Gold Price Forecast: XAUUSD declines towards $1,740 as DXY extend gains amid dismal market mood

- Gold price is expected to decline further to near $1,740.00 as the risk-off profile is gaining more traction.

- The DXY has refreshed its weekly high at 107.40 and has not displayed any sign of exhaustion yet.

- An upbeat US Durable Goods Orders data will create more troubles for Fed policymakers.

Gold price (XAUUSD) has turned sideways after dropping to near $1,743.00 in the early European session. The precious metal witnessed selling pressure after surrendering the crucial support of $1,750.00 as the risk aversion theme was underpinned by the market participants. The absence of potential triggers indicates that weekly anxiety is impacting risk-sensitive assets.

The US dollar index (DXY) has refreshed its weekly high at 107.40 and has not displayed any sign of exhaustion yet. Meanwhile, the 10-year US Treasury yields have tumbled to near 3.79% as investors don’t see a continuation of bigger rate hikes by the Federal Reserve (Fed) ahead.

This week, the ultimate event will be the release of the US Durable Goods Orders data, which is due on Wednesday. The economic data is expected to expand by 0.4%, similar to the prior advancement. Fed chair Jerome Powell is going through sleepless nights deriving a strategic plan to trim consumer spending. An absence of a decline in Durable Goods Orders data won’t be able to compel manufacturers to trim the prices of end goods. This might weigh more pressure on the gold prices ahead.

Gold technical analysis

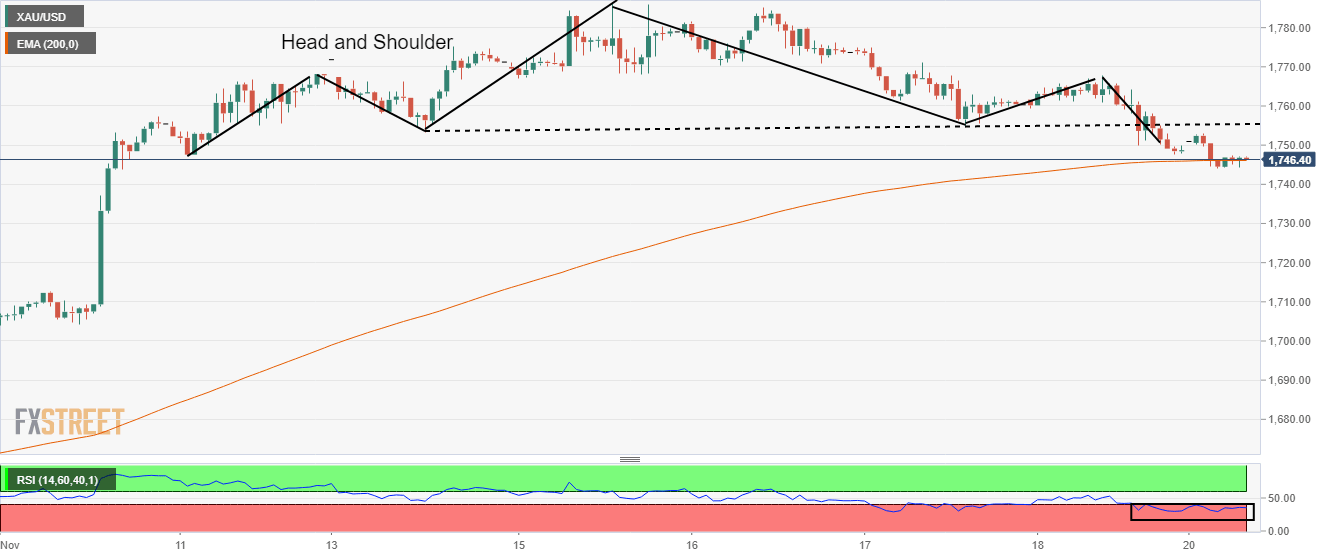

Gold price has witnessed a steep fall after a breakdown of the Head and Shoulder chart pattern on an hourly scale. The precious metal has dropped to near the 200-period Exponential Moving Average (EMA) around $1,744.50, therefore a decisive move is expected ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been triggered.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.