Gold price continues to rise despite mounting US bond yields

- Gold price hovers near fresh highs around $2,350 as the US Dollar remains sideways.

- US yields rally as traders pare Fed rate cut expectations.

- US inflation could guide market expectations for Fed rate cuts ahead.

Gold price (XAU/USD) falls slightly from record fresh all-time highs near $2,350 in Monday's early New York session. The near-term appeal remains extremely strong global central bankers purchase gold heavily. The rally in the precious metal remains unabated even though US Treasury yields increased after the robust United States Nonfarm Payrolls report for March shifted expectations for the Federal Reserve (Fed) pivoting to rate cuts in the second half of this year.

10-year US Treasury yields rise to four-month highs near 4.45%. Generally, higher bond yields dampen Gold’s appeal as they increase the opportunity cost of holding investment in the latter. However, the case has not held up in the last few weeks.

Fed policymakers don’t see rate cuts as appropriate as robust labor market data could halt the progress in reducing inflation to the 2% target.

Even one Fed policymaker sees no need for rate cuts this year if price pressures persist. Last week, Minneapolis Fed Bank President Neel Kashkari said rate cuts won’t be required this year if inflation stalls. Kashkari, who is currently not a voting member, warned: “The Fed needs to keep interest rates higher in the range of 5.25%-5.50% if inflation remains stronger than hoped”. He added that “if that still does not work, further rate increases are not off the table, but they are also not a likely scenario given what we know right now," Reuters reports.

Daily digest market movers: Gold price exhibits strength while US Dollar turns subdued

- Gold price trades close to all-time highs near $2,350, boosted by global central banks' robust purchase of gold.

- The US Dollar failed to catch the bid even though strong United States labor market data for March dents speculation for the Federal Reserve (Fed) to begin reducing interest rates, which are currently expected from June.

- The US Nonfarm Payrolls (NFP) report showed that the labor market recorded an increase of 303K fresh payrolls, significantly better than the 200K expected and the prior reading of 270K. The Unemployment Rate fell to 3.8% from the consensus and the prior reading of 3.9%. Robust labor demand is generally followed by strong wage growth as employers are forced to offer higher pay due to a shortage of workers. Higher wage growth boosts consumer spending, which keeps inflation stubbornly higher.

- The labor market data showed that the Fed does not need to pivot to rate cuts sooner. The CME FedWatch tool shows that traders are pricing in 48% for lowering borrowing costs in June, down significantly from 58% a week ago.

- After the strong US NFP data, Fed Governor Michelle Bowman said, “We are still not yet at the point where it is appropriate to lower the policy rate, and I continue to see a number of upside risks to inflation,” Reuters reported. Bowman remains confident that inflation will soften ahead with labor demand remaining strong. She added that if that happens, "it will eventually become appropriate to lower the federal funds rate gradually to prevent monetary policy from becoming overly restrictive.”

- Going forward, investors will focus on the US Consumer Price Index (CPI) data for March, which will be published on Wednesday. The inflation data will provide more cues about when the Fed could start reducing its interest rates. Strong price pressures could keep hopes of rate cuts for June off the table while soft figures could prompt speculation for the contrary.

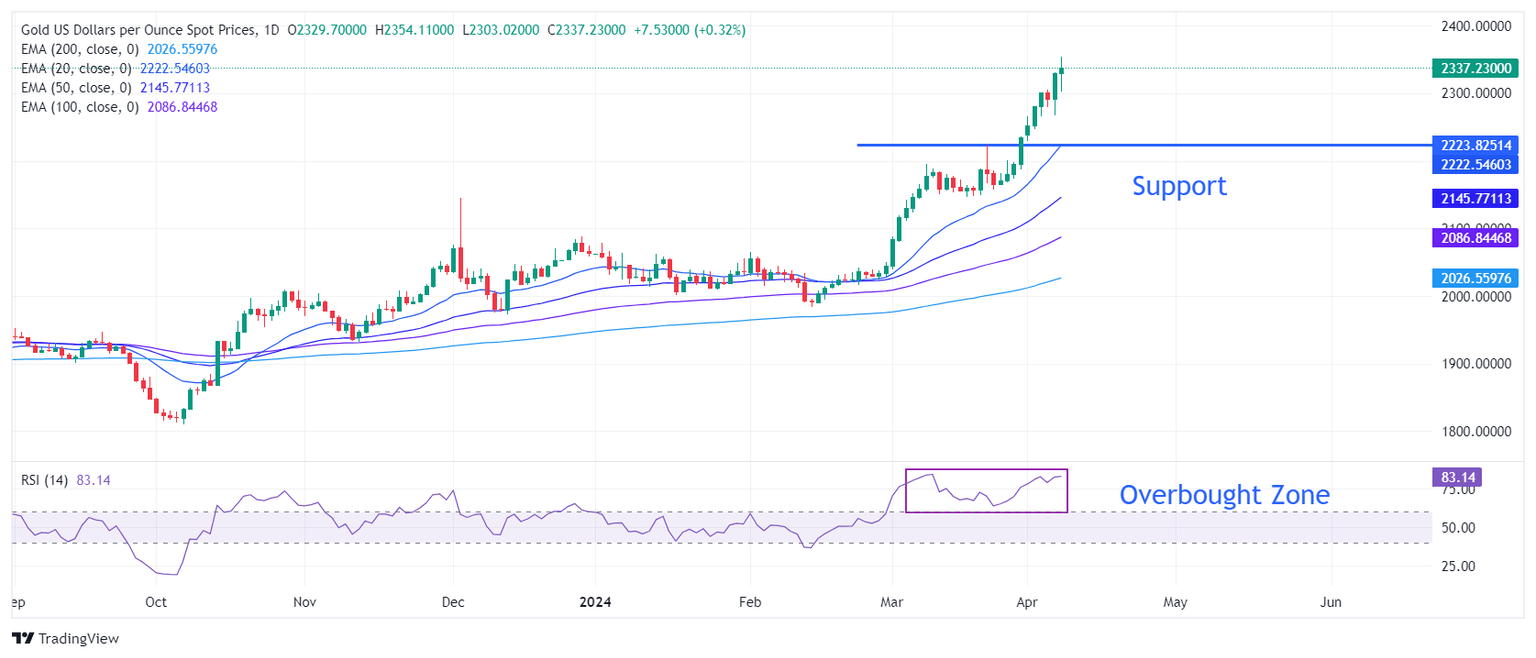

Technical Analysis: Gold price trades around $2,350

Gold price continues to add gains even though momentum oscillators turn extremely overbought – a situation when upside potential gets limited. The precious metal rallies to $2,350 but is expected to turn sideways as investors are expected to make fresh positions after the release of the US inflation data.

On the downside, March 21 high at $2,223 will be a major support area for the Gold price bulls.

The 14-period Relative Strength Index (RSI) reaches 84.00, which indicates that bullish momentum is still active. However, overbought signals have emerged.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.