Gold Price Forecast: XAU/USD rebound eyes $1,990 and US factors – Confluence Detector

- Gold Price extends recovery despite firmer US Dollar, justifying downbeat Treasury bond yields.

- Cautious mood ahead of voting on US debt ceiling deal in House, mixed US data allow XAU/USD buyers to keep the reins.

- Sustained break of $1,950 resistance confluence, now support, keeps the Gold Price on the buyer’s radar.

Gold Price (XAU/USD) picks up bids to refresh intraday high as buyers cheer a two-day winning streak, after refreshing the lowest levels in 10 weeks. In doing so, the XAU/USD fails to justify the latest rebound in the US Dollar Index (DXY) but aptly cheers the downbeat Treasury bond yields as markets await the US House of Representatives voting on the debt ceiling agreement. Also important to watch is the Fed’s Beige Book and the US JOLTS Job Openings for April, not to forget inflation clues from Eurozone.

Apart from the pre-data positioning and month-end consolidation, the XAU/USD price also benefits from the mixed US data, as well as China’s readiness for more stimulus amid downbeat activity numbers. Further, hopes that the US policymakers will anyhow avoid the US default and hawkish Federal Reserve (Fed) bets appear challenging the Gold price as the metal is a whisker above the short-term key support confluence, previous resistance.

Also read: Gold Price Forecast: Bear Cross confirmation to threaten 100 DMA support again

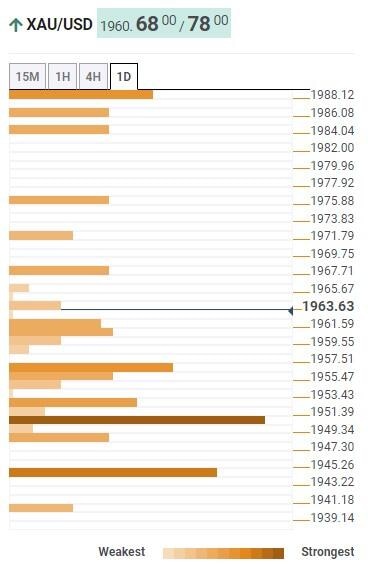

Gold Price: Key levels to watch

As per our Technical Confluence Indicator, the Gold Price grinds higher past $1,950 resistance-turned-support comprising 5-DMA and the previous monthly low.

The XAU/USD recovery also crossed the $1,957 immediate support including the Fibonacci 23.6% in one-day to further convince the commodity bulls.

It should be noted that the Gold Price weakness past $1,950 needs validation from the $1,945 support level that encompasses the Pivot Point one-month S1 and Fibonacci 61.8% on one-day to welcome the XAU/USD sellers.

On the flip side, Fibonacci 61.8% on one-week and Pivot Point one-week R1, respectively around $1,968 and $1,975, can prod the Gold buyers before directing them to a convergence of the Fibonacci 61.8% on one-month, around $1,990 by the press time.

Overall, the Gold price remains on the buyer’s radar unless staying beyond $1,950.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.