Gold Price Forecast: XAU/USD stays defensive above $1,780 support, US Michigan CSI eyed

- Gold price remains sidelined while keeping the previous day’s bounce off 50-DMA.

- US dollar struggles to regain traction even as Fed policymakers resist welcoming easy CPI/PPI.

- Yields retreat from three-week high to print the first daily loss in four.

- US Michigan Consumer Sentiment Index eyed to confirm receding fears of inflation.

Gold price (XAU/USD) remains sidelined at around $1,790 heading into Friday’s European session as traders seek fresh clues to overcome the dilemma surrounding US inflation and the Fed’s next moves.

Recently, President and Chief Executive Officer of the Federal Reserve Bank of San Francisco Mary Daly mentioned that she is open to a 75bps rate hike in September. Previously, Minneapolis Fed President Neel Kashkari favored higher rates and Chicago Fed President Charles Evans sounded grim over the economic transition.

In doing so, the Fed policymakers fail to welcome the latest weakness in the inflation data. On Thursday, the US Producer Price Index (PPI) for July tracked the headline Consumer Price Index (CPI) while easing to 9.8% YoY versus 11.3% prior and 10.4% market forecasts, the data published by the US Bureau of Labor Statistics revealed. Details suggest that the monthly PPI dropped to the lowest levels since May 2020, to -0.5% compared to 1.0% expected and 0.2% prior, which in turn signaled more easing of inflation fears. Elsewhere, US Initial Jobless Claims eased to 262K for the week ending August 6 versus 263K expected and downwardly revised 248K prior.

Amid these plays, the US 10-year Treasury yields retreat from a three-week high, also snapping a three-day uptrend, amid recession fears. However, Wall Street closed mixed and Asia-Pacific shares outside Japan grind lower.

It should be noted that the pessimism surrounding the US-China tension over Taiwan and covid woes in Beijing also negatively affect gold prices due to the dragon nation’s status as the world’s largest commodity user. Recently, Fitch ratings mentioned that they anticipate a recovery in China's tourism spending in 2h22 as pandemic-related controls are relaxed.

Moving on, the first reading of the US Michigan Consumer Sentiment Index (CSI) for August, expected at 52.5 versus 51.5 prior, is important for the XAU/USD traders to overcome the latest indecision.

Technical analysis

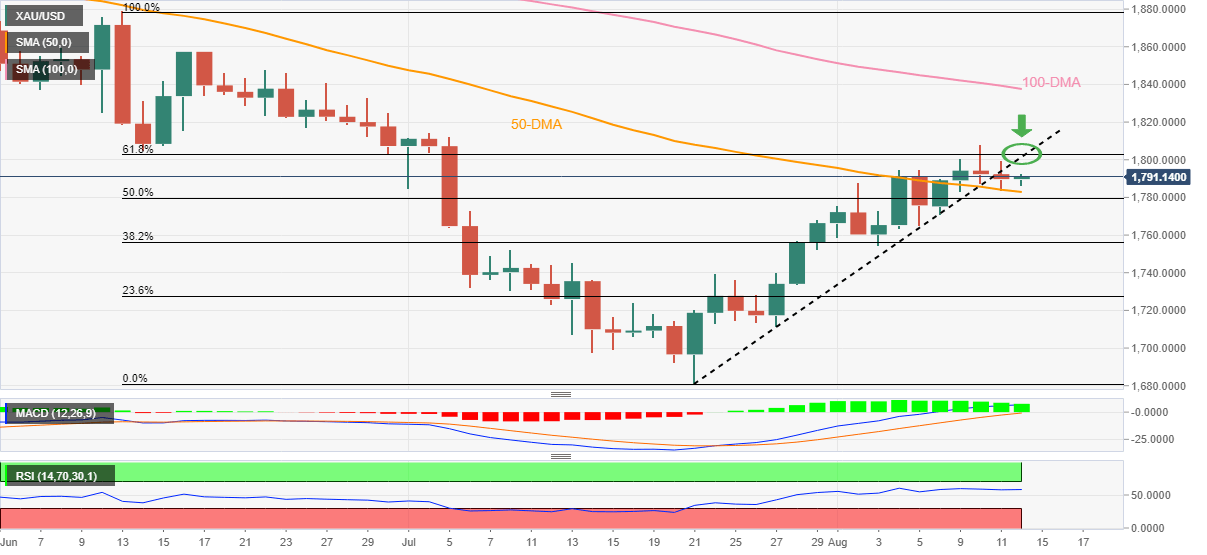

Gold price floats above the 50-DMA support near $1,780, despite closing below a three-week-old ascending trend line the previous. The upside momentum also takes clues from the firmer RSI.

However, the receding bullish bias of the MACD signals challenges the XAU/USD bulls.

Also raising doubts about the metal’s further upside is the convergence of the previous support line from July 21 and the 61.8% Fibonacci retracement level of the June-July downtrend, around $1,805.

Should the metal prices stay successfully beyond $1,805, the run-up towards the 100-DMA level surrounding $1,838 can’t be ruled out.

On the contrary, a daily closing below the 50-DMA support of around $1,780 could open the doors for the bullion’s south-run towards the monthly low surrounding $1,754.

Gold: Daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.