Gold Price Forecast: XAU/USD’s path of least resistance appears down, US jobs data eyed

- Gold price recovery remains capped amid a risk-on market profile.

- The US dollar corrects with the Treasury yields as the Fed angst recedes.

- Gold trades between key daily averages, bearish RSI keeps downside appealing.

Gold price extended its rebound from six-week lows into the third consecutive day on Tuesday, closing the day just above the $1,800 mark. The bright metal rallied as high as $1,809 before easing slightly towards the closing. The bullish reversal in gold was mainly backed by the best three-day Wall Street rally posted since 2020, which reduced the demand for the safe-haven US dollar. The ongoing correction in the Treasury yields also helped gold reverse a part of the previous week’s losses, as the metal recorded the biggest weekly decline in ten. Stronger-than-expected US ISM Manufacturing PMI and JOLTS job openings data also failed to offer some reprieve to the dollar bulls, as the dust settled over the hawkish Fed decision. The calm before a potential Russia-Ukraine storm also kept gold buyers on the front foot.

Gold price is extending the retreat on Wednesday, despite the persistent weakness in the greenback and yields. Gold bulls turn cautious ahead of the US ADP employment numbers and ‘Super Thursday’, with the BOE and ECB decisions on the cards. The US private sector is seen adding 207K jobs in January vs. 807K previous.

The yellow metal also bears the brunt of the risk-on market mood, fuelled by the US corporate earnings outlook and signs that Fed officials favor calibrated monetary-policy tightening to tame inflation. Traders will also watch out for any geopolitical developments between the US and Russia over Ukraine. Diplomatic talks between the US, NATO and Russia showed little sign of a breakthrough.

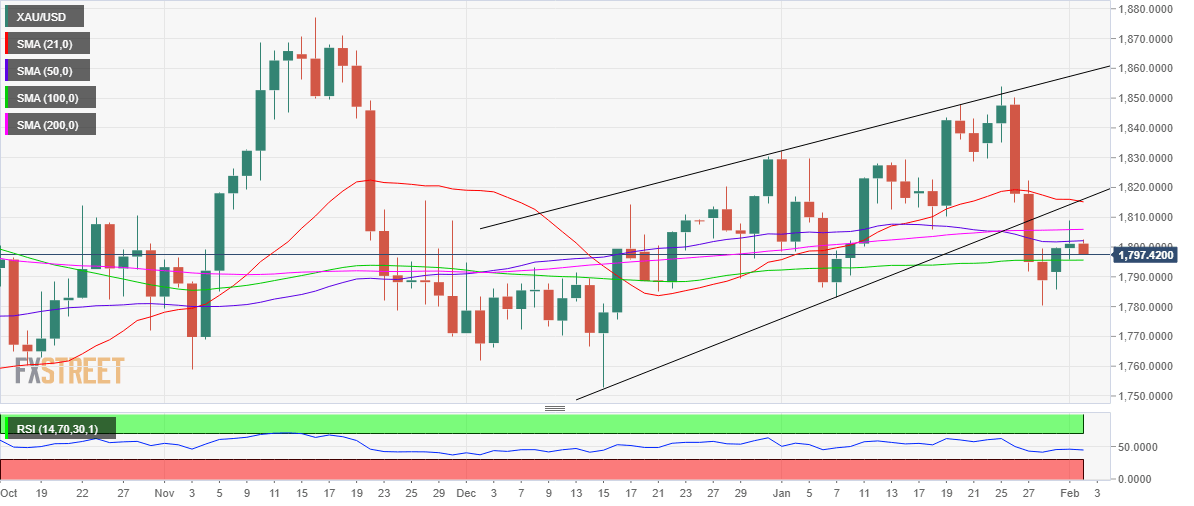

Gold Price Chart - Technical outlook

Gold: Daily chart

At the time of writing, gold price is trading just below the $1,800 threshold, wavering between the horizontal 50-Daily Moving Average (DMA) $1,802 on the upside.

Meanwhile, bears are fencing the $1,795 area, where the horizontal 100-DMA aligns.

The downside appears more compelling, as the bearish wedge remains in play while sellers just have one key barrier in the 100-DMA to crack.

Additionally, the 14-day Relative Strength Index (RSI) is inching lower below the midline, allowing room for more declines.

Therefore, a sustained break below the 100-DMA will call for a retest of the January 28 lows of $1,780.

Once that is breached, the additional downside will target the December 16 troughs of $1,776.

Further south, the $1,750 psychological barrier will be back on bears’ radars.

On the flip side, recapturing 50-DMA on a daily closing basis is critical to take on the all-important 200-DMA once again, which is now at $1,806.

Should the renewed upside hold, gold buyers will look out to test the confluence of the wedge support-turned-resistance and bearish 21-DMA at $1,815.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.