Gold Price Forecast: XAU/USD eyes above $2,020 as White House needs to raise US debt ceiling sooner

- Gold price is aiming to surpass $2,020.00 as its appeal has improved amid US debt ceiling concerns.

- An extension in the US debt ceiling would result in a downgrade of the US long-term outlook.

- Gold price is marching towards $2,048.75 after a symmetrical triangle breakout.

Gold price (XAU/USD) is gathering strength for a breakout above the immediate resistance of $2,020.00 in the Asian session. The precious metal has shifted into a bullish trajectory as concerns for the United States are mounting. After the headlines from US Treasury Secretary Janet Yellen that the Treasury will run out of funds in early June if the administration fails to raise the debt ceiling and will face problems in making payments.

US President Joe Biden is declining negotiations with US House of Senate Joseph McCarthy as Republicans want big cuts in President’s spending initiatives. However, concerns that the US economy won’t be able to make payments smoothly would force US Biden to come to the table for debt ceiling talks.

An extension in the US debt ceiling would result in a downgrade of the US long-term outlook, which would have a negative impact on the US Dollar, Treasury yields, and S&P500. However, the appeal of the Gold price will improve further as safe-haven.

Meanwhile, S&P500 futures have added moderate gains in Asia, showing signs of improvement in the risk appetite. However, the overall market mood is still risk-off. The US Dollar Index (DXY) has dropped sharply to near 101.72 and is expected to extend its downside to near 101.63 ahead of the Federal Reserve (Fed) policy.

A consecutive 25 basis points (bps) interest rate hike from Fed chair Jerome Powell is expected to be followed by neutral guidance as US labor market conditions are easing and manufacturing activities are consistently contracting.

Gold technical analysis

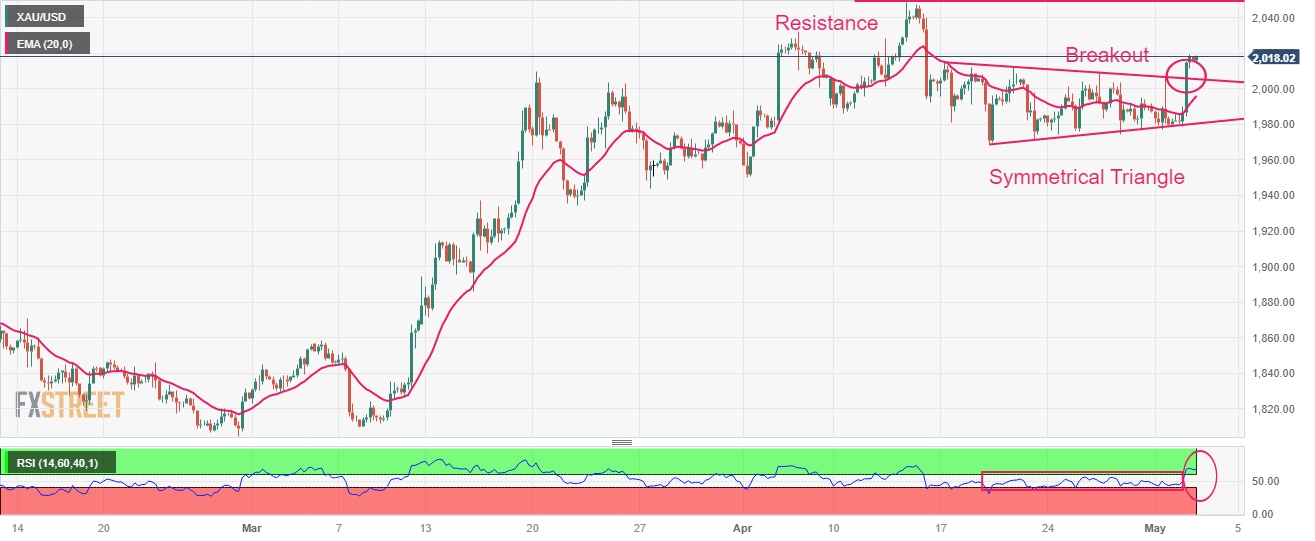

Gold price delivered a breakout of the Symmetrical Triangle chart pattern formed on a four-hour scale, which results in wider ticks and heavy volume. The yellow metal is marching towards the horizontal resistance plotted from April 13 high at $2,048.75.

Advancing 20-period Exponential Moving Average (EMA) at $1,996.47 will provide support to the Gold bulls.

The Relative Strength Index (RSI) (14) has climbed above 60.00 indicating that the upside momentum is active now.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.