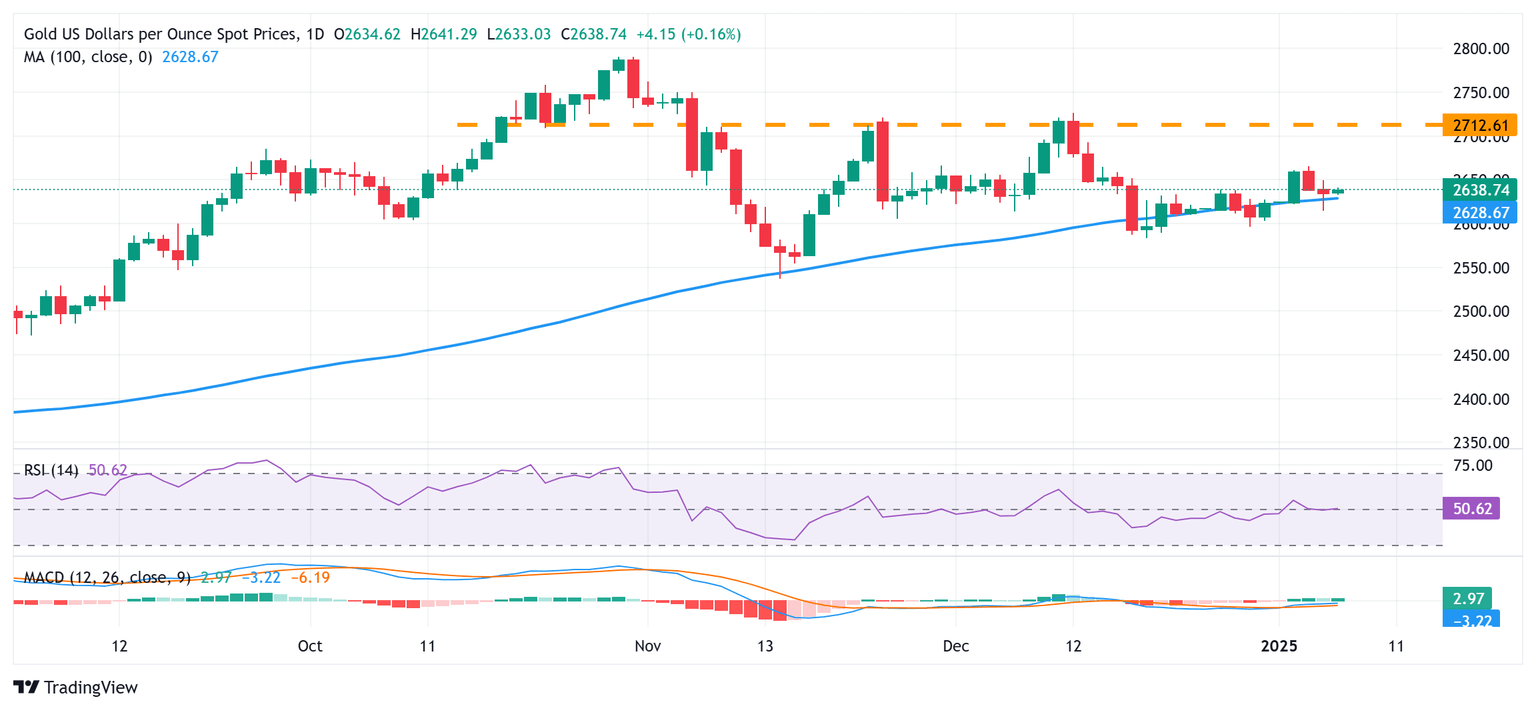

Gold price needs to find acceptance below the 100-day SMA for bears to seize control

From a technical perspective, the overnight resilience above the 100-day Simple Moving Average (SMA) and the subsequent bounce warrants some caution for bearish traders. Moreover, oscillators on the daily chart have recovered from negative territory, which, in turn, supports prospects for some near-term upside. Any further move up, however, is likely to confront some resistance near the $2,655-2,657 horizontal zone ahead of the $2,665 area, or the multi-week high touched last Friday. The momentum could extend further towards an intermediate resistance near the $2,681-2,683 zone en route to the $2,700 mark. The latter should act as a pivotal point, which if cleared will set the stage for an extension of a two-week-old uptrend.

On the flip side, the 100-day SMA, currently pegged near the $2,626 area, followed by the overnight swing low, around the $2,615-2,614 region, and the $2,600 mark could offer some support to the Gold price. This is followed by the December swing low, around the $2,583 area, which if broken will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.