Gold Price Forecast: XAU/USD prints four-day winning streak below $1,900 on Fed, China catalysts

- Gold price grinds higher for the fourth consecutive day amid sluggish session.

- Market’s reassessment of hawkish Fed talks, China-inspired risk-on mood favor XAU/USD bulls.

- A light calendar could challenge the Gold price inside a short-term trading range.

Gold price (XAU/USD) remains firmer around $1,880 during the four-day uptrend on early Thursday.

In doing so, the metal buyers take clues from the US Dollar’s pullback, as well as risk-positive headlines surrounding China, amid sluggish trading hours of the day. That said, hawkish concerns surrounding the Federal Reserve (Fed), however, challenge the buyers but technical analysis joins the price-positive catalysts to portray XAU/USD upside.

US Dollar Index (DXY) traces softer Treasury bond yields to reverse the previous day’s recovery moves, down 0.22% intraday near 103.25 at the latest. That said, the US 10-year Treasury bond yields reversed from a one-month high to snap a three-day uptrend on Wednesday, pressured around 3.62% by the press time.

The pullback in yields could be linked to the market’s reassessment of the hawkish Fed talks as Chairman Jerome Powell hesitated in praising the jobs report but Fed Governor Christopher Waller, New York Federal Reserve President John Williams and Fed Governor Lisa Cook highlight inflation fear to suggest further rate increases from the US central bank. Furthermore, comments from the US diplomats such as Treasury Secretary Janet Yellen and President Joe Biden also amplified inflation concerns, as well as hopes of no recession in the US, which in turn suggests a safe side for the Fed to hike the benchmark rates.

On the other hand, risk appetite improves amid the sentiment-positive headlines surrounding China and the US. That said, the receding fears of the US-China jitters, following the China balloon shooting by the US, join hopes of People’s Bank of China’s (PBOC) rate cuts and the restart of the China-based companies’ listing on the US exchanges to favor risk-on mood. Additionally favoring the sentiment could be the receding recession woes surrounding China and the US. On Wednesday, global rating giant Fitch inflated China's growth forecasts while US Treasury Secretary Yellen and President Biden recently cheered hopes of growth in the current year.

While portraying the mood, the Asia-Pacific shares grind higher whereas the S&P 500 Futures ignore Wall Street’s losses to print mild gains by the press time.

Looking ahead, Gold price may have to rely on the risk catalysts amid a light calendar, comprising only the US Weekly Jobless Claims.

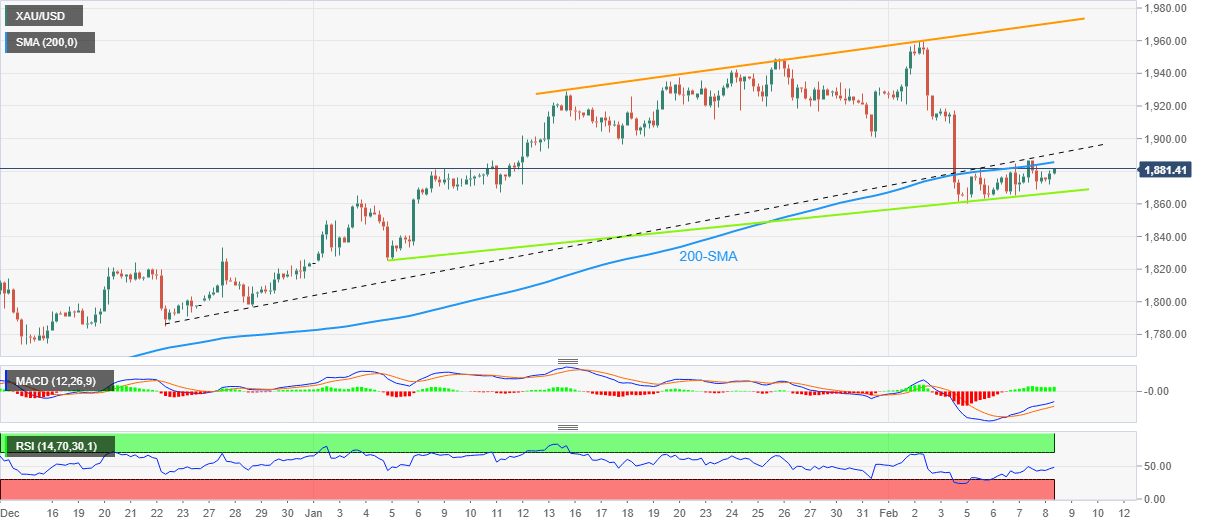

Gold price technical analysis

Gold price holds onto the week-start recovery from a five-week-old ascending support line, around $1,865 by the press time. Adding strength to the upside bias are the bullish MACD signals and firmer RSI (14).

However, the 200-SMA and previous support line from December 22, 2022, near $1,885 and $1,890 in that order, cap the metal’s immediate upside.

Hence, the yellow metal is likely to remain firmer between $1,865 and $1,890, despite maintaining the short-term trading range.

In a case where the XAU/USD remains firmer past $1,890, the $1,900 threshold and a three-week-old resistance line, close to $1,977 at the latest, will gain the market’s attention.

Alternatively, a downside break of $1,865 can drag the commodity prices toward the previous monthly low of $1,825.

Gold price: Four-hour chart

Trend: Limited recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.