Gold Price Forecast: XAU/USD encounters barricades around $1,875 as USD Index attempts recovery

- Gold price has sensed selling pressure after encountering significant offers near $1,875.00.

- A topsy-turvy performance is expected from the USD Index ahead of Fed Powell’s speech.

- The battle between the Fed and higher inflation could get uglier amid a fresh rise in US employment data.

Gold price (XAU/USD) is facing pressures in recovery extension above the critical resistance of $1,875.00 in the Asian session. The precious metal has sensed selling interest as the US Dollar Index (DXY) has attempted a recovery after correcting to near 103.10. A topsy-turvy performance is expected from the USD Index as investors are awaiting the speech from Federal Reserve (Fed) chair Jerome Powell for fresh impetus.

The USD Index (DXY) was highly expected to demonstrate some volatility contraction signs after a three-day winning streak post mammoth United States Nonfarm Payrolls (NFP) data. The USD Index bulls have exhausted after a sheer ride, and the upside bias is still intact. S&P500 futures are holding minor gains recorded in the Asian session.

The speech from Fed chair Jerome Powell ahead has become significant amid a fresh rise in the employment numbers in the United States labor market. After observing a meaningful decline trend in inflation, the street started expecting a pause in the policy tightening spell by the Fed. However, the upbeat January employment data has conveyed that the battle against inflation has a lot of steam left.

Gold technical analysis

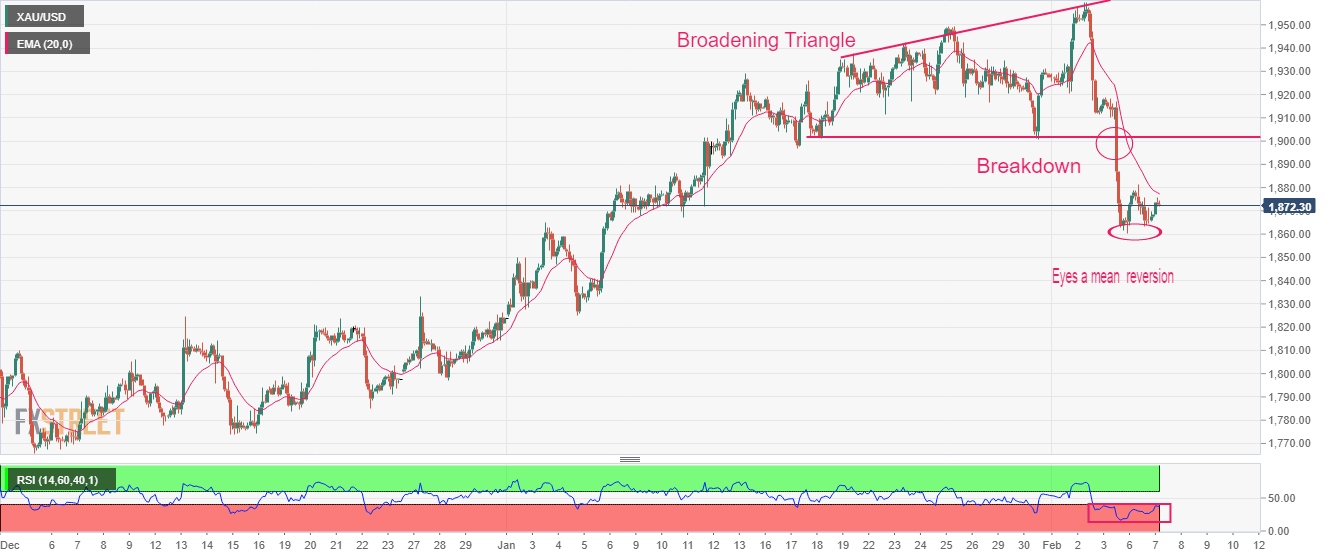

Gold price has gauged a cushion after refreshing its monthly low around $1,860.00 on a two-hour scale. The precious metal showed a perpendicular fall after delivering a breakdown of the Broadening Triangle chart pattern. Usually, a one-sided vertical fall reverses to the 20-period Exponential Moving Average gradually for further guidance, which is placed around $1,877.25, at the press time.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, still favors the bearish bias.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.