Gold Price Forecast: XAU/USD eyes $1,615 and $1,607 amid a down week – Confluence Detector

- Gold price is on track for the second straight weekly loss amid surging Treasury yields.

- The US dollar jumps back into the game on risk-aversion and aggressive Fed rate hike bets.

- XAU/USD’s path of least resistance remains to the downside, with eyes on $1,607.

Gold price is testing bullish commitments near 2022 lows on its way to the $1,600 threshold heading into a new week. The Fed entered the blackout period ahead of its November 2 rate hike decision. Therefore, the recent speeches from Fed policymakers and a surprise drop in the US Jobless Claims data had a significant impact on the aggressive Fed rate hike expectations. The US Treasury yields shot through the roof, thereafter, driving the dollar northward alongside, throwing the metal under the bus. The parabolic rise in the USD/JPY pair on policy divergence is also benefiting dollar bulls. The bullion is headed for the second consecutive weekly decline, as higher borrowing costs continue denting the yieldless metal. All eyes now turn towards a fresh batch of top-tier US economic data due for release in the week ahead.

Also read: Gold Price Forecast: XAU/USD eyes a sustained break below $1,615 as yields keep rallying

Gold Price: Key levels to watch

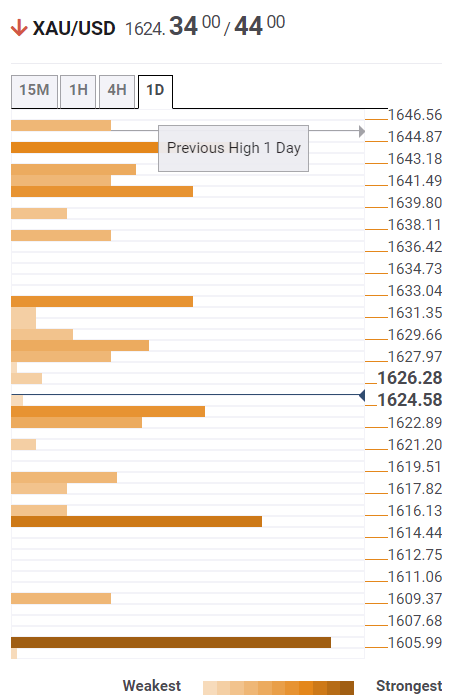

The Technical Confluence Detector shows that the gold price is likely to find footing below the previous day’s low of $1,623, despite the renewed uptick.

The pivot point one-day S1 at $1,618 could come to the rescue of buyers before they look to attack the previous month’s low of $1,615.

A sustained break below the latter will open up downside towards the critical cap at the pivot point one-month S1 at $1,607. Ahead of that, the pivot point one-day S2 at $1,609 could offer temporary support.

Alternatively, gold price needs to find acceptance above the confluence of the Fibonacci 23.6% one-day and SMA5 four-hour at $1,628 on its recovery. The next powerful barrier is seen at the Fibonacci 38.2% one-day at $1,632.

Further up, the Fibonacci 61.8% one-day at $1,637 would be a tough nut to crack for XAU buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.