Gold Price Forecast: XAU/USD bears move in, $1,810 eyed before $1,850

- Gold prices retreat from two-month-old descending resistance line.

- Cautious sentiment ahead of crucial inflation, World Bank forecsts test gold buyers.

- Fed’s Powell backed rate hikes but balance sheet normalization, demand-supply issues drowned yields, USD.

- Gold Price Forecast: Gold picks up momentum on dollar’s weakness

Update: Gold (XAU/USD) is stalling on the bid as the dollar firms in Asia. The greenback was put under renewed pressure overnight and forced into a key area of support on the 4-hour time frame as follows:

DXY H4 chart

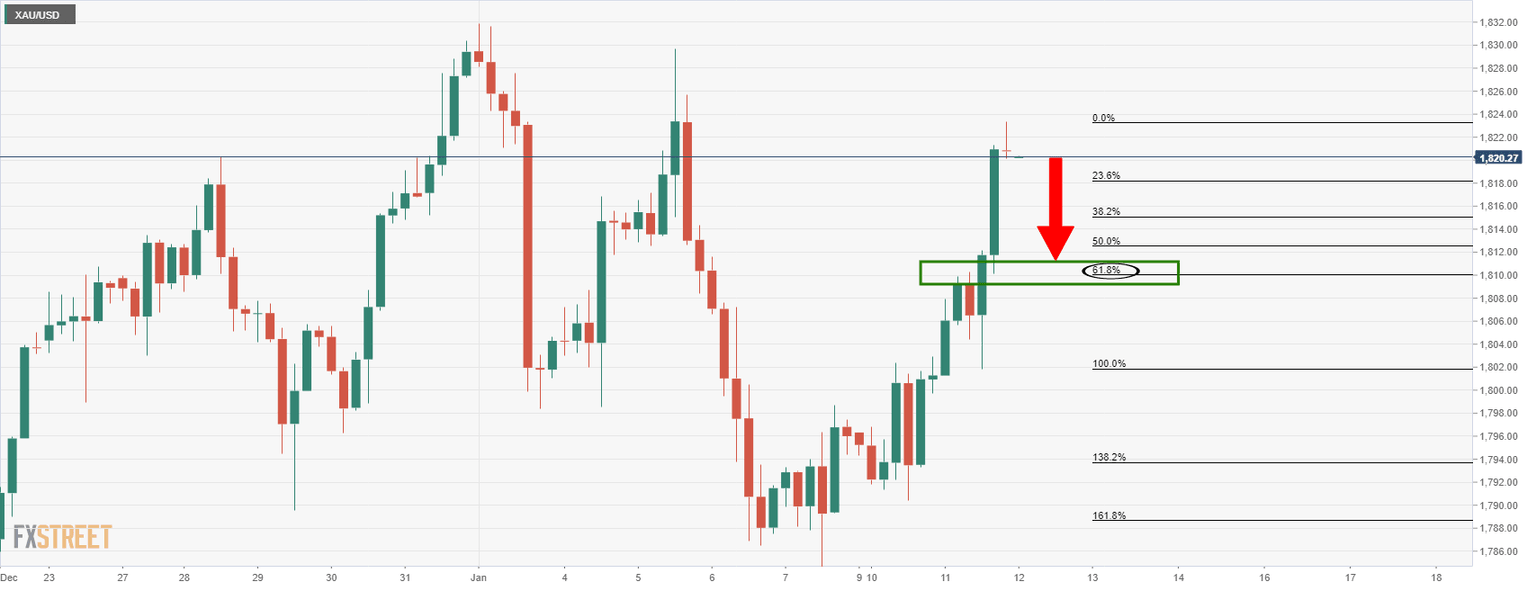

This enabled the price of gold to move higher, although XAU/USD has stalled and the downside is compelling on the 4-hour chart as follows:

The 61.8% Fibonacci aligns with the prior 4-hour resistance near $1,810. Given that expectations for an interest rate hike from the Fed in March are largely priced-in, there is scope for gold to pick up some additional demand on the back of any bearish corrections in the coming sessions; That will mean the US dollar breaking below the aforementioned support near 95.50 in the comings days.

In doing so, the greenback could fall all the way back to test 95 the figure, opening scope for gold to test as high as $1,850:

End of update

Gold (XAU/USD) bulls take a breather around the weekly top, recently easing to $1,820, amid an early Asian session on Wednesday. The yellow metal jumped the most since mid-December the previous day after the upbeat market sentiment drowned the US Treasury yields and US dollar.

Fed Chair Jerome Powell during testimony before the Senate Banking Committee could be cited as the major factor that favored the gold prices of late. However, the market’s anxiety ahead of the US Consumer Price Index (CPI) for December joins downbeat World Bank (WB) economic forecasts and virus woes to challenge the gold buyers.

