Gold price surges to record high and hovers near $2,800

- XAU/USD climbs 1.31%, touching a record after US GDP growth disappoints in Q4 2024.

- US Treasury yields drop as markets adjust to Fed's steady stance despite economic signals.

- Despite robust job market, Gold rallies as Fed Chair Powell hints at cautious approach to rate cuts.

Gold price skyrockets to a new all-time high (ATH) of $2,798 on Thursday after economic data from the United States (US) indicated the economy is slowing down, warranting the Federal Reserve (Fed) to lower interest rates despite holding them steady at Wednesday’s meeting. At the time of writing, the XAU/USD trades at $2,794, up 1.31%.

The yellow metal exploded on Thursday after being contained by the $2,770 figure for the last three days. US Treasury yields edged lower as traders grew disappointed following the last reading of 2024 of the fourth quarter Gross Domestic Product (GDP), which, although expanding, did so at a lower rate than expected.

Meanwhile, the jobs market remains robust, as the number of people applying for unemployment benefits decreased compared to the previous reading, according to the US Department of Labor.

Bullion prices soared, although the Fed held rates unchanged on Wednesday. Fed Chair Jerome Powell stated that policy is well-positioned and that they are not in a rush to cut interest rates.

Daily digest market movers: Gold price ignores mixed US data

- US GDP for Q4 204 dipped from 3.1% in Q3 to 2.3%, missing the mark. According to the US Department of Labor, Initial Jobless Claims for the week ending January 24 fell to 207K, coming in lower than the expected 220K and the previous week's 223K.

- Gold’s advance is also sponsored by the fall of US yields. The US 10-year T-note yield dropped two basis points down to 4.516%. US real yields, as measured by the 10-year Treasury Inflation-Protected Securities (TIPS), followed suit, tumbling two basis points to 2.138%.

- Bullion prices are also unfazed by a hawkish Fed, which unanimously voted to keep interest rates steady at 4.25% - 4.50% on Wednesday. The central bank cited a resilient US economy, limited progress in reducing inflation, and a recovering labor market as key factors behind the decision.

- While Trump’s plans are still unclear, he set a deadline of Saturday for tariffs of 25% on Mexico and Canada, and has also said he intends to impose across-the-board levies that are “much bigger” than the 2.5% figure previously suggested by Treasury Secretary Scott Bessent.

- The swaps market is pricing 50 bps of Fed rate cuts in 2025.

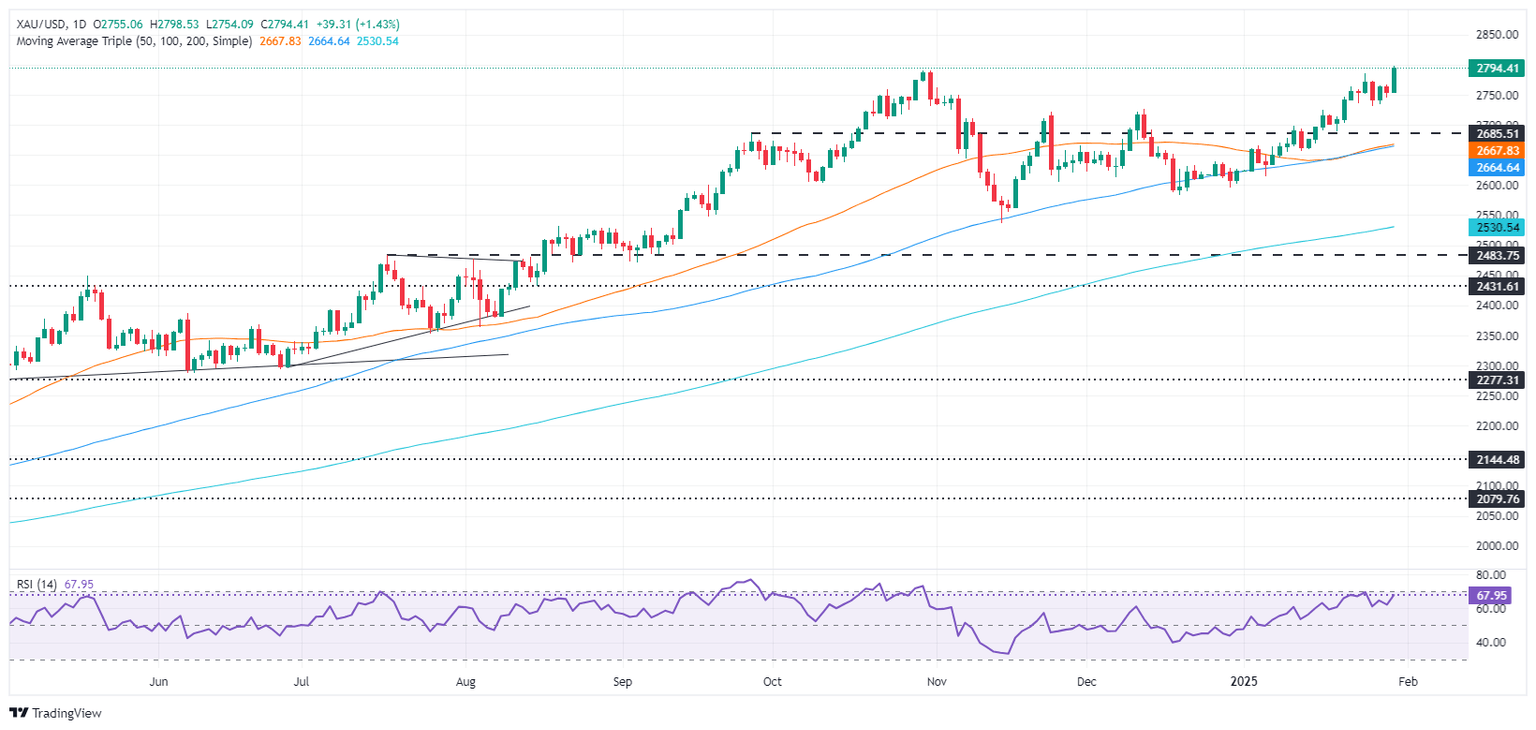

XAU/USD technical outlook: Gold lurks near $2,800 as bulls’ eye $3,000

Gold’s uptrend has resumed with the precious metal hitting a record high of $2,798. Bulls path toward $2,800 is clear, and buyers could test key psychological levels like $2,850, $2,900 and $3,000.

Conversely, sellers must drag XAU/USD’s prices below $2,750, so they could remain hopeful of testing $2,700. Further downside is seen below the latter, with the next key support at $2,663, the confluence of the 50 and 100-day Simple Moving Averages (SMAs).

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Jan 30, 2025 13:30 (Prel)

Frequency: Quarterly

Actual: 2.3%

Consensus: 2.6%

Previous: 3.1%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.