Gold price rises above $2,400 as bond yields weaken, US data in focus

- Gold price bounces back in the countdown to a string of US economic data.

- Firm Fed rate cut hopes to keep the upside in the US Dollar limited.

- Gold price in India sinks after customs duty reduction.

Gold price (XAU/USD) gains ground near the round-level resistance of $2,400 in Tuesday’s North American session. The precious metal finds cushion as US bond yields slumps amid firm speculation that the Federal Reserve (Fed) will begin lowering its key borrowing rates from September. 10-year US Treasury yields tumble to near 4.23%. Higher yields on interest-bearing assets reduce the opportunity cost of holding an investment in non-yielding assets, such as Gold.

Earlier, the Gold price was under pressure amid expectations that Donald Trump could emerge victorious in the United States (US) presidential elections in November. The expectations for Donald Trump gaining a second term rose after an assassination attack on him and US President Joe Biden’s withdrawal of his re-election bid from the White House. However, US Vice President Kamala Harris has been chosen as the nominee of Democrats.

Growing speculation for Trump 2.0 has prompted upside risks to consumer inflation expectations. In a note on Monday, Australian investment bank Macquarie said, "Trump 2.0 will be a more inflationary policy regime, given restricted immigration, higher tariffs, and the extension of the Tax Cut and Jobs Act of 2025." The scenario is favorable for the US Dollar (USD). The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to near 104.50.

Daily digest market movers: Gold price on MCX in India nosedives on custom duty reduction

- Gold price rebounds above the crucial resistance of $2,400. However, the near-term outlook of the Gold price is still uncertain as investors await a slew of US economic data, which will be published this week.

- Investors will focus on the preliminary US S&P Global PMI for July, Q2 Gross Domestic Product (GDP), and Durable Goods Orders and Personal Consumption Expenditures Price Index (PCE) data for June, which will provide fresh cues about when the US Federal Reserve (Fed) will start reducing interest rates.

- The Manufacturing PMI is estimated to have expanded at a meager pace to 51.7 from June’s reading of 51.6. The Services PMI, a measure of activities in the service sector, is estimated to have expanded at a slower pace of 54.4 from the prior release of 55.3.

- The major trigger will be the Fed’s preferred inflation gauge, the PCE index, which will indicate whether price pressures remain on track to return to the desired rate of 2%. The confidence of Fed officials that inflation has returned to the path of 2% grew after recent inflation readings showed that price pressures rose at a slower-than-expected pace in June.

- According to the CME FedWatch tool, 30-day Federal Fund futures show the central bank beginning to lower its key borrowing rates from their current levels in the September meeting. The Fed is also expected to cut interest rates again in November or December.

- In the Indian region, Multi Commodity Exchange (MCX) Gold price nosedives below Rs. 69,000 after Prime Minister Narendra Modi-led-NDA reduces basic custom duty on precious metals to 6% from 10% in the Fiscal Budget 2024-2025. The decision is expected to boost demand for physical gold.

Technical Analysis: Gold price holds $2,400

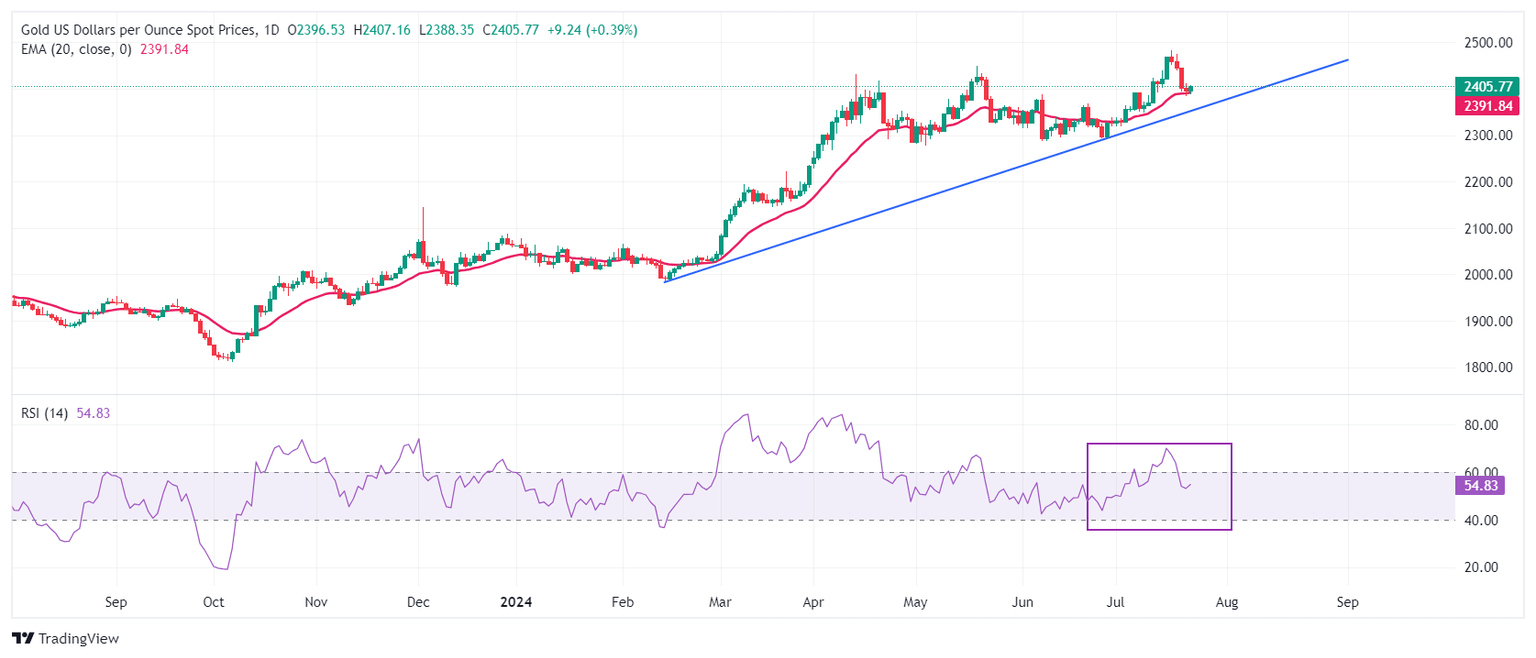

Gold price recaptures the crucial figure of $2,400. The precious metal finds cushion near the 20-day Exponential Moving Average (EMA), which trades around $2,390, suggesting that the near-term outlook has not weakened yet technically.

The advancing trendline plotted from the February 14 low at $1,984.30 will be a major support for Gold bulls.

The 14-day Relative Strength Index (RSI) drops inside the 40.00-60.00 range, suggesting that the upside momentum has stalled. However, the upside bias remains intact.

A fresh upside would appear if the Gold price breaks above all-time highs above $2,480.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.