Gold Price Forecast: XAU/USD bulls and bears battle it out between key hourly levels

- Gold is trapped between hourly support and resistance.

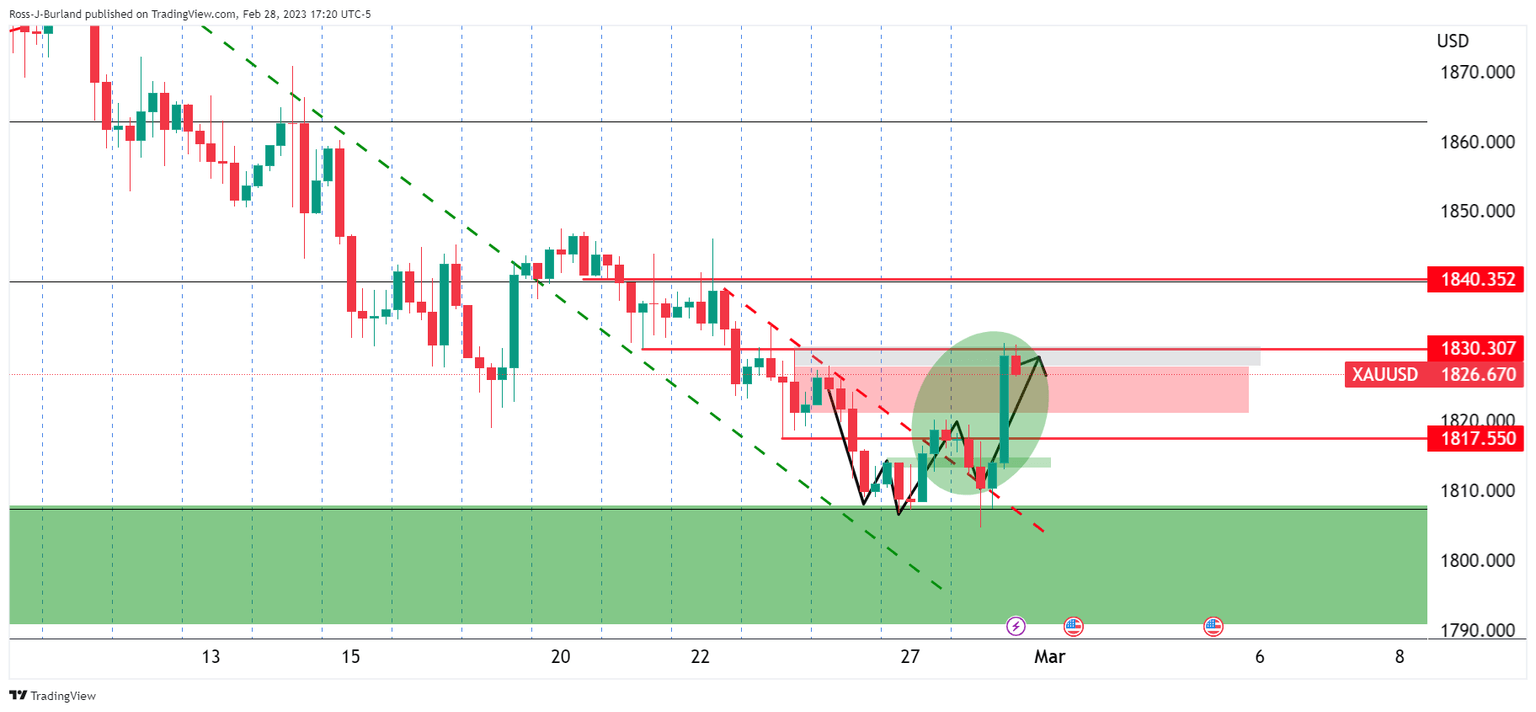

- The bulls are relying on a move above $1,837 while bears seek a break below $1,831.

Gold price is holding in a bullish territory after climbing from the start of the week's low near $1,823 and reaching a high of $1,844. However, the yellow metal finished with a loss on Thursday, following three three-day winning streak, as strength in the U.S. dollar weighed. The US Dollar Index, DXY,a measure of the greenback's strength against a basket of rivals, gained 0.6% to 105.102

The greenback and bond yields rose on expectations of higher interest rates due to a series of unexpectedly robust economic reports that have hit the screens in recent weeks that may prompt a more hawkish response from the central bank. The data has been promoted Fed member Kashkari (voter) to review his prior dovish stance who said he is open to a 50bps hike at the March meeting. Still, he emphasized that the terminal rate is more important than the size of rate hikes.

Analysts at ANZ Bank said that the data is likely to keep pressure on the Fed to raising rates. ''A stronger USD and higher yields were also headwinds for investor demand of the precious metal.'' Indeed, the US rate futures have priced in a peak fed funds rate of 5.4% hitting in September. The market has all but priced out Federal Reserve rate cuts this year. The Federal Reserve sentiment is keeping the greenback in the hands of the bulls as marked price in the notion that the central bank will have to raise interest rates more than initially expected.

Gold technical analysis

As per the prior Gold price analysis, Gold price rallied as follows:

Gold prior analysis

The prior Gold price analysis said ''the double bottom near the $1,800 psychological Gold price level is offering a compelling case for a move towards the $1,830s, a touch above the January opening lows. However, a retest of the W-formation's neckline could be on the cards first.''

Gold price update

As illustrated, the Gold price burst higher after the correction and offered bulls an opportunity in late European and US markets to the target area. At this juncture, the correction has met prior resistance and is now trapped as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.