Gold price eases from over two-month top on stronger USD, positive risk tone

- Gold price gains strong positive traction amid the flight to safety after Trump’s tariff remarks.

- Bets for more Fed rate cuts weigh on the US bond yields and further underpin the yellow metal.

- A modest USD recovery, along with a positive risk tone, caps further gains for the commodity.

Gold price (XAU/USD) retreats slightly after touching its highest level since November 6 during the early European session on Tuesday and currently trades just below the $2,725 area, still up over 0.50% for the day. The US Dollar (USD) stages a goodish recovery from a two-week low touched on Monday amid expectations that US President Donald Trump's protectionist policies would boost inflation and force the Federal Reserve (Fed) to stick to its hawkish stance. This, along with a generally positive tone around the equity markets, acts as a headwind for the safe-haven precious metal.

Meanwhile, Trump's tariff remarks spark concerns about a fresh wave of a global trade war. Furthermore, bets that the Fed will cut interest rates twice this year, which has been a key factor behind the recent sharp pullback in the US Treasury bond yields, should limit any meaningful corrective pullback for the non-yielding Gold price. Nevertheless, the XAU/USD retains its positive bias for the second straight day. Moreover, the fundamental backdrop suggests that the path of least resistance for the commodity remains to the upside in the absence of any relevant economic data from the US.

Gold price trims a part of intraday gains amid reviving USD demand, positive risk tone

- US President Donald Trump said this Tuesday that he intends 25% tariffs on Canada and Mexico, and the target date for tariffs would be as soon as early February. Trump further threatened that we could put tariffs on China if it doesn't approve a TikTok deal, underpinning demand for the safe-haven Gold price.

- The US Producer Price Index (PPI) and Consumer Price Index (CPI) released last week pointed to signs of abating inflation. This suggests that the Fed may not exclude the possibility of rate cuts by the end of this year and drags the yield on the benchmark 10-year US government bond to a nearly three-week low.

- The US Dollar (USD) regains positive traction following the overnight slump to a two-week low amid expectations that Trump's protectionist policies could boost inflation and force the Federal Reserve to stick to its hawkish stance. This, in turn, might cap any further gains for the non-yielding yellow metal.

- The Israel-Hamas ceasefire deal, along with hopes that Trump might relax curbs on Russia in exchange for a deal to end the Ukraine war, remains supportive of the positive risk tone. This might further hold back bulls from placing fresh bets around the XAU/USD in the absence of any relevant US economic data.

- The market focus will remain glued to the crucial Bank of Japan policy meeting on January 23-24 on Friday. Apart from this, the release of the flash PMI prints, which will be looked upon for fresh insight into the global economic health, should infuse volatility around the commodity during the latter half of the week.

Gold price remains on trak to test the next relevant hurdle near the $2,746-2,748 region

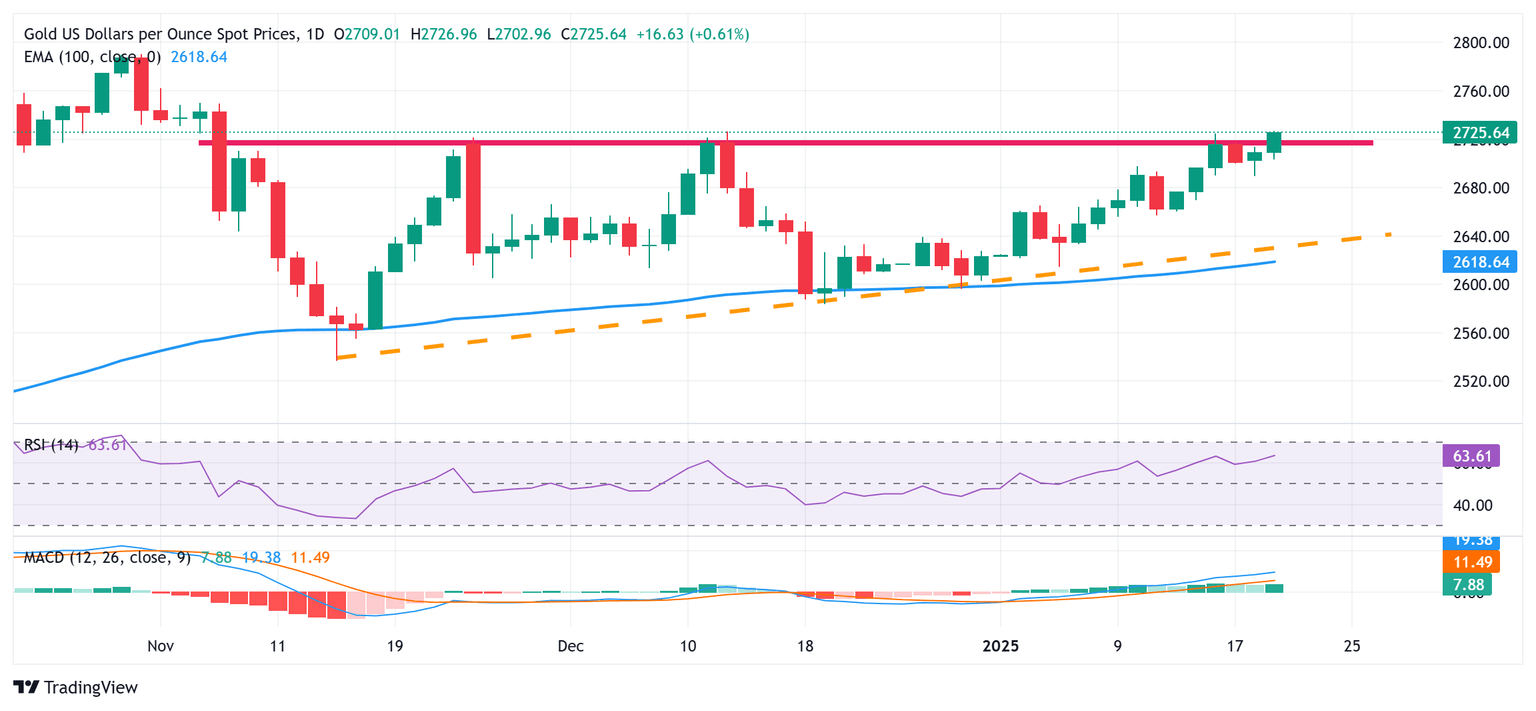

From a technical perspective, the Gold price now seems to have found acceptance above the $2,720 supply zone. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought territory. This, in turn, favors bullish traders and suggests that the path of least resistance for the XAU/USD is to the upside. Hence, some follow-through strength towards the next relevant hurdle near the $2,735 horizontal zone, en route to the $2,746-2,748 region, looks like a distinct possibility. The momentum could extend further towards challenging the all-time peak, around the $2,790 area touched in October 2024.

On the flip side, any corrective pullback now seems to find decent support near the $2,700 mark. A subsequent slide below the overnight swing low, around the $2,689 region, could prompt some technical selling and drag the Gold price further towards the $2,662-2,660 region. The latter should act as a pivotal point, below which the XAU/USD could fall to the $2,635 zone en route to the $2,622-2,618 confluence – comprising a short-term ascending trend-line extending from the November low and the 100-day Exponential Moving Average (EMA).

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.