- Gold traders are in anticipation of the Federal Reserve's Chairman Jerome Powell.

- The United States economy will be scrutinised in Friday's Nonfarm Payrolls report.

- China and the Coronavirus spread are keeping markets at bay.

- Gold is poised for a critical technical breakout for the past month of 2022.

Gold prices climbed on Tuesday even as the US Dollar and bond yields rose but were capped as traders get set for the Federal Reserve's chair, Jerome Powell, who will speak on Wednesday. Meanwhile, there is mixed sentiment surrounding the apparent easing of unrest in China over coronavirus curbs. Traders are also apprehensive while awaiting further important data from the US economy on Friday in the form of the Nonfarm Payrolls report.

The Gold price started Wednesday near $1,750, sitting in the middle of Tuesday's range which ended as an inside bar in comparison to Monday's business. Gold is pressured below what could turn out to be a key resistance area of around $1,762. There is a focus on the downside for the day ahead while capped there with eyes on $1,720 as illustrated in the technical analysis at the end of this article. Meanwhile, there are plenty of fundamentals to be aware of for the day ahead and the rest of the week. The clock is now ticking down towards the final weeks of the year and the critical Federal Reserve December interest rate decision.

Federal Reserve's Jerome Powell coming up

Federal Reserve chairman, Jerome Powell, is scheduled to speak on Wednesday. The chair is expected to ''reaffirm the Fed’s unwavering commitment to tackling inflation, the need for more measured rate rises taking account of increased two-way economic risks as policy becomes restrictive, and a degree of optimism that the Fed will be able to pull off a soft landing,'' analysts at ANZ Bank explained.

The tight labour market and elevated services inflation will be hot topics which would be expected to elevate the jobs report on Friday to a more urgent degree on Gold trader's radars. While markets welcome the prospect of smaller hikes, a need to reach an appropriately higher terminal rate due to a tight labour market could be a spanner in the works for Gold bugs ahead of the Federal Reserve meeting held on 13 & 14 of December.

Friday Nonfarm Payrolls outlook

''US Nonfarm Payrolls payrolls likely continued to slow gradually but still advanced firmly in November, falling only modestly below its three-month avg of 290k,'' analysts at TD Securities said. ''The Unemployment Rate likely stayed unchanged at 3.7%, while we look for wage growth to have slowed to 0.3% month over month after accelerating to 0.4% in October,'' the analysts added.

Ahead of that, ADP reports a private sector job estimate on Wednesday and is expected at 200k vs. 239k in October. October JOLTS job openings will also be reported Wednesday and is expected at 10.35 mln vs. 10.717 million in September.

China's Coronavirus hamstrings risk sentiment

China coronavirus protests erupted which has put China's president Xi Jinping and the Chinese Communist Party (CCP) in a bind. Thousands took to the streets in major cities across the nation in recent days, protesting against Covid restrictions.

An exhausted population has been asking how much longer must they endure Xi Jinping's zero-Covid policy. In one of President Xi's biggest political tests yet, the CCP is attempting to negotiate both mounting fury and a deep-rooted fear of Covid, all of which have upended the global economic outlook and added a new element of uncertainty on top of the Ukraine war, an energy crisis and inflation.

US Dollar's vs. Gold's safe-haven appeal

With a number of factors that have fundamentally stripped the US Dollar of its recent safe-haven appeal analysts at TD Securities warned that several catalysts could spark a leg lower in Gold as CTAs run out of dry powder on the bid.

''Systematic trend followers are still covering their shorts in gold markets as downside momentum signals subside. This continues to set the stage for a bull trap in precious metals as the resilient price action, buoyed by CTA short covering, attracts new long interest from discretionary money managers. However, the narrative is chasing prices,'' the analysts warned with respect to Gold's recent bullish correction.

Besides any uber-hawkish commentary from Federal Reserve speakers this week or ahead of the December meeting that could trap Gold bulls, the situation in China remains fluid and a probable catalyst for a flight for safety.

''We continue to downplay any hopes of quicker reopening despite conciliatory comments from mainland health officials,'' analysts at Brown Brothers Harriman argued.

