Gold Price Forecast: XAU/USD soars above $2,010 as Fed policymakers see quick US Inflation softening

- Gold price has climbed above $2,010.00 firmly as Fed policymakers are anticipating a quick deceleration in the US CPI.

- Fed minutes will be in focus as they will provide a detailed explanation behind the 25 bps rate hike in March.

- Gold price is marching towards the $2,032.00 resistance after sensing a stellar buying interest.

Gold price (XAU/USD) has shown a quick move above the critical resistance of $2,010.00 in the Asian session. The precious metal has jumped above $2,013.00 amid further weakness in the US Dollar Index (DXY). The USD Index has dropped to near 102.05 and is expected to rampant its downside journey. The downside bias for the USD Index is inspired by expectations of quick deceleration in the United States inflation as anticipated by Federal Reserve (Fed) policymakers.

Philadelphia Fed President Patrick Harker cited “I am keeping an eye on the data to see if more action on inflation is required.” Also, Minneapolis Fed Bank President Neel Kashkari sees inflation at the middle 3% by end of this year, closer to 2% next year.

Apart from them, Chicago Fed President Austan Goolsbee advocated a cautious approach as the combination of tight credit conditions and further restrictive monetary policy can hit sectors and regions differently than if monetary policy was acting on its own.

Wednesday’s US inflation data will be keenly watched as it carries significant value, being the last inflation data before the interest rate decision by the Fed scheduled in first week of May.

Also, Fed minutes will be in focus as they will provide a detailed explanation of hiking rates by 25 basis points (bps) in March.

The demand for US government bonds seems subdued ahead of US inflation data. The return offered on 10-year US Treasury bonds is juggling around 3.43%.

Gold technical analysis

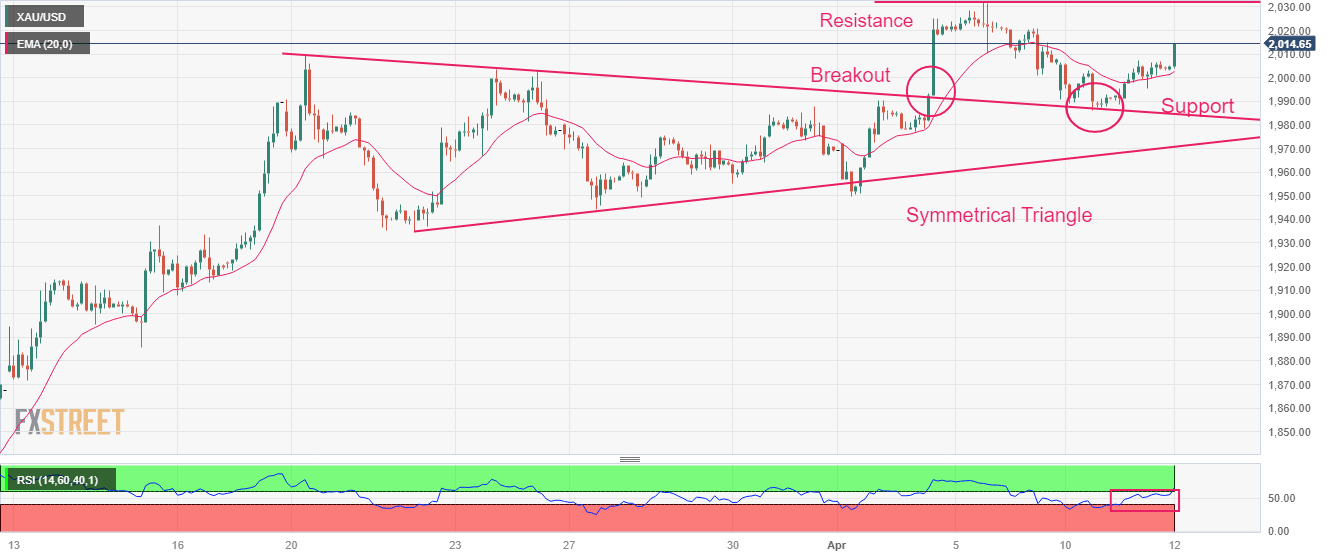

Gold price is marching towards the horizontal resistance plotted from April 05 high at $2,032.00 after sensing a stellar buying interest near the breakout region of the Symmetrical Triangle chart pattern formed on a two-hour scale.

The 20-period Exponential Moving Average (EMA) at $2,004.14 is providing cushion to the Gold bulls.

The Relative Strength Index (RSI) (14) is on the verge of breaking into the bullish range of 60.00-80.00, which will activate the upside momentum.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.