Gold price advances as traders await Fed Chair Powell's remarks

- Gold remains steady, unaffected by rising US Dollar and Treasury yields.

- Mixed US manufacturing data: S&P PMI expands, ISM PMI contracts for third consecutive month.

- US 10-year Treasury yield climbs nearly 9 bps to 4.489%, bolstering Greenback rebound.

Gold price advances late on Monday even though the Greenback registers minuscule gains propelled by elevated US Treasury bond yields, following a release of softer-than-expected US economic data. That, along with a shortened week in observance of Independence Day in the US and an eventful week, keeps the XAU/USD trading within familiar levels near $2,331, up 0.23%.

The US economy revealed business activity figures on the manufacturing front with mixed readings. The S&P Global Manufacturing PMI stood in expansionary territory, contrary to the ISM one, which contracted for the third straight month in June.

Market participants remained cautious, with US equity indices performing mixed in the mid-North American session. Meanwhile, the US 10-year Treasury yield rose almost nine basis points to 4.489%, lending a lifeline to the Greenback, down 0.33% earlier in the day before staging a comeback, gaining 0.09%.

Traders are eyeing the Federal Reserve (Fed) Chairman Jerome Powell's speech on Tuesday, followed by the Fed’s latest monetary policy minutes on Wednesday. After that, the US economic schedule will feature Services PMIs from S&P and the ISM, followed by Friday’s US Nonfarm Payrolls.

Daily digest market movers: Gold price prints minimal gains post-PMIs

- June’s US S&P Global Manufacturing PMI was 51.6, slightly higher than the previous month but missing the forecast of 51.7.

- ISM Manufacturing PMI for June was 48.5, lower than the estimates of 49.1 and down from May’s 48.7.

- According to CME FedWatch Tool, odds for a 25-basis-point Fed rate cut in September are at 59.5%, up from 58.2% last Friday.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by just 35 basis points (bps) by end of year.

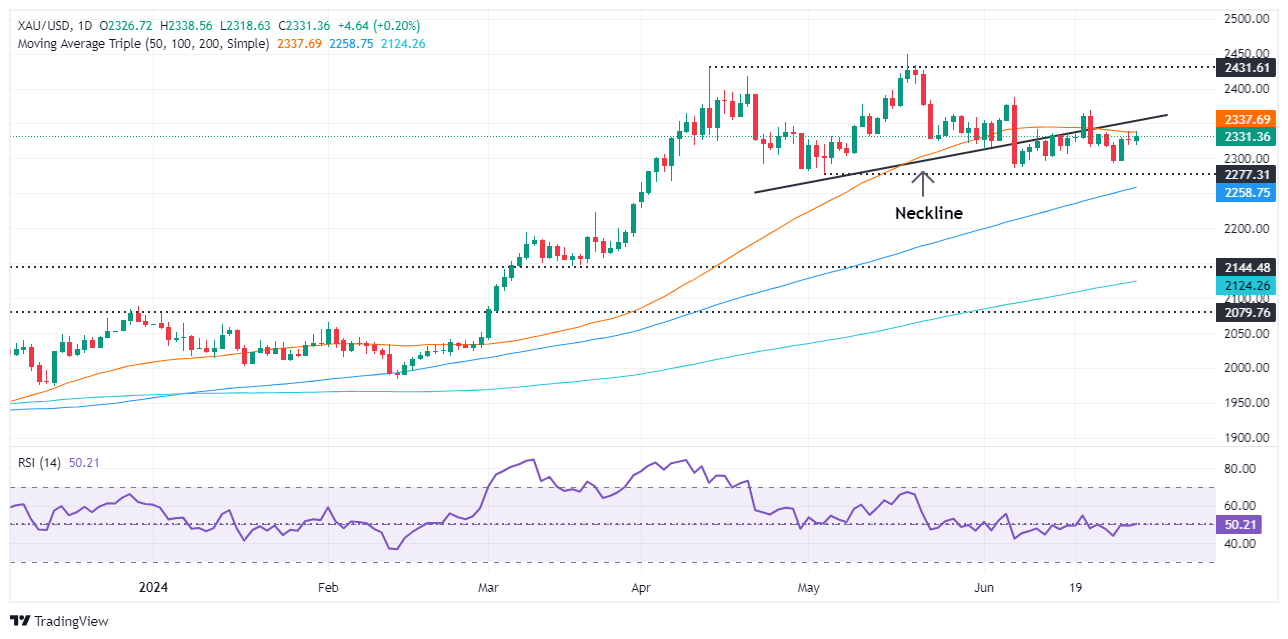

Technical analysis: Gold price hovers around Head-and-Shoulders neckline

Gold price remains upwardly biased, though it is consolidating near the Head-and-Shoulders neckline from $2,320 to $2,350. Although the bearish chart pattern remains in play, momentum has shifted neutral, with the Relative Strength Index (RSI) braced to its 50-neutral line, hinting that neither buyers nor sellers are in control.

For a bearish continuation, sellers need to push prices below $2,300. Once done, the next support would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie underneath, with sellers eyeing the Head-and-Shoulders chart pattern objective from $2,170 to $2,160.

On the other hand, if buyers stepped in and conquered $2,350, that would expose additional key resistance levels like the June 7 cycle high of $2,387, ahead of challenging the $2,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.