Gold Price News and Forecast: XAU/USD bulls keep the baton above $1600 amid coronavirus fears

Gold Price Analysis: Lower high, overbought RSI check buyers inside short-term rising channel

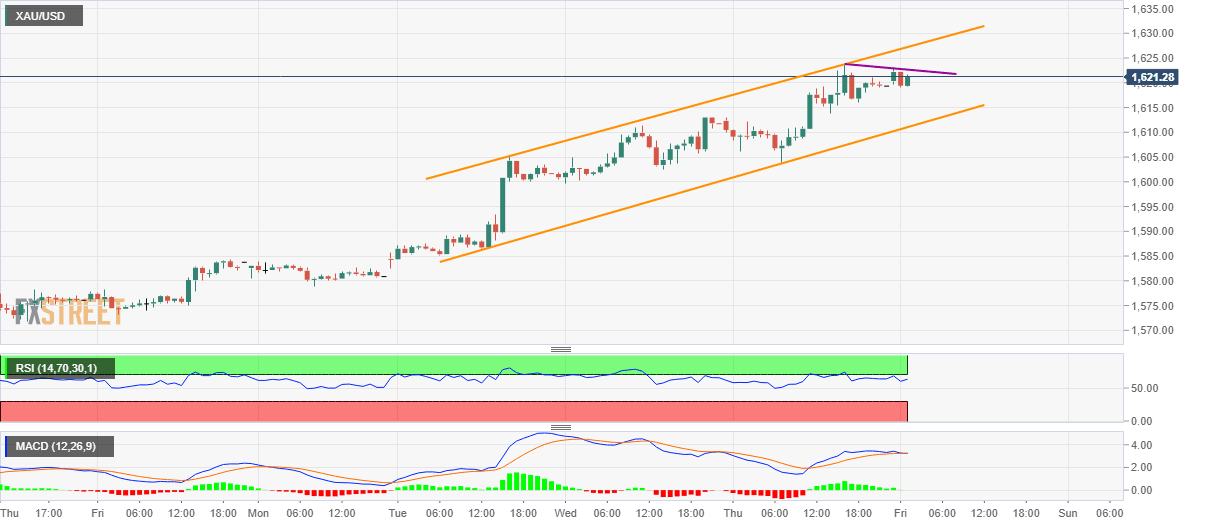

Gold prices stay mildly positive around $1,621 during early Friday. The yellow metal has been flashing a lower high formation since its pullback from $1,623.80 while MACD is also likely turning negative. Further to support the odds of a pullback are RSI conditions that signal a halt to the additional upside.

As a result, the bullion may decline to Wednesday’s high of $1,613 while the support line of a short-term rising channel, at $1,611 can question extra downside. If at all the quote dips below $1,611, $1,605 and $1,600 can entertain the bears ahead of recalling the early-week levels surrounding $1,584/83.

Gold: Bulls keep the baton above $1600 amid coronavirus fears

Gold stays positive around $1,622 ahead of the Tokyo open during Friday’s Asian session. While coronavirus has been the key to the bullion’s run-up, downbeat fundamentals from major economies also please the bulls.

The latest numbers from Hubei, as of February 20, suggest there are 411 new cases and 115 new deaths versus 349 new cases of infection and 108 deaths by the end of February 19. Despite the second change in the methodology to count, there have been more than 2,144 deaths and 62,442 infections in the region so far due to the epidemic. Also to note is the pace of contagion surrounding Japan, South Korea and Singapore.

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com

Author

FXStreet Team

FXStreet