Fed’s Powell showed readiness to hike interest rates to stop inflation from being entrenched but concerns over supply-demand mismatch and balance-sheet runoff weighed poured cold water on the face of US dollar bulls. The Fed Boss said that the balance sheet runoff could happen "perhaps later in the year," while also expecting that the supply crunch will ease somewhat and the economic impact of the Omicron variant will be short-lived.

Additionally, WB’s latest economic forecasts cited coronavirus woes to cut the global GDP expectations for 2022 to 4.1% from 4.3% previous estimations. The World Bank also trimmed economic forecasts for the US and China, by 0.5% to 3.7% and by 0.3% to 5.1% in that order.

Other than Powell’s testimony, US economic calendar was mostly silent with NFIB Business Optimism Index rising past 98.4 to 98.9 for December while IBD/TIPP Economic Optimism for January eased to 44.7 versus 48.4 previous readouts.

Elsewhere, record top daily covid infections in the US also tests the market sentiment and weigh on the gold prices. It’s worth noting, however, that Merck’s update, suggesting its covid treatment pill’s ability to tame coronavirus and all variants, placates the virus fears.

Against this backdrop, the US Dollar Index (DXY) dropped around 0.35% to poke December’s low around 95.60 whereas the Wall Street benchmarks cheered the second consecutive daily fall in the US 10-year Treasury yields by the end of Tuesday’s North American session. That said, S&P 500 Futures and the US Treasury yields remain sluggish at the latest.

Looking forward, US CPI will be crucial for gold prices as market players weigh on the Fed’s pace of rate hikes and balance sheet normalization. Should the headlines inflation figures match 7.0% YoY forecasts, versus 6.8% prior, the metal should extend the latest weakness.

Read: US Inflation Preview: Dizzying heights of 7% would cement a March hike, supercharge the dollar

Technical analysis

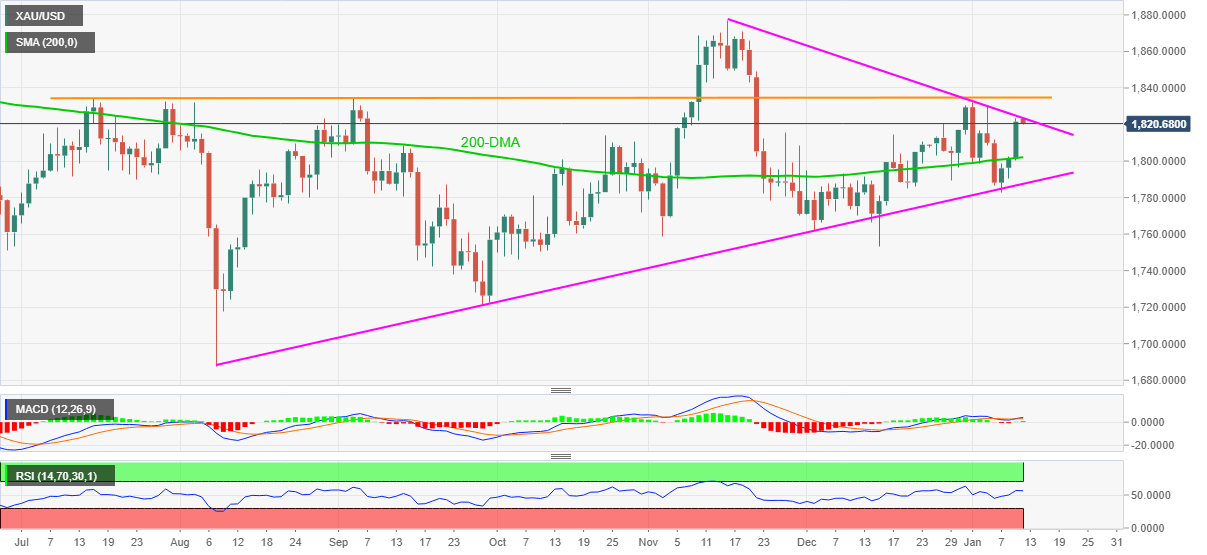

Although a clear upside break of the 200-DMA helped gold prices to jump the most in a month the previous day, a downward sloping trend line from mid-November, around $1,825, challenges bulls.

It should be noted, however, that the MACD remains sluggish but the higher low formation and recently improving RSI hints at the metal’s further upside past the immediate resistance line.

Following that, tops marked during July and September, close to $1,834, will be in focus ahead of directing gold buyers towards the $1,850 hurdle.

Meanwhile, a downside break of the 200-DMA level surrounding 1,802 will need validation from the $1,800 threshold to convince gold sellers.

Even so, an upward sloping support line from August, near $1,787 at the latest, will be a tough nut to crack for the gold bears.

To sum up, gold prices are likely to witness further upside, at least technically, but the fundamentals are far more important during the crucial day.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.