A combination of a hawkish twist in Fed sentiment and continued risks of a prolonged reopening in China would be expected to play into the hands of the US Dollar bulls and strip Gold of its safe-haven appeal

Gold technical analysis

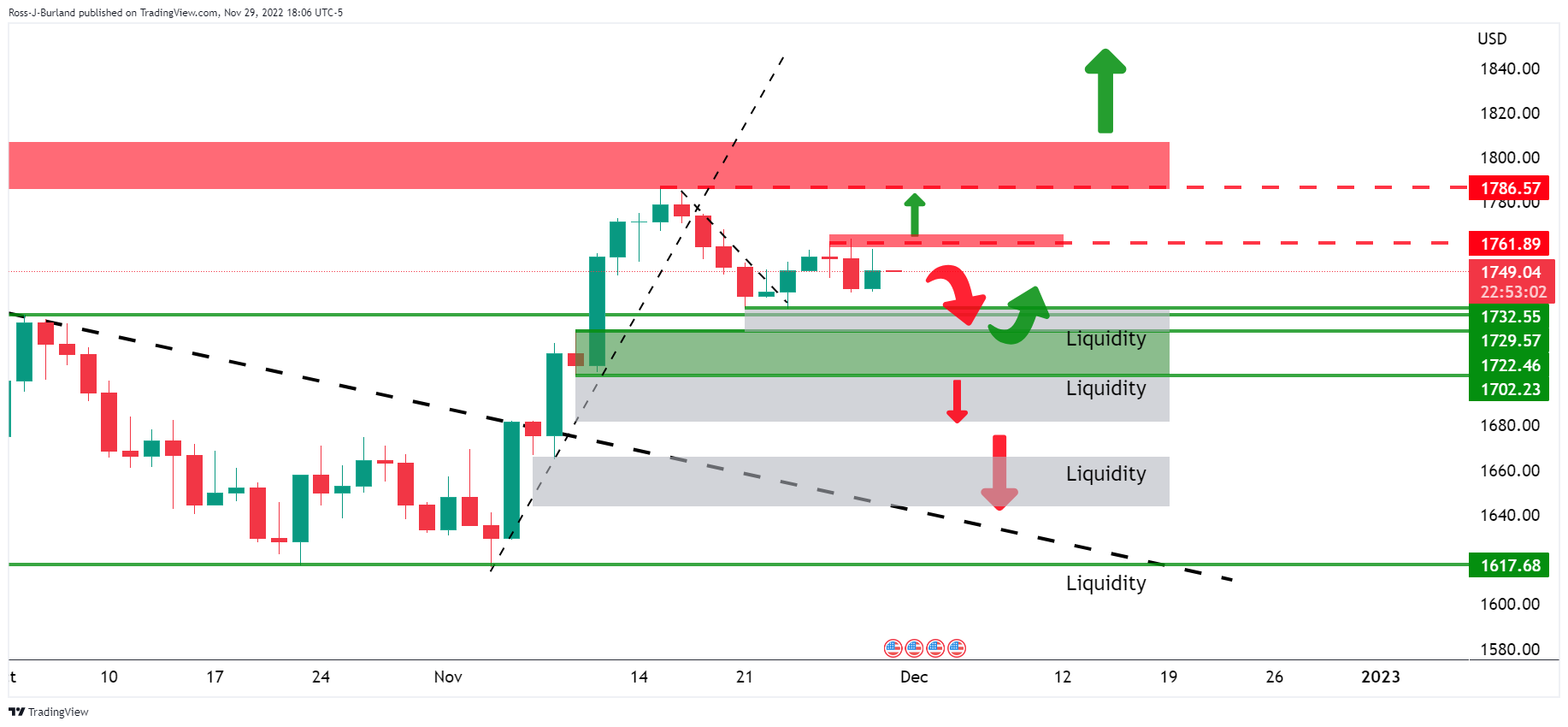

The daily chart shows that the Gold price is attempting to make a clean break to the upside having broken the long-term trendline resistance in a harmonic reversion pattern as illustrated above.

However, on closer inspection, the price is struggling on the bid at this juncture, bounded by both resistance and support. There are in-the-money longs below the spot price and that means liquidity for sellers to target in the meantime.

$1,720 will be an important support in this regard because a break of there opens risk all the way down into liquidity patches below $1,700. On the flip side, a break of $1,762 and then $1,790 opens the way for a deeper bullish correction and potentially a longer-term bull trend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.