Gold price bulls remain on the sidelines on stronger USD, positive risk tone

- Gold price attracts some dip-buying amid trade war concerns and geopolitical tensions.

- Rebounding US bond yields revive the USD demand and cap gains for the XAU/USD.

- Thin trading volumes on the back of a US holiday warrant caution for aggressive traders.

Gold price (XAU/USD) reverses an intraday dip to the $2,620 area and trades near the daily high during the first half of the European session on Thursday, albeit it lacks bullish conviction. Investors remain concerned that US President-elect Donald Trump's tariff plans will impact the global economic outlook. This, along with the worsening Russia-Ukraine conflict, turn out to be key factors that continue to act as a tailwind for the safe-haven precious metal.

That said, the prospects for slower interest rate cuts by the Federal Reserve (Fed), bolstered by Wednesday's mostly upbeat US macro data, trigger a modest rebound in the US Treasury bond yields. This, in turn, helps revive the US Dollar (USD) demand and caps the upside for the non-yielding Gold price. Apart from this, a positive risk tone further holds back bulls from placing aggressive bets amid relatively thin trading volumes on the back of a US holiday.

Gold price struggles to gain any meaningful traction amid mixed fundamental cues

- The US Bureau of Economic Analysis (BEA) reported on Wednesday that the Personal Consumption Expenditures (PCE) Price Index rose to 2.3% on a yearly basis in October from 2.1% in the previous month.

- Additional details of the report revealed that the core PCE Price Index, which excludes volatile food and energy prices, rose 0.3% on a monthly basis and edged higher from 2.7% in September to 2.8% last month.

- Separately, data published by the US Commerce Department showed that the world's largest economy expanded at a healthy 2.8% annual pace in the third quarter on strong consumer spending, which rose by 3.5%.

- Meanwhile, the Labor Department said that the number of Americans filing new applications for unemployment-related benefits fell by 2,000, to a seasonally adjusted 213,000 during the week ended November 23.

- This helps offset a slight disappointment from the US Durable Goods Orders, which rose 0.2% in October against an increase of 0.5% expected. Excluding transportation, orders increased by 0.1%, missing estimates.

- This comes on top of worries that US President-elect Donald Trump's policies will boost inflation and FOMC minutes, showing that the Committee could pause its easing of the policy rate if inflation remained elevated.

- The benchmark 10-year US Treasury yields rebound from a level not seen in a month and assist the US Dollar in reversing a part of the overnight slide to a two-week low, exerting some pressure on the Gold price.

- Trump earlier this week pledged to impose tariffs on a wide range of products coming into the US from Mexico, Canada, and China. Apart from this, geopolitical tensions underpin the safe-haven precious metal and help limit losses.

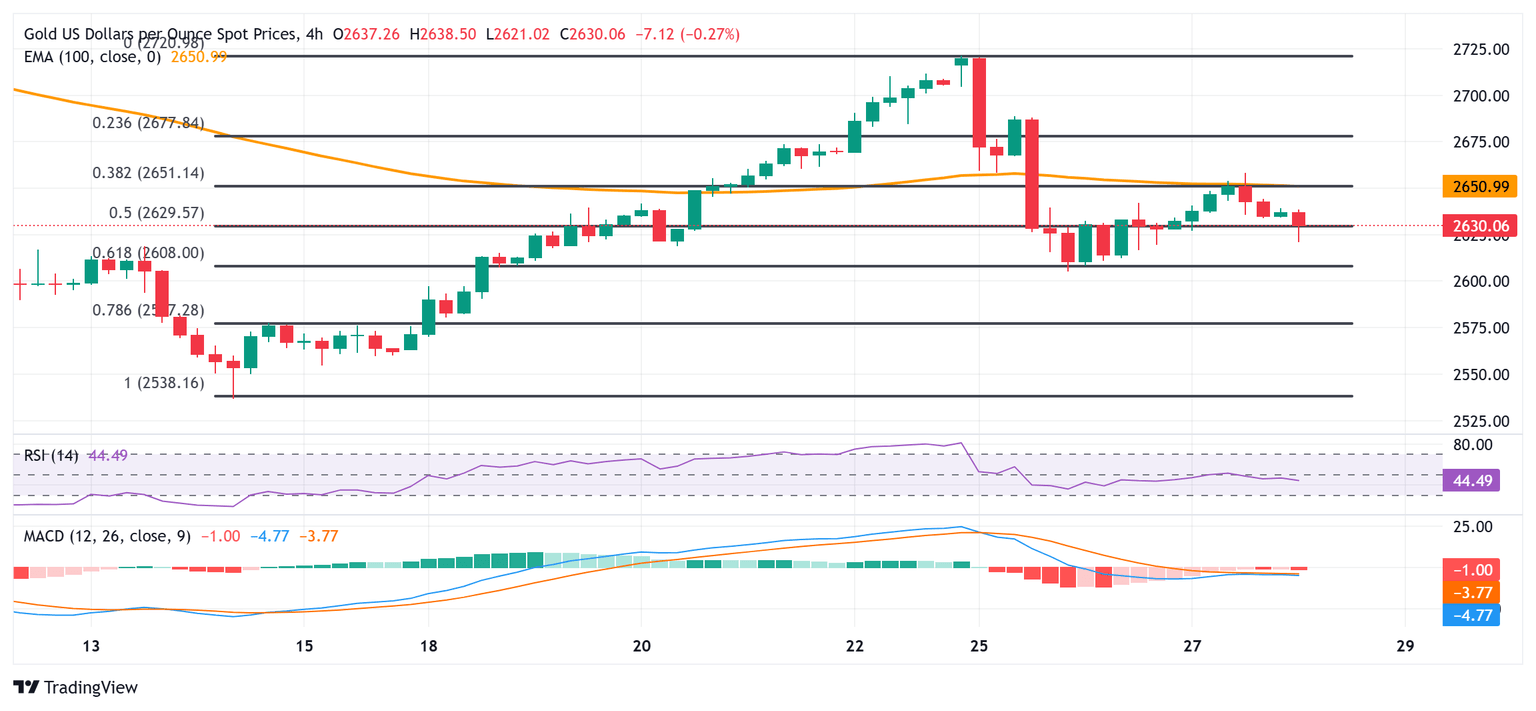

Gold price flirts with 100-period EMA on 4-hour chart; $2,600 holds the key for bulls

The overnight failure to find acceptance above the 100-period Exponential Moving Average (EMA) on the 4-hour chart and the subsequent downfall warrant caution for bullish traders. Furthermore, negative oscillators on hourly and daily charts suggest that the path of least resistance for the Gold price is to the downside. That said, it will still be prudent to wait for a sustained break and acceptance below the $2,600 mark before positioning for deeper losses. The XAU/USD might then aim to challenge the 100-day SMA, currently pegged near the $2,571-2,570 area, before eventually dropping to the monthly swing low, around the $2,537-2,536 region.

On the flip side, any move up beyond the Asian session peak, around the $2,638-2,639 zone, now seems to confront a strong barrier near the overnight swing high, around the $2,658 region. A sustained strength beyond the latter could lift the Gold price to the next relevant hurdle near the $2,677-2,678 hurdle en route to the $2,700 round figure. Some follow-through buying will suggest that the recent corrective decline from the all-time peak touched in October has run its course and shifts the bias in favor of bullish traders.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.