Gold Price Forecast: XAU/USD slides further below $1,800, US ADP eyed for fresh impetus

- Gold drops for the first time in three days, fades rebound from seven-week low.

- Sellers remain hesitant as market sentiment dwindles ahead of key data/events.

- Mixed Fedspeak, downbeat yields and geopolitical fears keep buyers on guard.

- Gold Price Forecast: XAU/USD’s path of least resistance appears down, US jobs data eyed

Update: Gold extended the previous day's retracement slide from the vicinity of the $1,810 level and witnessed some selling during the first half of the trading on Wednesday. The XAU/USD continued losing ground through the early European session and dropped to a fresh daily low, around the $1,95 region in the last hour.

A generally positive tone around the equity markets turned out to be a key factor that weighed on the safe-haven gold. That said, a combination of factors should hold back traders from placing aggressive bearish bets and limit the downside, at least for the time being. Less hawkish comments from Fed officials kept the US dollar bulls on the defensive, which should act as a tailwind for the dollar-denominated commodity. Apart from this, the conflict between Russia and the West over Ukraine could further lend some support to the safe-haven precious metal.

Moreover, investors might also prefer to wait for a fresh catalyst from Friday's release of the closely-watched US monthly jobs report – popularly known as NFP. In the meantime, the US ADP report on private-sector employment, due later during the early North American session on Wednesday, might influence the USD price dynamics and provide some impetus to gold. Apart from this, traders will take cues from the broader market risk sentiment to grab some short-term opportunities.

Previous update: Gold (XAU/USD) snaps two-day uptrend while printing mild losses around $1,797 during the early Wednesday morning in Europe. In doing so, the yellow metal consolidates weekly gains while fading the bounce from the lowest levels since late November.

Market’s indecision ahead of crucial catalysts joins mixed signals from central bankers and risk events to underpin the metal’s latest weakness. Also challenging the gold buyers is the 20th expansion of the US ISM Manufacturing PMI, to 57.6 versus 57.5 expected.

That said, Atlanta Fed President Raphael Bostic said on Tuesday that there is a "real danger" of inflation expectations drifting from the Fed's 2.0% target to 4% or higher. On the other hand, St Louis Fed President James Bullard said that he thinks it is an open question whether the Fed will have to become more restrictive (i.e. raise rates above the "neutral" 2.0%-2.5% zone).

On a different page, Elsewhere, the US Senate’s procedural voting on the China Competition Bill and chatters over Russia-Ukraine, as well as mixed concerns for global inflation, challenge market’s mood and weigh on gold prices.

Amid these plays, the US 10-year Treasury yields fade the previous day’s rebound from a weekly low near 1.80% while upbeat prints of the Wall Street benchmarks seem to help the S&P 500 Futures to remain firm around 4,555 at the latest.

Looking forward, the early signal to Friday’s US Nonfarm Payrolls (NFP), namely the US ADP Employment Change for January, expected 207K versus 807K prior, will be important for immediate direction. However, major attention will be given to Thursday’s ECB and Friday’s US jobs report, not to forget the Fedspeak.

Technical analysis

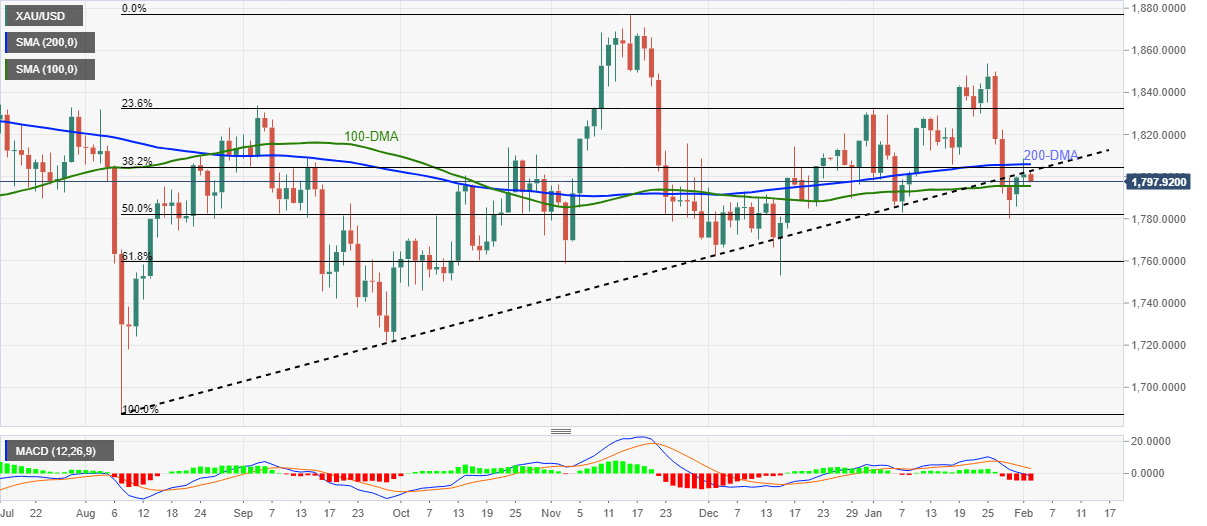

Although bearish MACD signals favor the 200-DMA’s rejection to gold buyers, 100-DMA and 50% Fibonacci retracement (Fibo.) of August-November upside, respectively near $1,795 and $1,782, challenge the commodity’s further weakness.

Given the market’s cautious mood ahead of the crucial data/events, coupled with the metal’s failures to conquer the key DMAs, gold prices are likely to remain sidelined unless breaking $1,782.

However, a clear downside break of $1,782 won’t hesitate to direct gold sellers towards the 61.8% Fibo. level near $1,760, which holds the key to gold bear’s dominance.

Alternatively, a daily closing beyond the 200-DMA level of $1,806 will direct gold buyers towards the 23.6% Fibonacci retracement level of $1,832.

It’s worth noting that gold’s upside past $1,832 will be questioned by January’s peak around $1,854, a break of which will escalate the run-up towards the late 2021 high of $1,877.

Gold: Daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.