Gold surges as US yields and US Dollar tumble

- Gold spikes as investors seek safety after Trump's day-one tariff threats.

- US Dollar Index drops, Treasury yields fall, both tailwinds for Bullion prices.

- Escalating Middle East tensions increases global uncertainty, boosting Gold's safe-haven status.

Gold rallied more than 1% and hit a two-month high of $2,745 on Tuesday as investors seeking safety bought the non-yielding metal following US President Donald Trump's remarks on tariffs. The Greenback, which initially advanced, has turned negative as depicted by the US Dollar Index (DXY), a tailwind for Bullion prices. The XAU/USD trades at $2,742 at the time of writing.

Trump’s first day in office improved risk appetite, only to suddenly turn risk-averse after he hinted at imposing tariffs on Canada and Mexico as he signed a tranche of executive orders. The Canadian Dollar (CAD) and the Mexican Peso (MXN) tumbled, consequently sending the Greenback to a daily high of 108.79, according to the DXY.

Despite this, the precious metal continued to trend higher, clearing key resistance at $2,730. In addition, US Treasury bond yields are dropping in the belly and long end of the curve, bolstering Gold prices. The US 10-year T-note yield tumbled five-and-a-half basis points (bps) to 4.572%.

In the Middle East, the ceasefire agreement between Israel and Hamas was set aside as Israeli forces began an operation in the West Bank city of Jenin. In response, Hamas called for escalating the fighting against Israel.

This week, the US economic docket will feature Initial Jobless Claims data, S&P Global Flash PMIs, and housing data.

Daily digest market movers: Gold price soars as US yields retreat

- Gold price rises as real yields tumbled three basis points. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS) yield sits at 2.17%.

- President Trump confirmed that universal tariffs on all imports to the US are under consideration as well and will come at a later stage, Reuters reports.

- Market participants are pricing in near-even odds that the Fed will cut rates twice by the end of 2025, with the first reduction occurring in June.

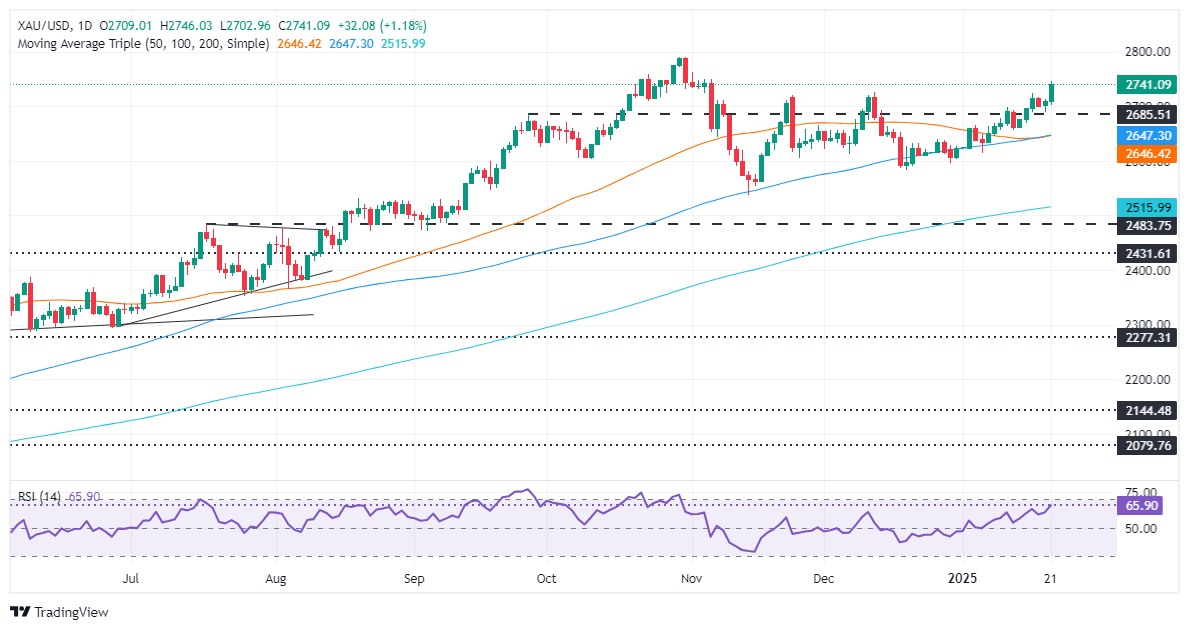

XAU/USD technical outlook: Gold price breaks higher toward $2,750

The uptrend in Gold prices resumed after bulls had failed to clear the December 12 daily peak of $2,725. This opened the door for challenging the psychological $2,750 figure, and the record high at $2,790 ahead of $2,800.

Conversely, if sellers drive XAU/USD below $2,700, the first support would be the January 13 swing low of $2,656, followed by the confluence of the 50 and 100-day Simple Moving Averages (SMAs) at $2,642 to $2,644.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.