Gold Price Forecast: XAU/USD looks to surpass $1,940 amid weaker yields, US GDP eyed

- Gold price attempts to surpass $1,940.00 as US yields drop further.

- The USD Index remains weak this year as attention is turning towards policy tightening in other advanced economies.

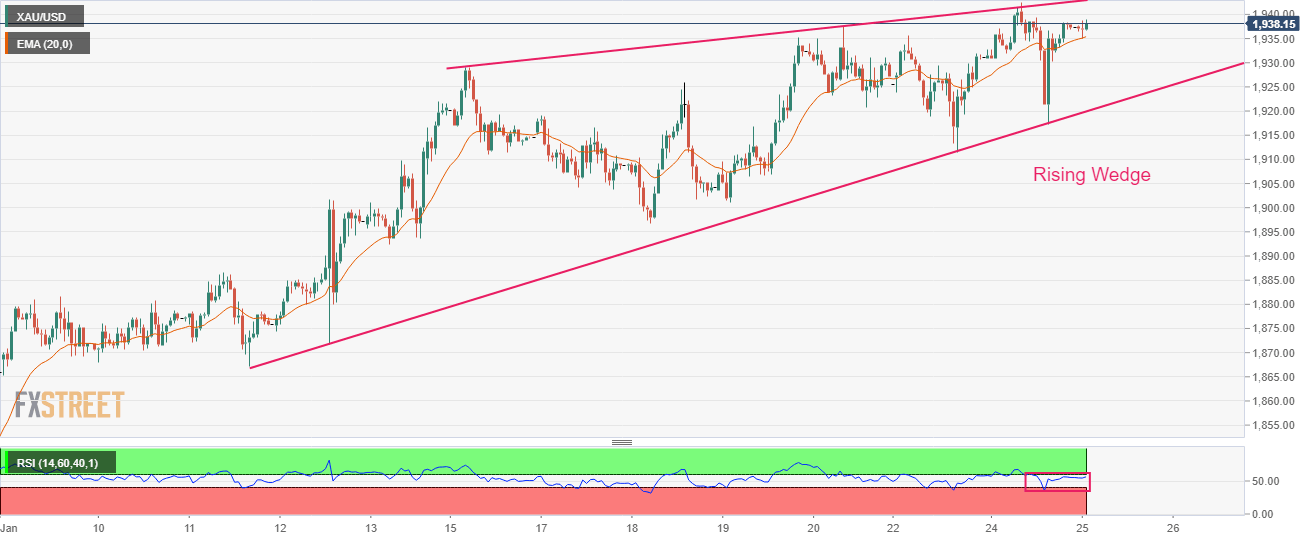

- Gold price is auctioning in a Rising Wedge, portraying a volatility contraction.

Gold price (XAU/USD) aims to overstep the immediate resistance of $1,940.00 in the Tokyo session. The precious metal is gaining strength amid rising demand for the US government bonds that have weakened yields further. The 10-year US Treasury yields have dropped to near 3.45%.

A sell-off in the S&P500 futures indicates that the market participants' risk-taking capacity is fading away. Missed estimates by tech-giant Microsoft in its December earnings and technical glitch in NYSE are impacting United States equities. The US Dollar Index (DXY) displays a sideways profile around 101.50 as investors await US Gross Domestic Product (GDP) data for fresh impetus.

Gold price might find strength if US GDP contracts dramatically, which might further bolster the expectations for a smaller interest rate hike by the Federal Reserve (Fed) in its February meeting. As per the estimates, the annual Q4CY2022 GDP will contract to 2.8% from the former release of 3.2%. For the USD Index outlook, economists at CIBC Capital Markets look for the mighty US Dollar to weaken in 2023 as the Fed is set to undershoot market expectations for the peak fed funds rate, and attention is turning to policy tightening in other advanced economies.

Gold technical analysis

Gold price is auctioning in a Rising Wedge chart pattern on an hourly scale that indicates volatility contraction, which will result in wider ticks and heavy volume after an explosion. The 20-period Exponential Moving Average (EMA) at $1,935.33 is a cushion for the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) oscillates in a 40.00-60.00 range, demonstrating a lackluster performance by the Gold price ahead.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.