Gold price eases from multi-day top, still well bid above $2,650 level

- Gold price catches fresh bids on Friday amid trade war fears and geopolitical tensions.

- The USD hits a fresh two-week low and offers further support to the XAU/USD pair.

- Bets for slower rate cuts by the Fed might keep a lid on the non-yielding yellow metal.

Gold price (XAU/USD) sticks to its intraday bullish bias through the early European session on Friday and currently trades just below a four-day top, around the $2,657-2,658 area. Concerns about the effect of US President-elect Donald Trump's trade tariffs on global growth and the protracted Russia-Ukraine war continue to drive haven flows towards the precious metal. Apart from this, depressed US Treasury bond yields and an intraday US Dollar (USD) dip to a two-week low turn out to be another factor that benefits the commodity.

Meanwhile, expectations that US President-elect Donald Trump's expansionary policies would revive inflationary pressures and signs that the progress in lowering US inflation stalled in October could restrict the Fed from easing policy further. This, in turn, could limit any further slide in the US bond yields and lend support to the USD, warranting caution before placing fresh bullish bets around the non-yielding Gold price. Hence, strong follow-through buying is needed to confirm that the XAU/USD has formed a near-term base near the $2,600 mark.

Gold price bulls seem unaffected by bets for slower rate cuts by the Fed

- Russian President Vladimir Putin said Russia may use its new hypersonic missile to attack decision-making centres in Ukraine in response to the latter's firing of Western missiles at its territory.

- US President-elect Donald Trump earlier this week pledged to impose tariffs on all products coming into the US from Canada, Mexico and China, which, in turn, could trigger trade wars.

- The US Dollar struggles to capitalize on Thursday's modest gains as traders now see a 70% chance that the Federal Reserve will cut interest rates at the next policy meeting in December.

- Minutes from the November FOMC meeting released earlier this week revealed that committee members were divided over how much farther they may need to cut interest rates.

- The PCE data showed on Wednesday that the progress in lowering inflation in the US stalled in October. Investors also seem convinced that Trump's policies will boost inflation.

- This suggests that the Fed may proceed cautiously, fueling uncertainty over the outlook for interest rates in 2025 and limiting any further decline in the US Treasury bond yields.

- The benchmark 10-year US Treasury yield touched a two-week low on Wednesday on hopes that Trump's Treasury Secretary nominee, Scott Bessent, will want to control US deficits.

- There isn't any relevant market-moving economic data due for release on Friday and US stock markets will close early in observance of the Thanksgiving holiday.

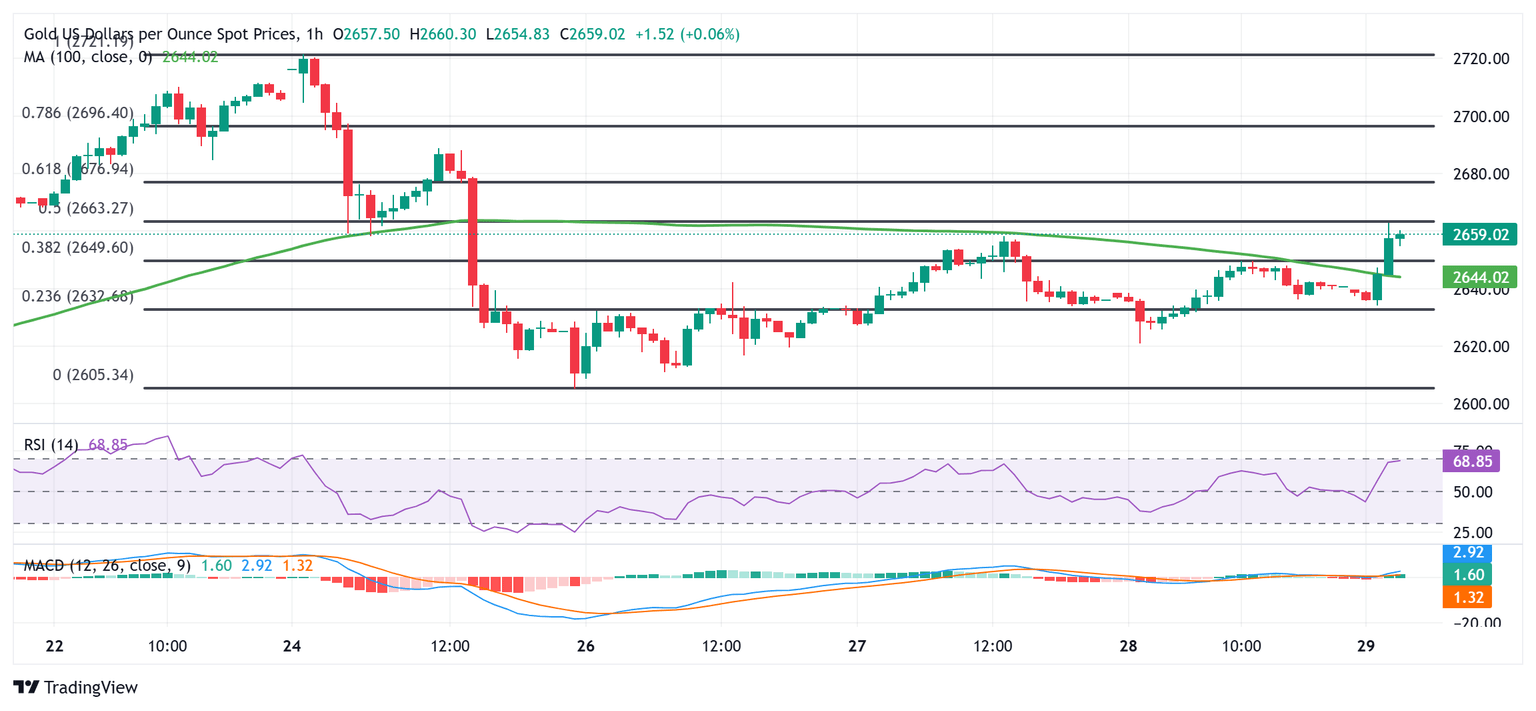

Gold price 100-hour SMA resistance breakpoint holds the key for bulls

From a technical perspective, an intraday breakout above the $2,649-2,650 confluence hurdle – comprising the 100-hour Simple Moving Average (SMA) and the 38.2% Fibonacci retracement level of the weekly decline – was seen as a key trigger for bulls. The subsequent move up, however, stalls near the $2,663-2,664 region, which coincides with the 50% retracement level and should act as a pivotal point. Some follow-through buying has the potential to lift the Gold price to the $2,677 region, or the 61.8% Fibo. level, en route to the $2,700 round figure.

On the flip side, the $2,650 confluence resistance breakpoint now seems to protect the immediate downside, below which the Gold price could slide back to the $2,633 area (23.6% Fibo. level) and the overnight swing low, around the $2,620 region. The next relevant support is pegged near the monthly trough, around the $2,605 region. Some follow-through selling below the $2,600 mark should pave the way for deeper losses towards the 100-day SMA, currently pegged near the $2,573 area, en route to the monthly low, around the $2,537-2,536 region.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.