Gold Price Forecast: XAU/USD eyes a sustained break below $1,615 as yields keep rallying

- Gold price extends weakness amid a relentless rise in the US Treasury yields.

- Surging yields boost the US dollar amid an aggressive Fed rate hike outlook and recession fears.

- XAU/USD remains on track to test $1,600, as technical setup favors sellers.

Gold price is licking its wounds while trading close to three-week lows near $1,620 on the final trading day of the week, heading for the second consecutive weekly decline. The bright metal continues to feel the heat of the multi-year highs reached in the US Treasury yields across the curve amid prospects of aggressive Fed rate hikes and an inevitable global recession. The recent strength in the yields is underpinning the sentiment around the US dollar, offering a double-whammy to the USD-priced gold price. Markets remain in a cautious mood, with the US corporate earnings season underway and renewed political chaos in the UK, which will leave the country with the fifth Prime Minister in six years. Further, China’s covid and economic concerns continue to keep investors on tenterhook, especially after its twice-a-decade party congress. Amid a risk-averse market environment, investors seek safety in the dollar at the expense of the bullion.

Later in the day, the US dollar price action, risk trends and the dynamic of the Treasury yields will be closely followed for fresh trading in the yellow metal, as the UK political developments could also impact the market’s perception of risk. Further, the end-of-the-week flows could come into play ahead of a big and eventful next week. In the meantime, a speech from the New York Fed President John Williams will be awaited, as the benchmark 10-year US yields take out 4.25%, at the moment.

Also read: While inflation refuses to go away, gold refuses to go up

On Thursday, XAU/USD enjoyed good two-way business after the US dollar struggled with its recovery and risk sentiment improved in the European session. Although the UK political turmoil and surging Treasury yields revived the dollar demand in the American session. British PM Liz Truss quit on Thursday after a tumultuous brief term in which her economic policies roiled financial markets. Truss leaves a divided party seeking a leader who can unify its warring factions. The metal faded its rebound to near the $1,645 supply zone and reverted towards multi-week troughs of $1,623. The precious metal settled the day marginally in the red at $1,628.

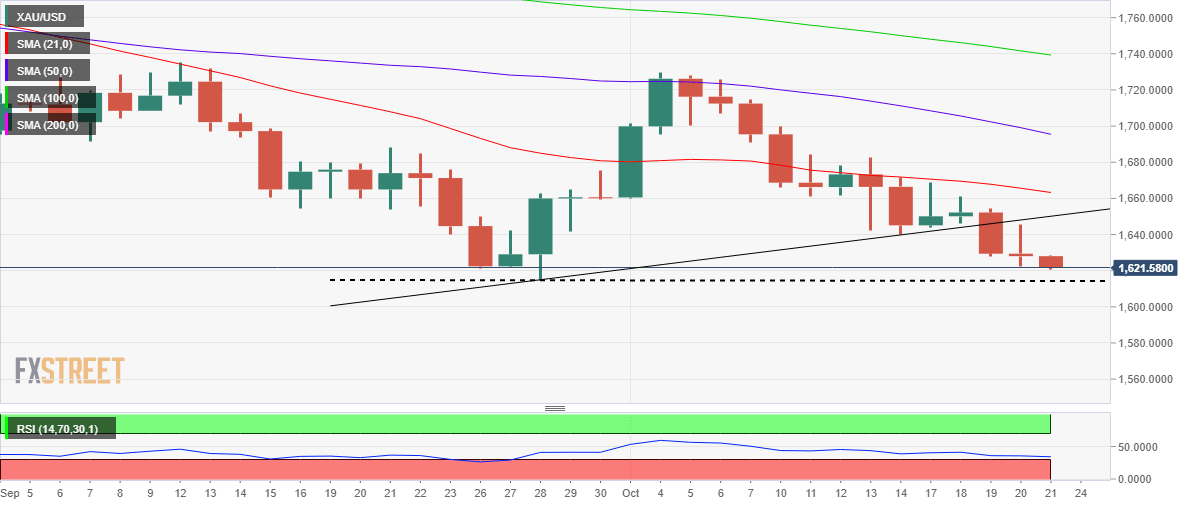

Gold price technical outlook: Daily chart

The downside break of the rising trendline support, earlier this week, has kept XAU sellers alive and kicking.

Bears now gather strength to take out the 2022 lows at $1,615, paving way for a test of the $1,600 round figure.

The 14-day Relative Strength Index (RSI) is pointing south towards the oversold territory while below the midline, suggesting that there is more room to the downside.

On the flip side, bulls could attempt a dead cat bounce to the $1,630 level, above which a fresh upswing towards the $1,650 resistance cannot be ruled out. That level is the confluence of the rising trendline support-turned-resistance and the previous day’s high.

The mildly bearish 21-Daily Moving Average (DMA) at $1,663 will be next on buyers’ radars.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.