Gold Price Forecast: XAU/USD struggles to extend rally above $1,870, upside seems favored

- Gold price is facing barricades around $1,870.00, upside looks solid amid the volatile US Dollar Index.

- S&P500 futures have added more gains in Friday’s rally, portraying an upbeat market mood.

- Gold price is getting much attention amid rising expectations of a recession in the United States.

Gold price (XAU/USD) is hovering in a narrow range around the immediate hurdle of $1,870 in the Asian session. The precious metal is looking to extend its upside journey amid the higher risk appetite of the market participants.

S&P500 futures have added more gains in Friday’s rally, portraying an upbeat market mood. The US Dollar Index (DXY) has sensed barricades around 103.50 and will find an intermediate cushion around 103.00. The 10-year US Treasury yields have dropped to near 3.56% amid a decline in the safe-haven’s appeal.

Gold price is getting much attention amid rising expectations of a recession in the United States. After a consecutive drop in the US ISM Manufacturing PMI, the Services PMI has also slipped, too, indicating that the overall demand in the United States economy has weakened. The Services PMI plunged significantly to 49.6 vs. the projection of 55.0. Also, New Orders Index that displays forward demand dropped massively to 45.2 vs. the expectations of 58.5. A slowdown in economic activities and its forward projections are impacting the US Dollar.

Gold technical analysis

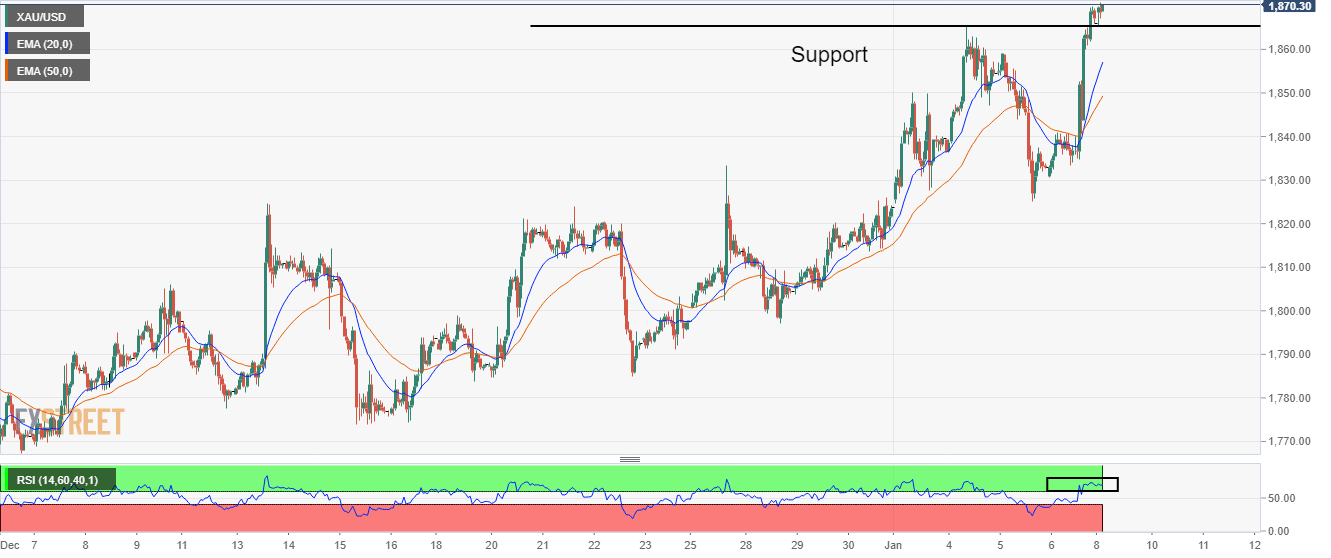

Gold price has delivered an upside break of the horizontal resistance plotted from the January 4 high at $1,865.15 on an hourly scale, which will act as significant support ahead. The 20-and 50-period Exponential Moving Averages (EMAs) have delivered a bull cross around $1,840.58, which adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the bullish momentum has been triggered.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.