Gold Price Forecast: XAU/USD bears approach $1,930 support on upbeat US Dollar, firmer yields

- Gold Price renews intraday low to extend post-NFP losses.

- US Dollar cheers hawkish Fed bets, sour sentiment amid sluggish session.

- US Factory Orders, ISM Services PMI eyed for intraday directions.

Gold Price (XAU/USD) stays on the bear’s radar for the second consecutive day as the precious metal renews intraday low near $1,945, extending the post-NFP losses amid to early Monday amid firmer US Dollar and the Treasury bond yields.

That said, the US Dollar Index (DXY) prints mild gains around 104.12 as it keeps the previous day’s recovery from a one-week low amid Monday’s sluggish Asian session. In doing so, the greenback’s gauge versus the six major currencies cheers the market’s fears of higher Federal Reserve (Fed) rates and the US-China tension, not to forget the fresh war headlines surrounding Russia and Ukraine.

Apart from that, an increase in the odds supporting June’s 0.25% Fed rate hike and a reduction in the market’s bets of a Fed rate cut in 2023 also seem to favor the US Dollar and yields, which in turn exerts downside pressure on the Gold price amid a sluggish start to the week. It’s worth noting that Friday’s Nonfarm Payrolls (NFP) surprised markets with a strong outcome and renewed hawkish concerns about the US central bank. That said, the US-China tension about Taiwan joins the headlines suggesting a heavy battle between Russia and Ukraine also weighs on the sentiment and allows the DXY to remain firmer, which in turn favors the Gold sellers.

Alternatively, recently firmer China PMIs and doubts about the Fed’s capacity to keep the rates higher for longer challenge the Gold bears.

Amid these plays, the US 10-year and two-year Treasury bond yields recover after snapping a three-week uptrend by the end of the last Friday. That said, the S&P500 Futures also portray the risk-off mood by mild losses as it retreats from the highest levels since August 2022.

To sum up, sour sentiment joins hawkish Fed bets to weigh on the Gold price but a lack of major data/events and upbeat catalysts from China put a floor under the quote ahead of the US Factory Orders and ISM Services PMI for May.

Gold Price Technical analysis

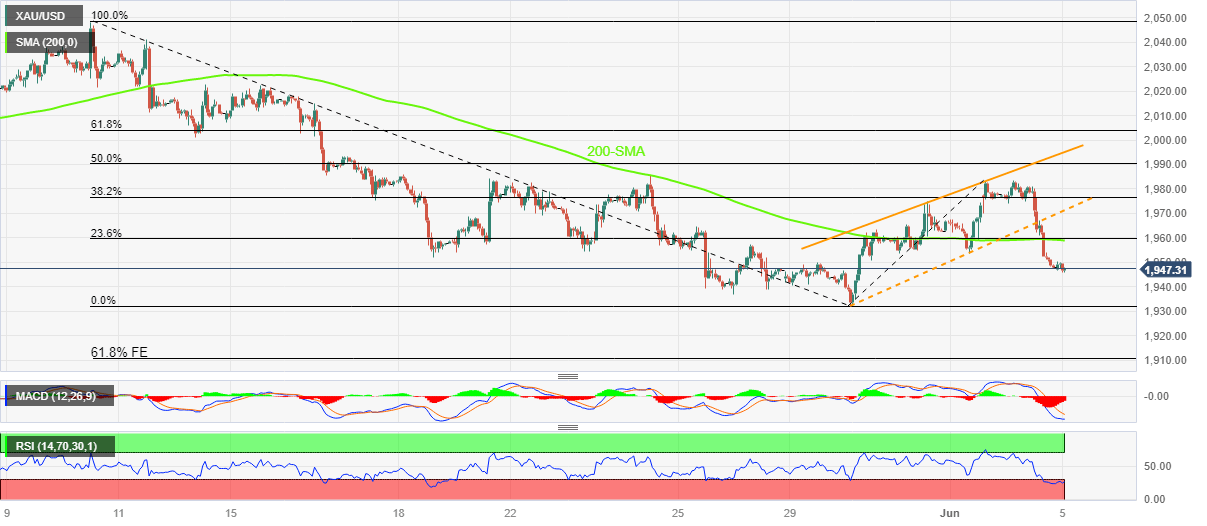

Gold price justifies the downside break of a short-term bullish channel, as well as the 200-SMA, as it approaches the yearly low marked in May at around $1,932. Adding strength to the downside bias are the bearish MACD signals.

It’s worth noting, however, that the RSI (14) line is in the oversold territory, which in turn suggests limited downside room for the XAU/USD past $1,932.

The same highlights the 61.8% Fibonacci Expansion (FE) of the Gold Price moves between May 10 to June 01, around $1910, as the key support to watch afterward.

Meanwhile, the Gold price recovery may initially aim for the 200-SMA hurdle of around $1,960 before challenging the bottom line of an ascending trend channel stretched from the last Tuesday, close to $1,970 at the latest.

Gold price: Hourly chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.