Gold Price Forecast: XAU/USD bulls flirt with $1,930 hurdle amid China LNY holidays, Fed ‘blackout’

- Gold price remains mildly bid near one-week-old resistance surrounding nine-month high.

- China’s Lunar New Year (LNY) holidays, pre-FOMC absence of Fed talks restrict market moves.

- Softer US Dollar keeps XAU/USD buyers hopeful ahead of PMIs, US Q4 GDP.

Gold price (XAU/USD) dodders around the $1,930 mark as bulls keep the reins after a five-week uptrend, printing mild gains to reverse the previous day’s pullback. In so doing, the precious metal aptly depicts the market’s conditions amid a light calendar and absence of Chinese traders, not to forget that Federal Reserve (Fed) policymakers are off stage during the pere-FOMC blackout.

China’s Lunar New Year (LNY) celebrations restrict the market moves in Asia not only because the dragon nation is the biggest economy in the region but also because the nation’s reopening recently bolstered global markets. Even so, the market optimism surrounding Beijing remains on the table and keeps the Gold price firmer due to China’s dominance in the XAU/USD market.

On the other hand, Fed policymakers enter a two-week silence period ahead of the February Federal Open Market Committee (FOMC). Their last sentences were mixed though they mostly defended the bank's hawkish bias. Even so, the market forecasts that the Fed will slow interest-rate increases for the second straight meeting in February, and get closer to a policy pivot. That said, downbeat US data and easing inflation woes underpin the dovish market’s expectations of the US central bank.

Against this backdrop, the US Treasury yields remain pressured, fading the last few days’ corrective bounces, while the US stock futures print mild losses and the Asia-Pacific equities trade is mixed.

Although Gold traders have started the week in a sluggish mode, the first readings of January’s Purchasing Managers Indexes (PMI) and the US fourth-quarter (Q4) Gross Domestic Product (GDP) could offer active days ahead. That said, XAU/USD traders will be interested in softer US data to keep the latest upside momentum intact.

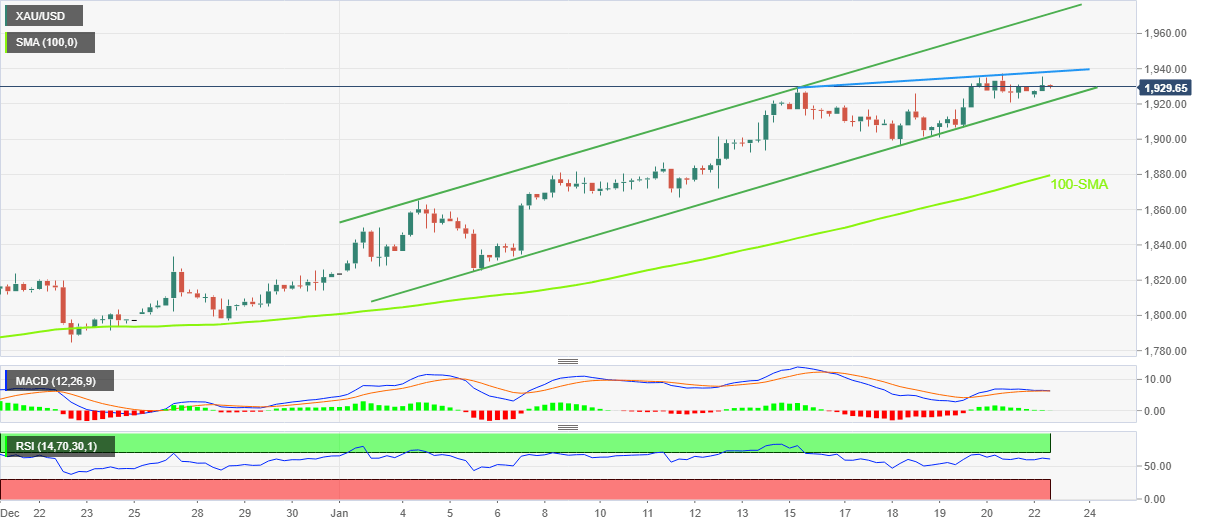

Gold price technical analysis

Gold price grinds higher around a nine-month top marked in the last week while staying inside a 13-day-old bullish channel formation, currently between $1,972 and $1,921.

The impending bear cross on the MACD bearishly reinforces the XAU/USD failure to cross the one-week-old resistance line, close to $1,939 by the press time, to challenge the immediate upside.

It’s worth noting that the Gold price run-up beyond $1,972 could quickly challenge the April 2022 peak of $1,998 before targeting the $2,000 round figure.

Meanwhile, the firmer RSI (14) and the metal’s sustained trading beyond the 100-SMA level surrounding $1,880 keeps the Gold buyers hopeful. A break and close above the January 20 highs in the $1,930s, will be a key breakthrough for bulls, and probably lead to further upside. Alternatively, a break below $1,905 will create a more bearish scenario in the short term.

To sum up, the Gold buyers appear to be running out of steam but bears are off the table unless the quote stays beyond $1,880.

Gold price: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.